Question: What difference does it make for income tax purposes whether an intangible asset is (1) acquired in connection with a business acquisition, (2) acquired by

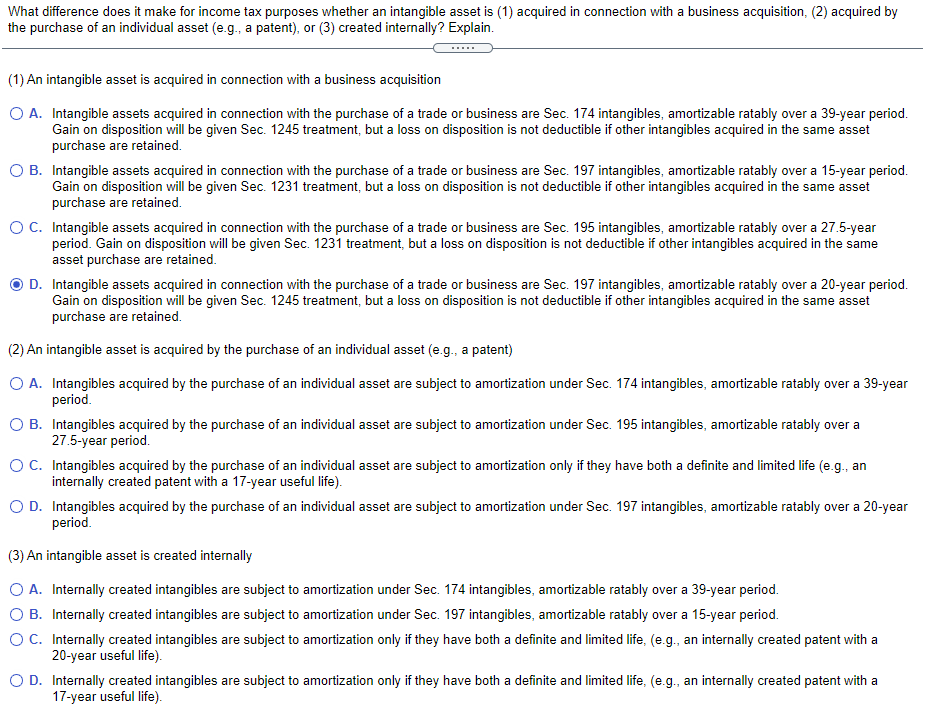

What difference does it make for income tax purposes whether an intangible asset is (1) acquired in connection with a business acquisition, (2) acquired by the purchase of an individual asset (e.g., a patent), or (3) created internally? Explain. (1) An intangible asset is acquired in connection with a business acquisition O A. Intangible assets acquired in connection with the purchase of a trade or business are Sec. 174 intangibles, amortizable ratably over a 39-year period. Gain on disposition will be given Sec. 1245 treatment, but a loss on disposition is not deductible if other intangibles acquired in the same asset purchase are retained. OB. Intangible assets acquired in connection with the purchase of a trade or business are Sec. 197 intangibles, amortizable ratably over a 15-year period. Gain on disposition will be given Sec. 1231 treatment, but a loss on disposition is not deductible if other intangibles acquired in the same asset purchase are retained. OC. Intangible assets acquired in connection with the purchase of a trade or business are Sec. 195 intangibles, amortizable ratably over a 27.5-year period. Gain on disposition will be given Sec. 1231 treatment, but a loss on disposition is not deductible if other intangibles acquired in the same asset purchase are retained. D. Intangible assets acquired in connection with the purchase of a trade or business are Sec. 197 intangibles, amortizable ratably over a 20-year period. Gain on disposition will be given Sec. 1245 treatment, but a loss on disposition is not deductible if other intangibles acquired in the same asset purchase are retained (2) An intangible asset is acquired by the purchase of an individual asset (e.g., a patent) O A. Intangibles acquired by the purchase of an individual asset are subject to amortization under Sec. 174 intangibles, amortizable ratably over a 39-year period. OB. Intangibles acquired by the purchase of an individual asset are subject to amortization under Sec. 195 intangibles, amortizable ratably over a 27.5-year period. O C. Intangibles acquired by the purchase of an individual asset are subject to amortization only if they have both a definite and limited life (e.g., an internally created patent with a 17-year useful life). OD. Intangibles acquired by the purchase of an individual asset are subject to amortization under Sec. 197 intangibles, amortizable ratably over a 20-year period. (3) An intangible asset is created internally O A. Internally created intangibles are subject to amortization under Sec. 174 intangibles, amortizable ratably over a 39-year period. OB. Internally created intangibles are subject to amortization under Sec. 197 intangibles, amortizable ratably over a 15-year period. OC. Internally created intangibles are subject to amortization only if they have both a definite and limited life, (e.g., an internally created patent with a 20-year useful life) OD. Internally created intangibles are subject to amortization only if they have both a definite and limited life, (e.g., an internally created patent with a 17-year useful life)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts