Question: what are the explanation behind the difference in cost per unit computed using absorption costing and abc coating? QUESTION 3 Triple Limited makes three types

what are the explanation behind the difference in cost per unit computed using absorption costing and abc coating?

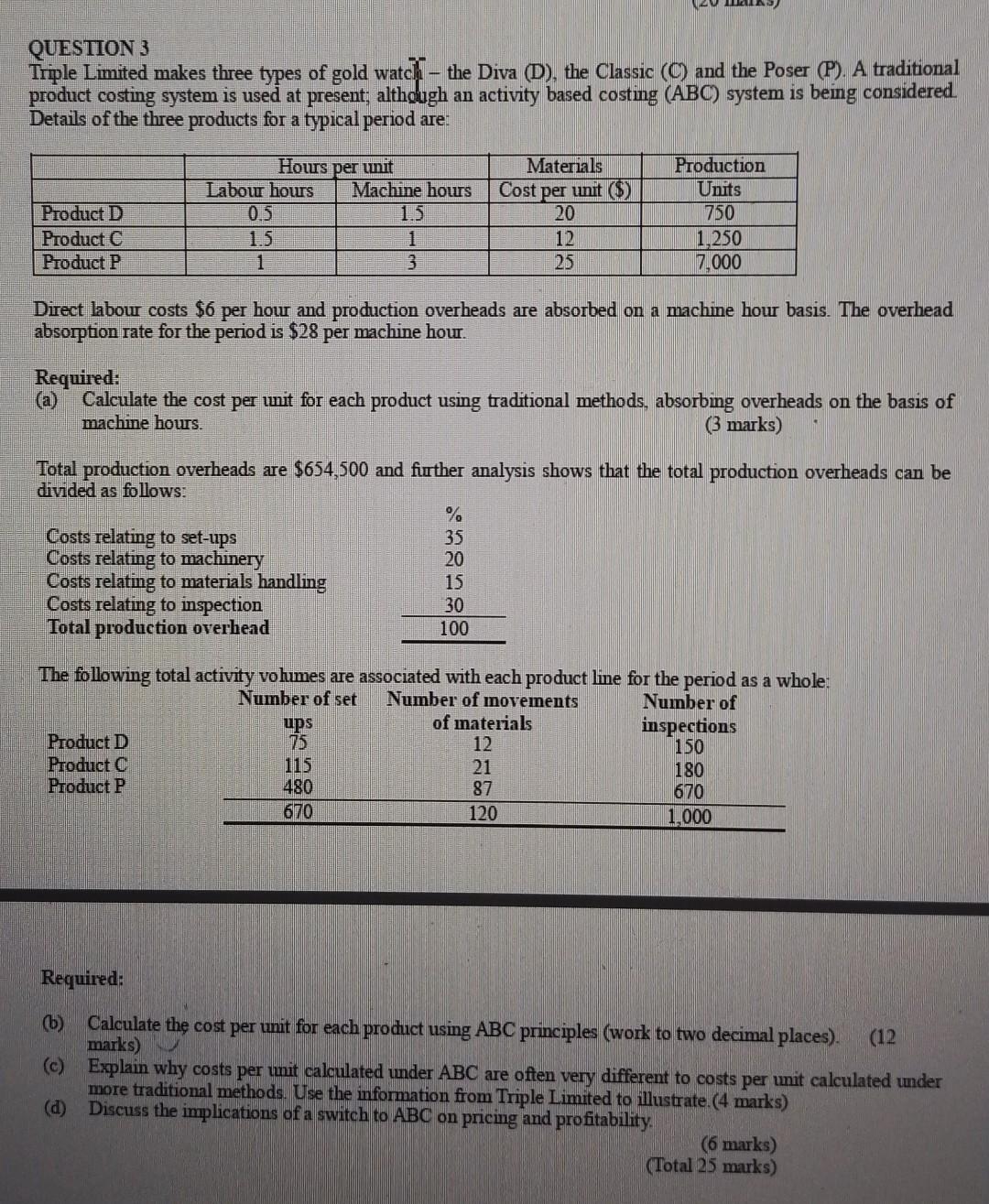

QUESTION 3 Triple Limited makes three types of gold watcli - the Diva (D), the Classic (C) and the Poser (P). A traditional product costing system is used at present; although an activity based costing (ABC) system is being considered. Details of the three products for a typical period are: Direct labour costs $6 per hour and production overheads are absorbed on a machine hour basis. The overhead absorption rate for the period is $28 per machine hour. Required: (a) Calculate the cost per unit for each product using traditional methods, absorbing overheads on the basis of machine hours. (3 marks) Total production overheads are $654,500 and further analysis shows that the total production overheads can be divided as follows: The following total activity volumes are associated with each product line for the period as a whole: Numhan of cat Numhan nf mneramante Required: (b) Calculate the cost per unit for each product using ABC principles (work to two decimal places). marks) (c) Explain why costs per unit calculated under ABC are often very different to costs per unit calculated under more traditional methods. Use the information from Triple Limited to illustrate. (4 marks) (d) Discuss the implications of a switch to ABC on pricing and profitability. (6 marks) (Total 25 marks) QUESTION 3 Triple Limited makes three types of gold watcli - the Diva (D), the Classic (C) and the Poser (P). A traditional product costing system is used at present; although an activity based costing (ABC) system is being considered. Details of the three products for a typical period are: Direct labour costs $6 per hour and production overheads are absorbed on a machine hour basis. The overhead absorption rate for the period is $28 per machine hour. Required: (a) Calculate the cost per unit for each product using traditional methods, absorbing overheads on the basis of machine hours. (3 marks) Total production overheads are $654,500 and further analysis shows that the total production overheads can be divided as follows: The following total activity volumes are associated with each product line for the period as a whole: Numhan of cat Numhan nf mneramante Required: (b) Calculate the cost per unit for each product using ABC principles (work to two decimal places). marks) (c) Explain why costs per unit calculated under ABC are often very different to costs per unit calculated under more traditional methods. Use the information from Triple Limited to illustrate. (4 marks) (d) Discuss the implications of a switch to ABC on pricing and profitability. (6 marks) (Total 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts