Question: What are the excel keystrokes for the calculation Can you also provide the excel formulas. And not just the answers. Thank you fx A B

What are the excel keystrokes for the calculation

Can you also provide the excel formulas. And not just the answers. Thank you

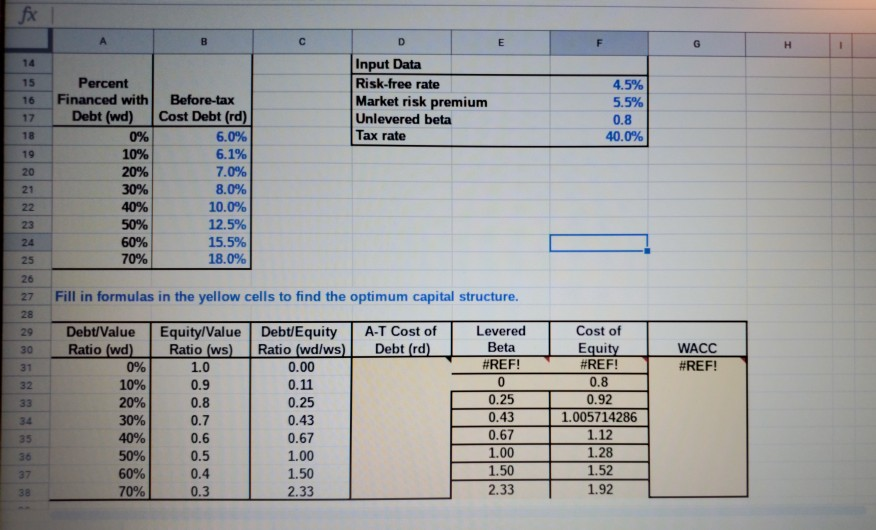

fx A B D E Input Data Risk-free rate Market risk premium Unlevered beta 14 Percent 15 4.5% Financed with Before-tax 16 5.5% Debt (wd) Cost Debt (rd) 17 0.8 Tax rate 6.0% 6.1 % 0% 40.0% 18 10% 20% 19 7.0% 20 8.0% 30% 21 40% 10.0% 22 50% 12.5% 23 60% 15.5% 24 70% 18.0% 25 26 Fill in formulas in the yellow cells to find the optimum capital structure. 27 28 Equity/Value Debt/Equity Ratio (ws) 0% Levered Cost of Debt/Value A-T Cost of 29 Ratio (wd/ws) Ratio (wd) Debt (rd) Beta Equity #REF! WACC #REF! 30 #REF! 1.0 0.00 31 0 0.8 10% 0.11 0.9 32 0.25 0.43 0.92 1.005714286 20% 0.8 0.25 33 30% 0.7 0.43 34 0.67 1.00 1.12 40% 0.6 0.67 35 1.28 50% 0.5 1.00 36 1.50 1.52 60% 0.4 1.50 37 70% 2.33 1.92 0.3 2.33 38 0% 0.3 2.33 2 WACC at optimum debt ratio Optimum debt ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts