Question: What are the entries for case A,B and C? Exercise 4-5. Record the entries of the partnership dissolution for the following independent cases: Case A

What are the entries for case A,B and C?

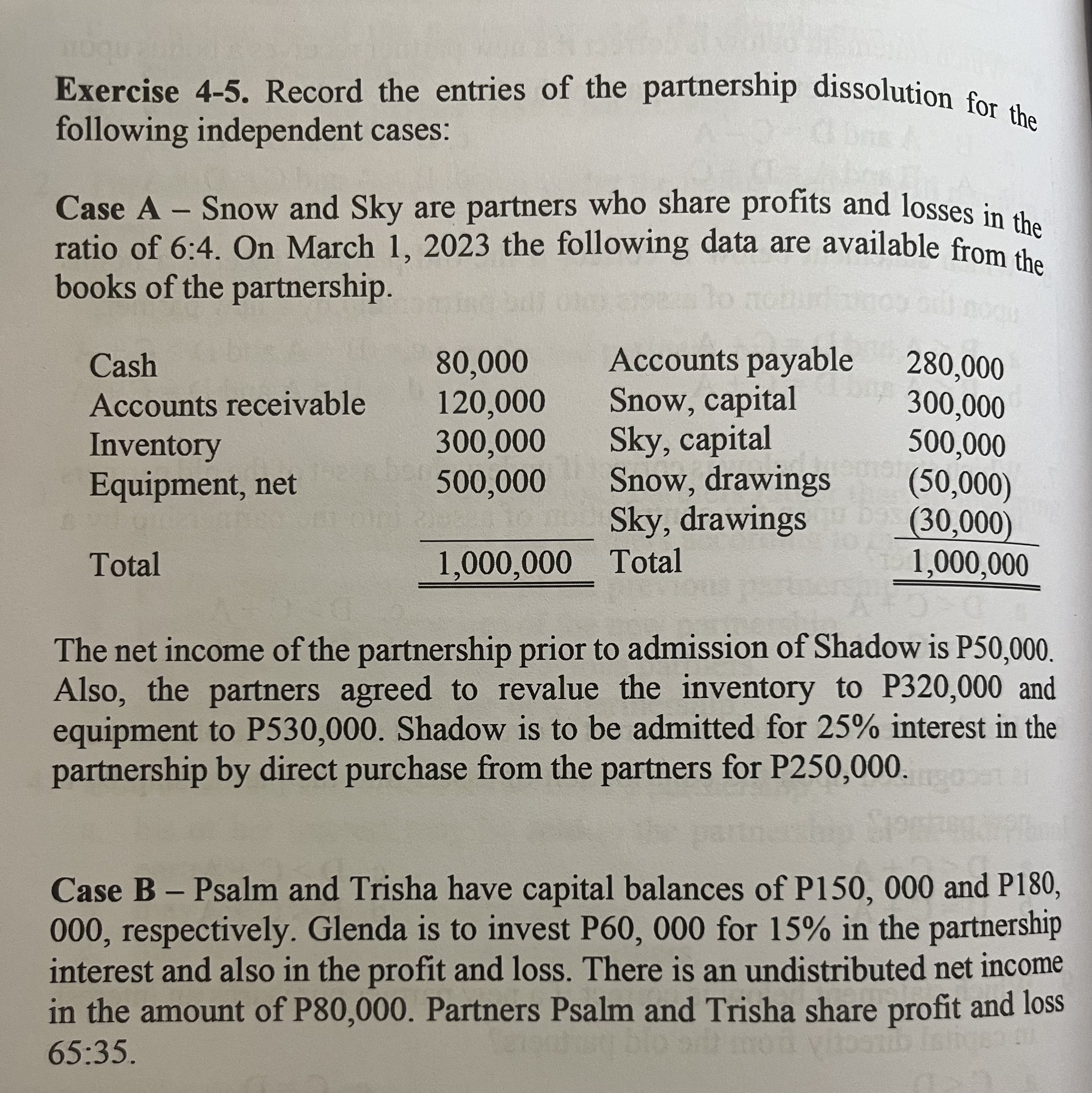

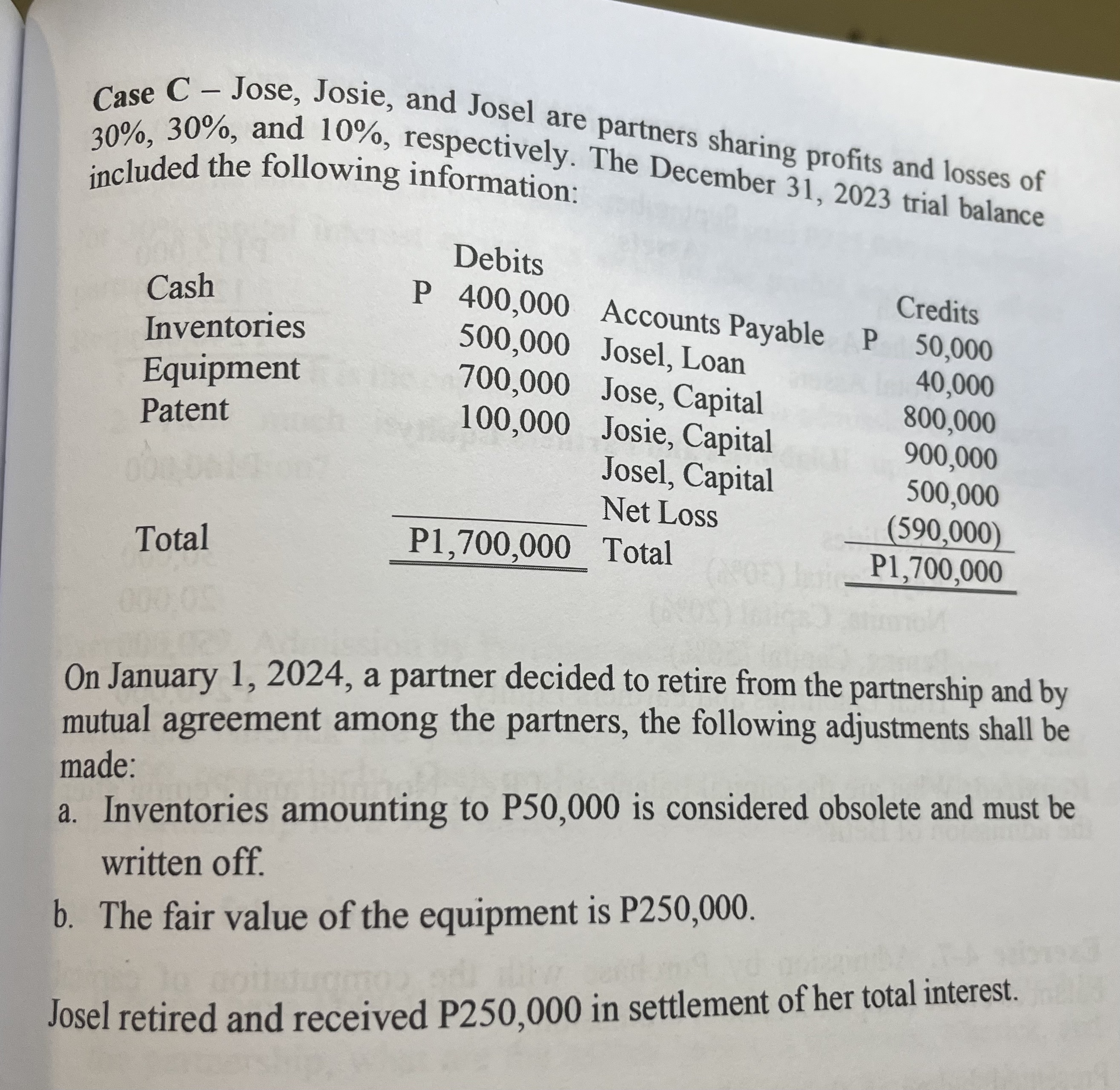

Exercise 4-5. Record the entries of the partnership dissolution for the following independent cases: Case A - Snow and Sky are partners who share profits and losses in the ratio of 6:4. On March 1, 2023 the following data are available from the books of the partnership. The net income of the partnership prior to admission of Shadow is P50,000. Also, the partners agreed to revalue the inventory to P320,000 and equipment to P530,000. Shadow is to be admitted for 25% interest in the partnership by direct purchase from the partners for P250,000. Case B - Psalm and Trisha have capital balances of P150, 000 and P180, 000 , respectively. Glenda is to invest P60,000 for 15% in the partnership interest and also in the profit and loss. There is an undistributed net income in the amount of P80,000. Partners Psalm and Trisha share profit and loss 65:35. Case C - Jose, Josie, and Josel are partners sharing profits and losses of 30%,30%, and 10%, respectively. The December 31,2023 trial balance included the following information: On January 1, 2024, a partner decided to retire from the partnership and by mutual agreement among the partners, the following adjustments shall be made: a. Inventories amounting to P50,000 is considered obsolete and must be written off. b. The fair value of the equipment is P250,000. Josel retired and received P250,000 in settlement of her total interest. Exercise 4-5. Record the entries of the partnership dissolution for the following independent cases: Case A - Snow and Sky are partners who share profits and losses in the ratio of 6:4. On March 1, 2023 the following data are available from the books of the partnership. The net income of the partnership prior to admission of Shadow is P50,000. Also, the partners agreed to revalue the inventory to P320,000 and equipment to P530,000. Shadow is to be admitted for 25% interest in the partnership by direct purchase from the partners for P250,000. Case B - Psalm and Trisha have capital balances of P150, 000 and P180, 000 , respectively. Glenda is to invest P60,000 for 15% in the partnership interest and also in the profit and loss. There is an undistributed net income in the amount of P80,000. Partners Psalm and Trisha share profit and loss 65:35. Case C - Jose, Josie, and Josel are partners sharing profits and losses of 30%,30%, and 10%, respectively. The December 31,2023 trial balance included the following information: On January 1, 2024, a partner decided to retire from the partnership and by mutual agreement among the partners, the following adjustments shall be made: a. Inventories amounting to P50,000 is considered obsolete and must be written off. b. The fair value of the equipment is P250,000. Josel retired and received P250,000 in settlement of her total interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts