Question: What assumption about risk-adjusted techniques for measuring performance poses a potential problem? Multiple Choice Portfolio risk is constant over time Returns are normally distributed None

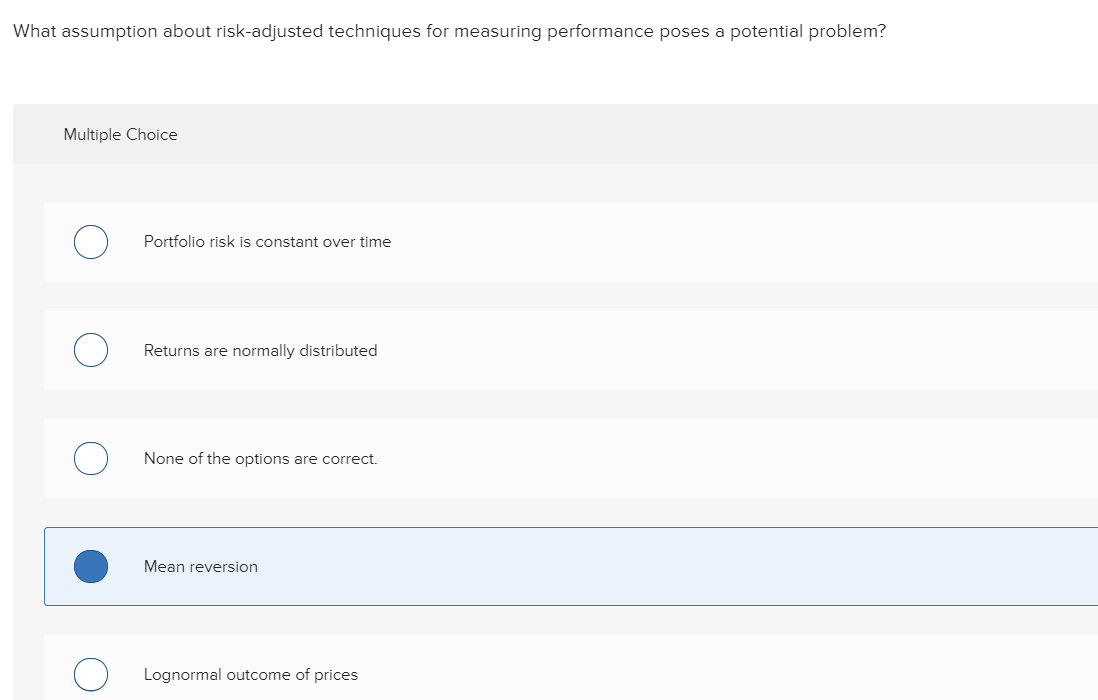

What assumption about risk-adjusted techniques for measuring performance poses a potential problem? Multiple Choice Portfolio risk is constant over time Returns are normally distributed None of the options are correct. Mean reversion Lognormal outcome of prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts