Question: What are the key differences between a solvency crisis and a liquidity crisis in commercial banks? A solvency crisis is characterized by a lack of

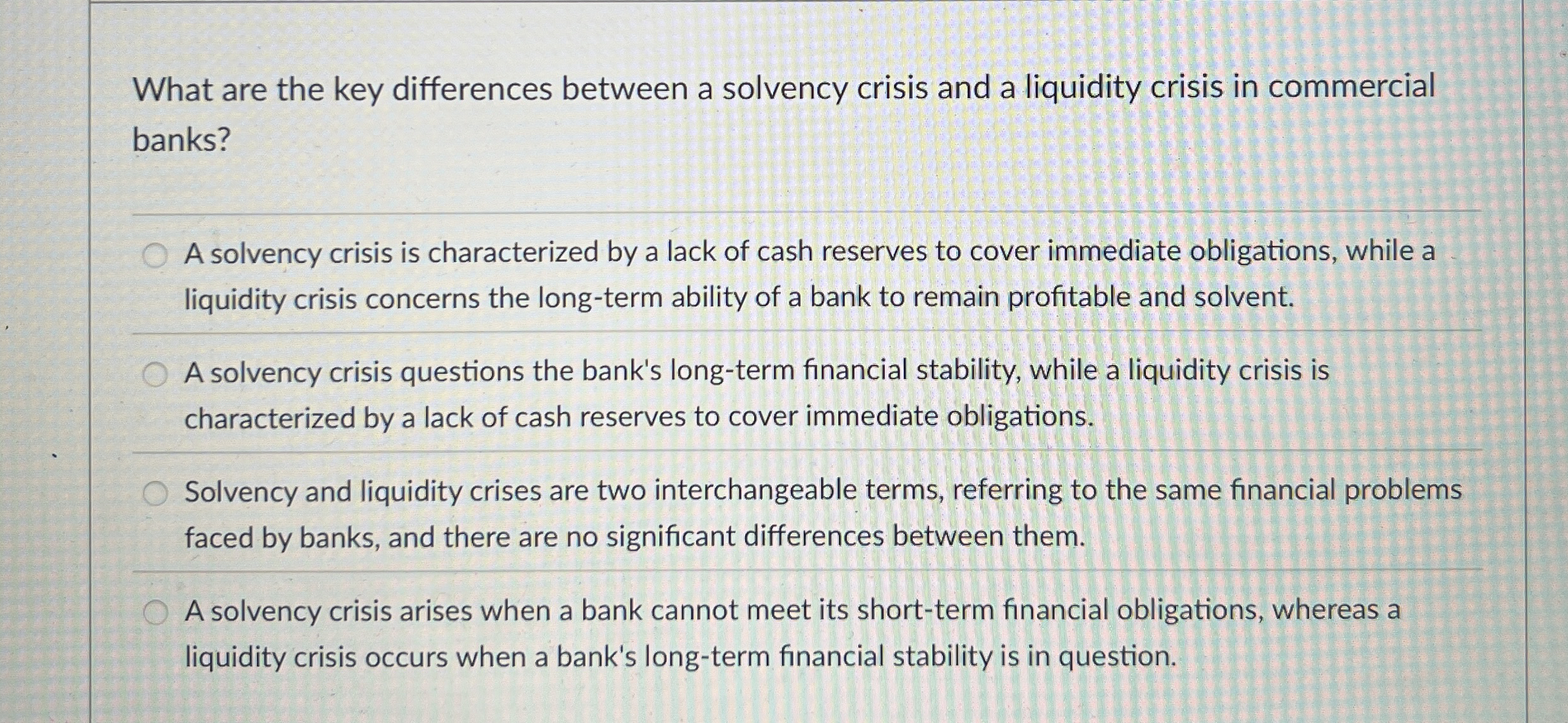

What are the key differences between a solvency crisis and a liquidity crisis in commercial banks?

A solvency crisis is characterized by a lack of cash reserves to cover immediate obligations, while a liquidity crisis concerns the longterm ability of a bank to remain profitable and solvent.

A solvency crisis questions the bank's longterm financial stability, while a liquidity crisis is characterized by a lack of cash reserves to cover immediate obligations.

Solvency and liquidity crises are two interchangeable terms, referring to the same financial problems faced by banks, and there are no significant differences between them.

A solvency crisis arises when a bank cannot meet its shortterm financial obligations, whereas a liquidity crisis occurs when a bank's longterm financial stability is in question.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock