Question: - What are the average monthly returns and standard deviations for each of the EIFS? - Which performed best on a risk/return basis during this

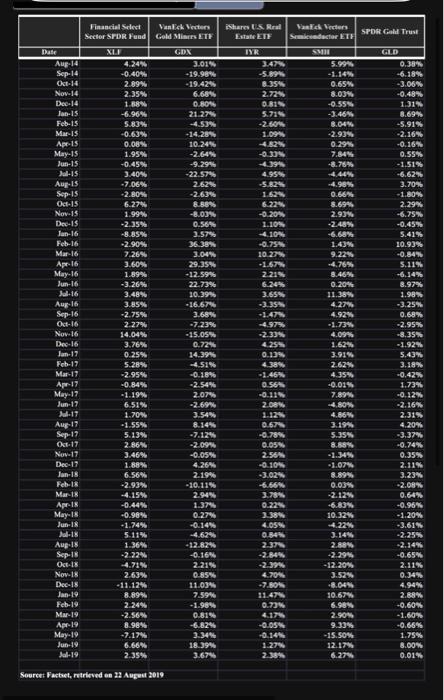

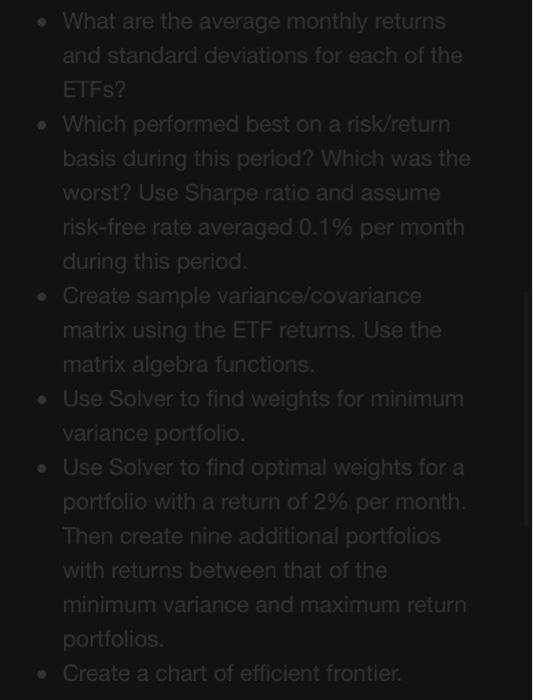

- What are the average monthly returns and standard deviations for each of the EIFS? - Which performed best on a risk/return basis during this period? Which was the worst? Use Sharpe ratio and assume risk-free rate averaged 0.1% per month during this period. - Create sample variance/covariance matrix using the ETF returns. Use the matrix algebra functions. - Use Solver to find weights for minimum variance portfolio. - Use Solver to find optimal weights for a portfolio with a return of 2% per month. Then create nine additional portfolios with returns between that of the minimum variance and maximum return portfolios. - What are the average monthly returns and standard deviations for each of the EIFS? - Which performed best on a risk/return basis during this period? Which was the worst? Use Sharpe ratio and assume risk-free rate averaged 0.1% per month during this period. - Create sample variance/covariance matrix using the ETF returns. Use the matrix algebra functions. - Use Solver to find weights for minimum variance portfolio. - Use Solver to find optimal weights for a portfolio with a return of 2% per month. Then create nine additional portfolios with returns between that of the minimum variance and maximum return portfolios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts