Question: what are the answers Question 2 (1 point) Partner B is investing in a partnership with Partner A. B contributes as part of his initial

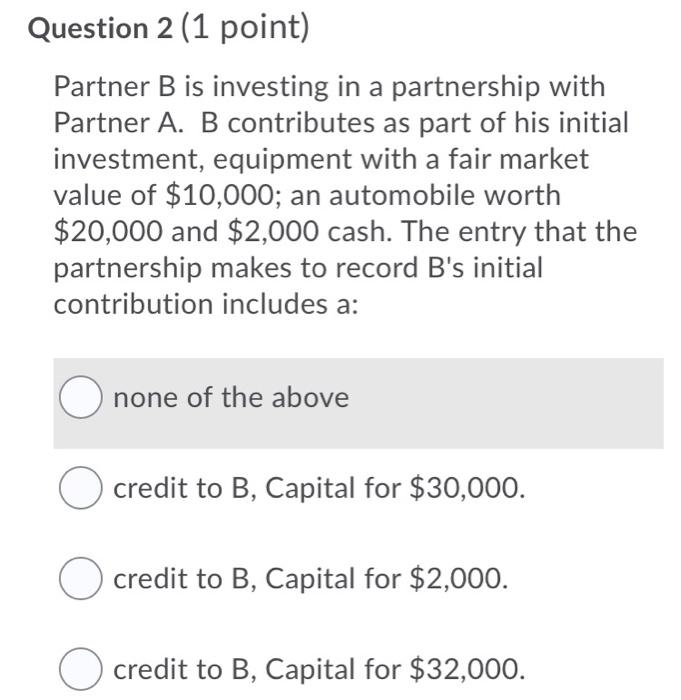

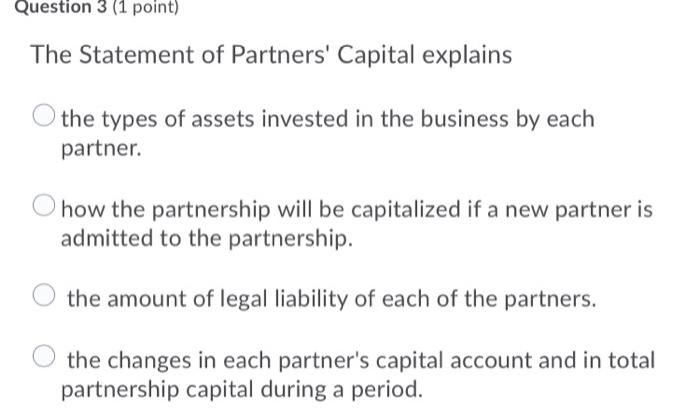

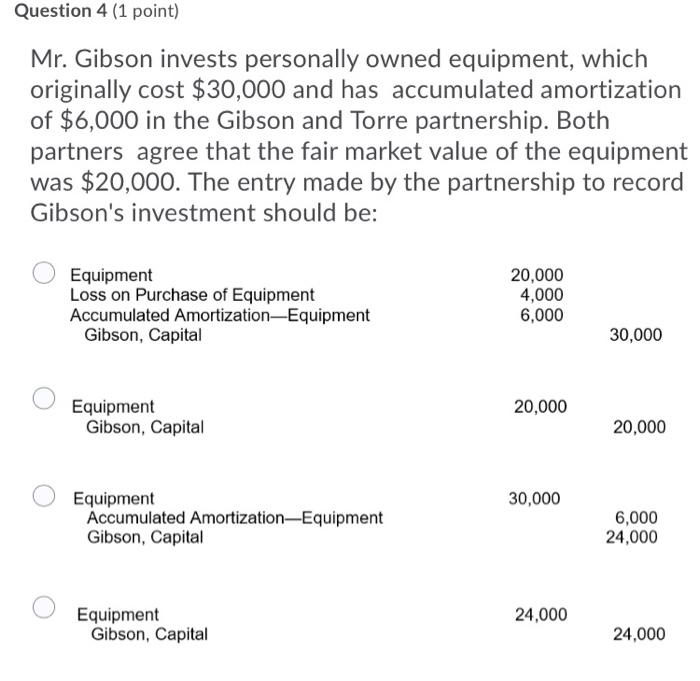

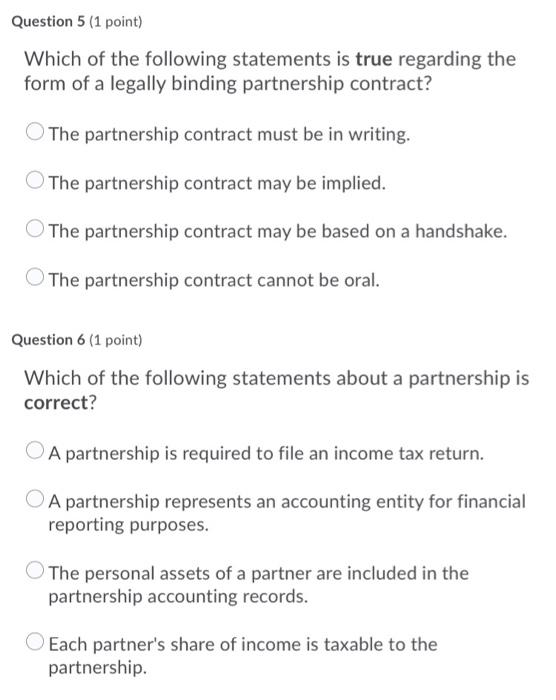

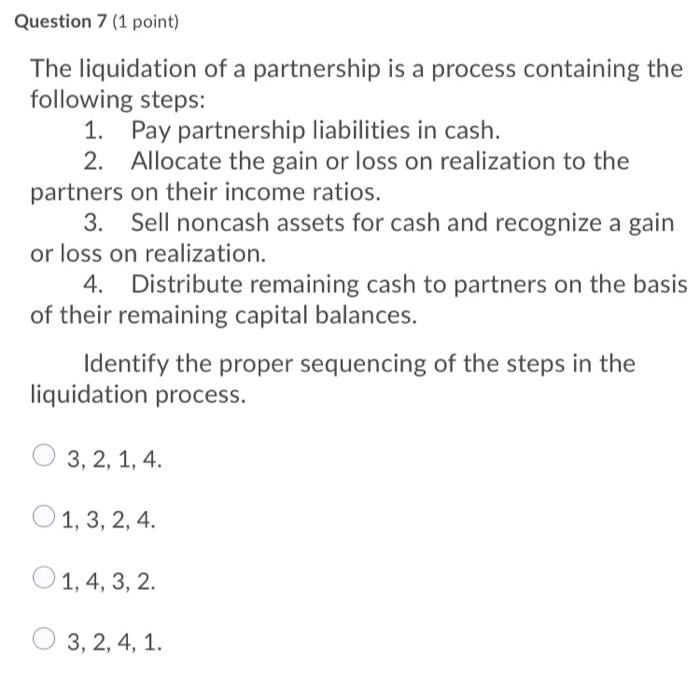

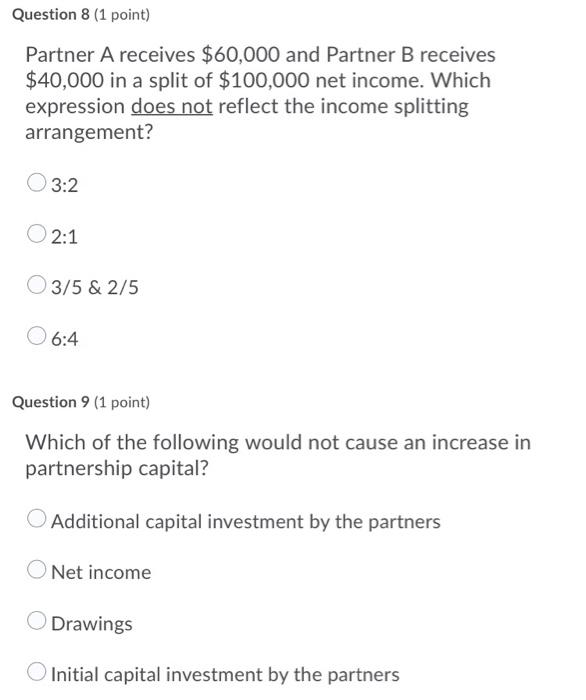

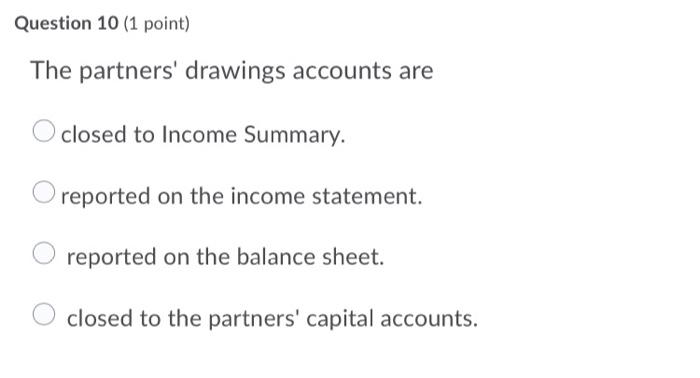

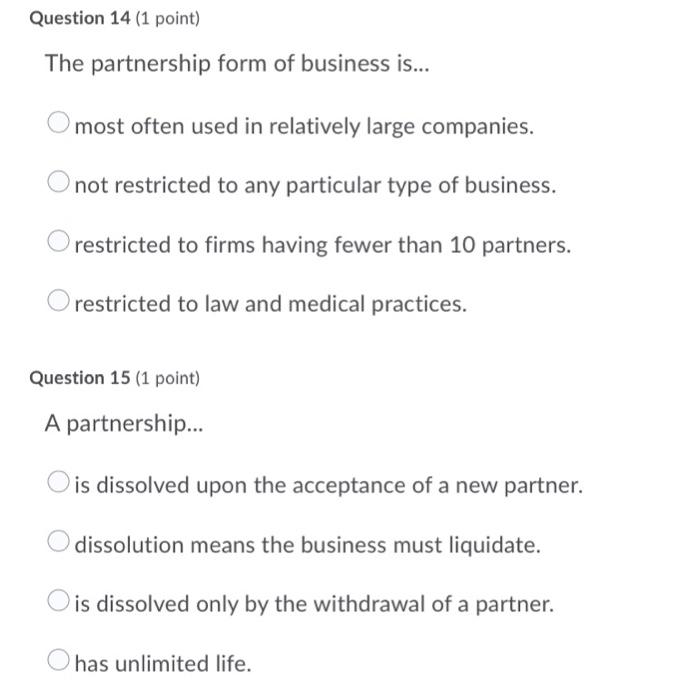

Question 2 (1 point) Partner B is investing in a partnership with Partner A. B contributes as part of his initial investment, equipment with a fair market value of $10,000; an automobile worth $20,000 and $2,000 cash. The entry that the partnership makes to record B's initial contribution includes a: O none of the above O credit to B, Capital for $30,000. O credit to B, Capital for $2,000. O credit to B, Capital for $32,000. Question 3 (1 point) The Statement of Partners' Capital explains the types of assets invested in the business by each partner. how the partnership will be capitalized if a new partner is admitted to the partnership. the amount of legal liability of each of the partners. the changes in each partner's capital account and in total partnership capital during a period. Question 4 (1 point) Mr. Gibson invests personally owned equipment, which originally cost $30,000 and has accumulated amortization of $6,000 in the Gibson and Torre partnership. Both partners agree that the fair market value of the equipment was $20,000. The entry made by the partnership to record Gibson's investment should be: Equipment Loss on Purchase of Equipment Accumulated Amortization-Equipment Gibson, Capital 20,000 4,000 6,000 30,000 20,000 Equipment Gibson, Capital 20,000 30,000 Equipment Accumulated Amortization Equipment Gibson, Capital 6,000 24,000 24,000 Equipment Gibson, Capital 24,000 Question 5 (1 point) Which of the following statements is true regarding the form of a legally binding partnership contract? The partnership contract must be in writing. The partnership contract may be implied. The partnership contract may be based on a handshake. The partnership contract cannot be oral. Question 6 (1 point) Which of the following statements about a partnership is correct? A partnership is required to file an income tax return. A partnership represents an accounting entity for financial reporting purposes. The personal assets of a partner are included in the partnership accounting records. Each partner's share of income is taxable to the partnership. Question 7 (1 point) The liquidation of a partnership is a process containing the following steps: 1. Pay partnership liabilities in cash. 2. Allocate the gain or loss on realization to the partners on their income ratios. 3. Sell noncash assets for cash and recognize a gain or loss on realization. 4. Distribute remaining cash to partners on the basis of their remaining capital balances. Identify the proper sequencing of the steps in the liquidation process. 3, 2, 1, 4. O 1, 3, 2, 4. O 1, 4, 3, 2. O , , 3, 2, 4, 1. Question 8 (1 point) Partner A receives $60,000 and Partner B receives $40,000 in a split of $100,000 net income. Which expression does not reflect the income splitting arrangement? 3:2 2:1 O 3/5 & 2/5 6:4 Question 9 (1 point) Which of the following would not cause an increase in partnership capital? Additional capital investment by the partners Net income Drawings Initial capital investment by the partners Question 10 (1 point) The partners' drawings accounts are closed to Income Summary. reported on the income statement. reported on the balance sheet. closed to the partners' capital accounts. Question 12 (1 point) The partnership of Fehr and Selig reports net income of $30,000. The partners share equally in income and losses. The entry to record the partners' share of net income will include a credit to Income Summary for $30,000. debit to Selig, Capital for $15,000. credit to Fehr, Drawings for $15,000. credit to Fehr, Capital for $15,000. Question 13 (1 point) A general partner in a partnership... O is always the general manager of the firm. O is the partner who lacks a specialization. has unlimited liability for all partnership debts. is liable for partnership liabilities only to the extent of that partner's capital equity. Question 14 (1 point) The partnership form of business is... most often used in relatively large companies. not restricted to any particular type of business. restricted to firms having fewer than 10 partners. restricted to law and medical practices. Question 15 (1 point) A partnership... is dissolved upon the acceptance of a new partner. dissolution means the business must liquidate. is dissolved only by the withdrawal of a partner. has unlimited life

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts