Question: What are the last three calculations? Please show your work. Southeast Ale Company is a microbrewery in Anchorage. By the end of 20X1, the company's

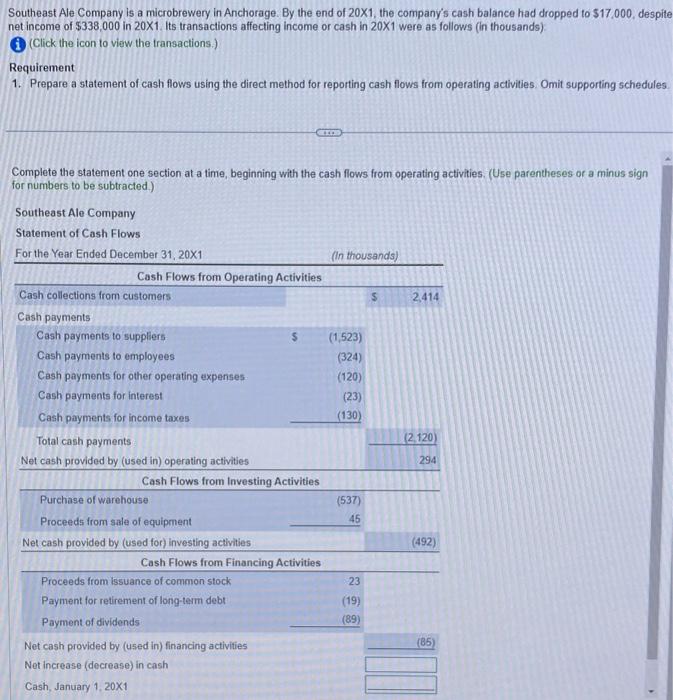

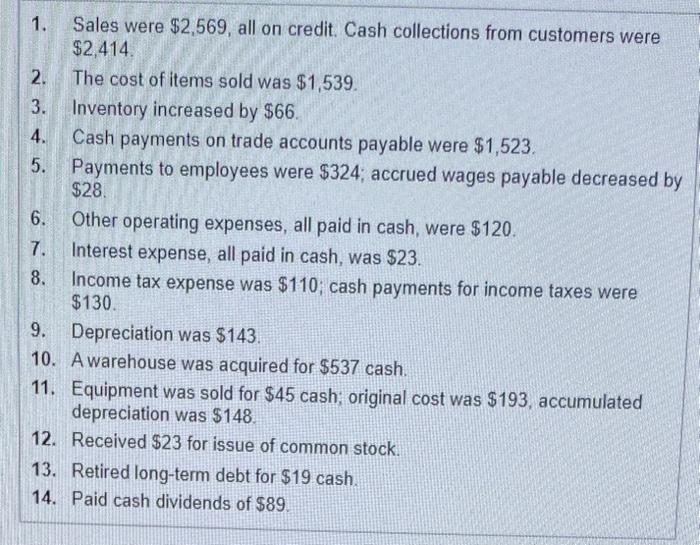

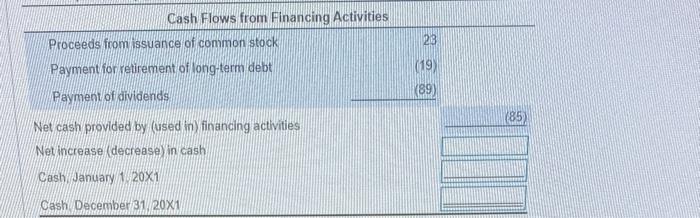

Southeast Ale Company is a microbrewery in Anchorage. By the end of 20X1, the company's cash balance had dropped to $17,000, despite net income of $338,000 in 20X1. Its transactions affecting income or cash in 20X1 were as follows (in thousands) (Click the icon to view the transactions.) Requirement 1. Prepare a statement of cash flows using the direct method for reporting cash flows from operating activities. Omit supporting schedules. Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use parentheses or a minus sign for numbers to be subtracted.) 1. Sales were $2,569, all on credit. Cash collections from customers were $2,414. 2. The cost of items sold was $1,539. 3. Inventory increased by $66. 4. Cash payments on trade accounts payable were $1,523. 5. Payments to employees were $324; accrued wages payable decreased by $28. 6. Other operating expenses, all paid in cash, were $120. 7. Interest expense, all paid in cash, was $23. 8. Income tax expense was $110; cash payments for income taxes were $130. 9. Depreciation was $143. 10. A warehouse was acquired for $537cash. 11. Equipment was sold for $45 cash; original cost was $193, accumulated depreciation was $148. 12. Received $23 for issue of common stock. 13. Retired long-term debt for $19 cash. 14. Paid cash dividends of $89. Cash Flows from Financing Activities Proceeds from issuance of common stock 29 Payment for retirement of long-term debt (19) Payment of dividends (89) Net cash provided by (used in) financing activities Net increase (decrease) in cash Cash. January 1 20x1 Cash December 31 . 20x1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts