Question: what are the steps necessary to solve these problems One share of Van Horn Distributors, Inc. has a market price of $80. The firm lists

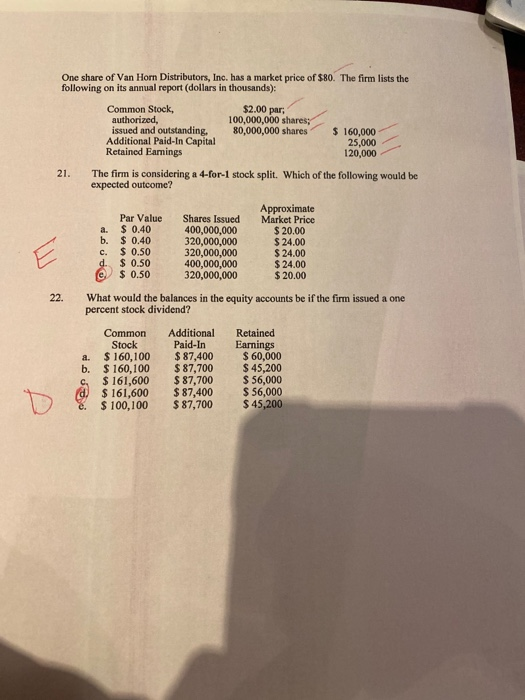

One share of Van Horn Distributors, Inc. has a market price of $80. The firm lists the following on its annual report (dollars in thousands): Common Stock, authorized, issued and outstanding. Additional Paid-In Capital Retained Eamings $2.00 par 100,000,000 shares; 80,000,000 shares $ 160,000 25,000 120,000 21. The firm is considering a 4-for-1 stock split. Which of the following would be expected outcome? a. b. c. d. @ Par Value $ 0.40 $ 0.40 $ 0.50 $ 0.50 $ 0.50 Shares Issued 400,000,000 320,000,000 320,000,000 400,000,000 320,000,000 Approximate Market Price $ 20.00 $24.00 $24.00 $ 24.00 $ 20.00 22. What would the balances in the equity accounts be if the firm issued a one percent stock dividend? a. b. c. d) e Common Stock $ 160,100 $ 160,100 $ 161,600 $ 161,600 $100,100 Additional Additional Paid-In $ 87,400 $ 87,700 $ 87,700 $ 87,400 $ 87,700 Retained Earnings $ 60,000 $ 45,200 $ 56,000 $ 56,000 $ 45,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts