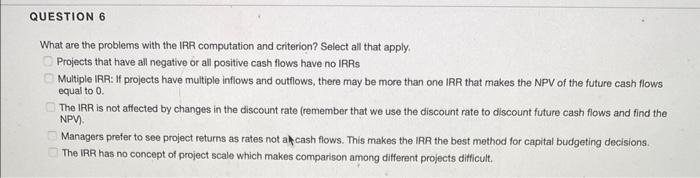

Question: What are the problems with the IRR computation and criterion? Select all that apply. Projects that have all negative or all positive cash flows have

What are the problems with the IRR computation and criterion? Select all that apply. Projects that have all negative or all positive cash flows have no IRRs Multiple IRR: If projects have multiple inflows and outlows, there may be more than one IRR that makes the NPV of the future cash flows equal to 0 . The IRR is not affected by changes in the discount rate (remember that we use the discount rate to discount future cash flows and find the NPV). Managers prefer to see project returns as rates not alfcash flows. This makes the IRR the best method for capital budgeting decisions. The IRR has no concept of project scale which makes comparison among different projects difficult

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts