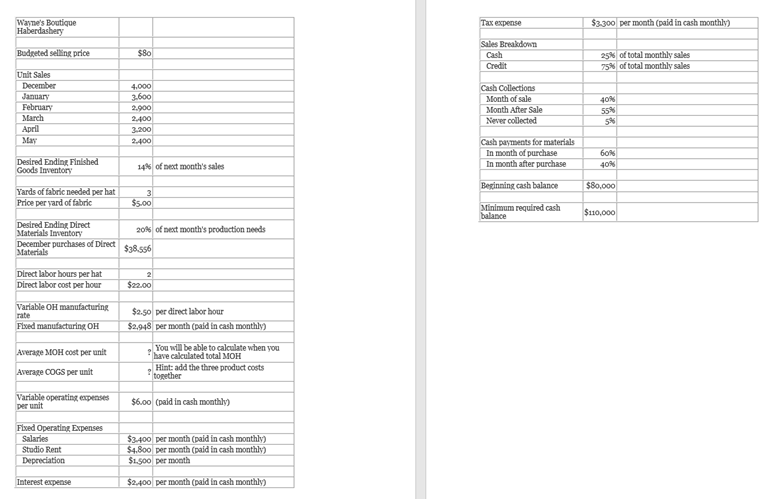

Question: What are the total variable operating expenses for March? What are the total fixed expenses for February? What are the total operating expenses for the

- What are the total variable operating expenses for March?

- What are the total fixed expenses for February?

- What are the total operating expenses for the quarter?

- What is the total cost of goods sold from the income statement for the quarter ended March 31?

- What is the operating income from the income statement (round to nearest penny)?

- What is the net income from the income statement (round to nearest penny)?

- How much cash is collected (on cash sales and credit sales) in January?

- How much cash is collected (on cash sales and credit sales) for the quarter?

- What are the cash payments in January on purchases made in December?

- What are the cash payments for operating expenses in February?

- What are the total cash payments for the quarter?

- What is the ending cash balance before financing for January?

- What is the ending cash balance before financing for February?

- What is the ending cash balance before financing for March?

- Does High End Crockery Corp ever need to borrow money to meet their minimum cash balance requirement?

Wayne's Boutique Haberdashery Tax expense $3.300 per month (paid in cash monthly Budgeted selling price $80 Sales Breakdown Cash Credit 25% of total monthly sales 75% of total monthly sales Unit Sales December January February March April 4.000 3.600 2.900 2.400 3.200 2.400 Cash Collections Month of sale Month After Sale Never collected 4096 55% 56 May Cash payments for materials In month of purchase In month after purchase Desired Ending Finished Goods Inventory 60M 401 14% of next month's sales Beginning cash balance $80,000 Yards of fabric needed per hat Price per yard of fabric 3 $5.00 Minimum required cash balance $110,000 20% of next month's production needs Desired Ending Direct Materials Inventory December purchases of Direct Materials $38.556 Direct labor hours per hat Direct labor cost per hour $22.00 Variable O manufacturing rate Fixed manufacturing OH $2.50 per direct labor hour $2.948 per month (paid in cash monthly) Average MOH cost per unit You will be able to calculate when you have cakulated total MOH Hint: add the three product costs together Average COGS per unit Variable operating expenses per unit $6.00 (paid in cash monthly Fixed Operating Expenses Salaries Studio Rent Depreciation $3.400 per month(paid in cash monthly) $4.800 per month (paid in cash monthly) $1.500 per month Interest expense $2.400 per month (pald in cash monthly) Wayne's Boutique Haberdashery Tax expense $3.300 per month (paid in cash monthly Budgeted selling price $80 Sales Breakdown Cash Credit 25% of total monthly sales 75% of total monthly sales Unit Sales December January February March April 4.000 3.600 2.900 2.400 3.200 2.400 Cash Collections Month of sale Month After Sale Never collected 4096 55% 56 May Cash payments for materials In month of purchase In month after purchase Desired Ending Finished Goods Inventory 60M 401 14% of next month's sales Beginning cash balance $80,000 Yards of fabric needed per hat Price per yard of fabric 3 $5.00 Minimum required cash balance $110,000 20% of next month's production needs Desired Ending Direct Materials Inventory December purchases of Direct Materials $38.556 Direct labor hours per hat Direct labor cost per hour $22.00 Variable O manufacturing rate Fixed manufacturing OH $2.50 per direct labor hour $2.948 per month (paid in cash monthly) Average MOH cost per unit You will be able to calculate when you have cakulated total MOH Hint: add the three product costs together Average COGS per unit Variable operating expenses per unit $6.00 (paid in cash monthly Fixed Operating Expenses Salaries Studio Rent Depreciation $3.400 per month(paid in cash monthly) $4.800 per month (paid in cash monthly) $1.500 per month Interest expense $2.400 per month (pald in cash monthly)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts