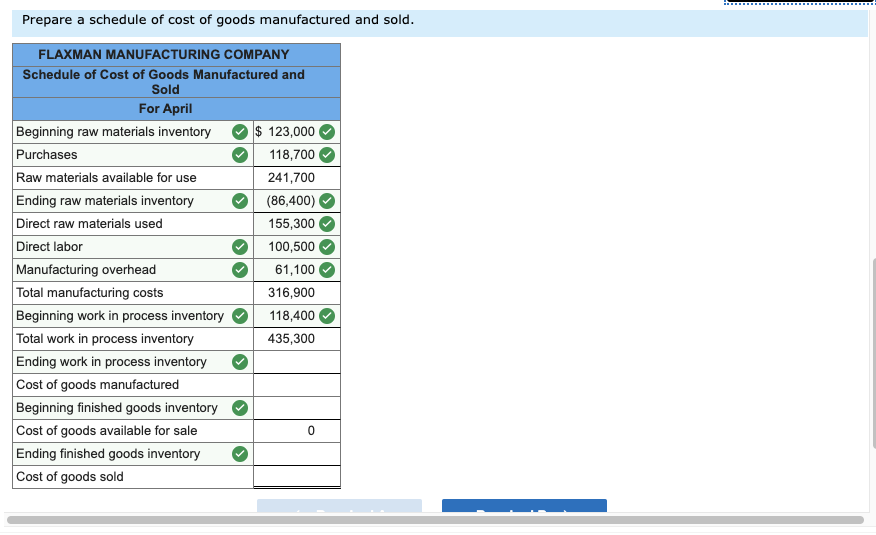

Question: What are the last ones? Ending work in process inventory through cost of goods sold? The following information pertains to Flaxman Manufacturing Company for April.

What are the last ones? Ending work in process inventory through cost of goods sold?

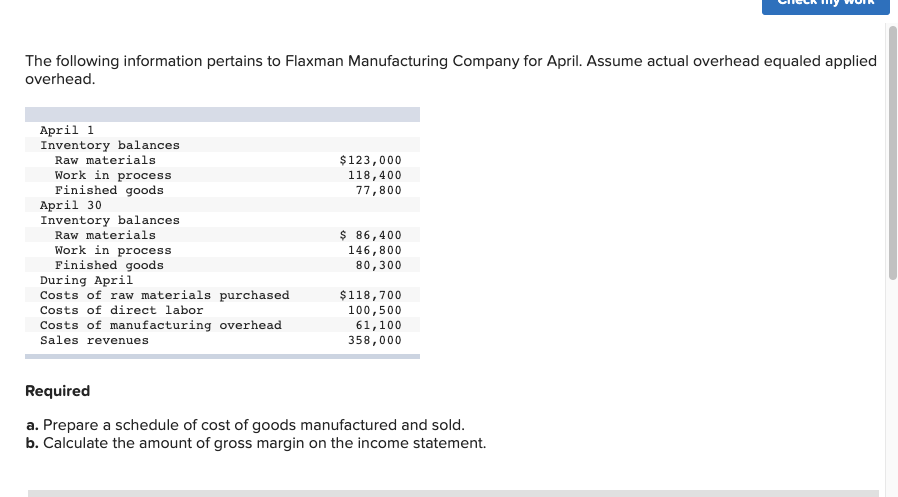

The following information pertains to Flaxman Manufacturing Company for April. Assume actual overhead equaled applied overhead. $123,000 118,400 77,800 April 1 Inventory balances Raw materials Work in process Finished goods April 30 Inventory balances Raw materials Work in process Finished goods During April Costs of raw materials purchased Costs of direct labor Costs of manufacturing overhead Sales revenues $ 86,400 146,800 80,300 $118,700 100,500 61,100 358,000 Required a. Prepare a schedule of cost of goods manufactured and sold. b. Calculate the amount of gross margin on the income statement. Prepare a schedule of cost of goods manufactured and sold. FLAXMAN MANUFACTURING COMPANY Schedule of Cost of Goods Manufactured and Sold For April Beginning raw materials inventory $ 123,000 Purchases 118,700 Raw materials available for use 241,700 Ending raw materials inventory (86,400) Direct raw materials used 155,300 Direct labor 100,500 Manufacturing overhead 61,100 Total manufacturing costs 316,900 Beginning work in process inventory 118,400 Total work in process inventory 435,300 Ending work in process inventory Cost of goods manufactured Beginning finished goods inventory Cost of goods available for sale 0 Ending finished goods inventory Cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts