Question: What difference does it make to the worst-case scenario in Example 19.1 if (a) the options are American rather than European and (b) the options

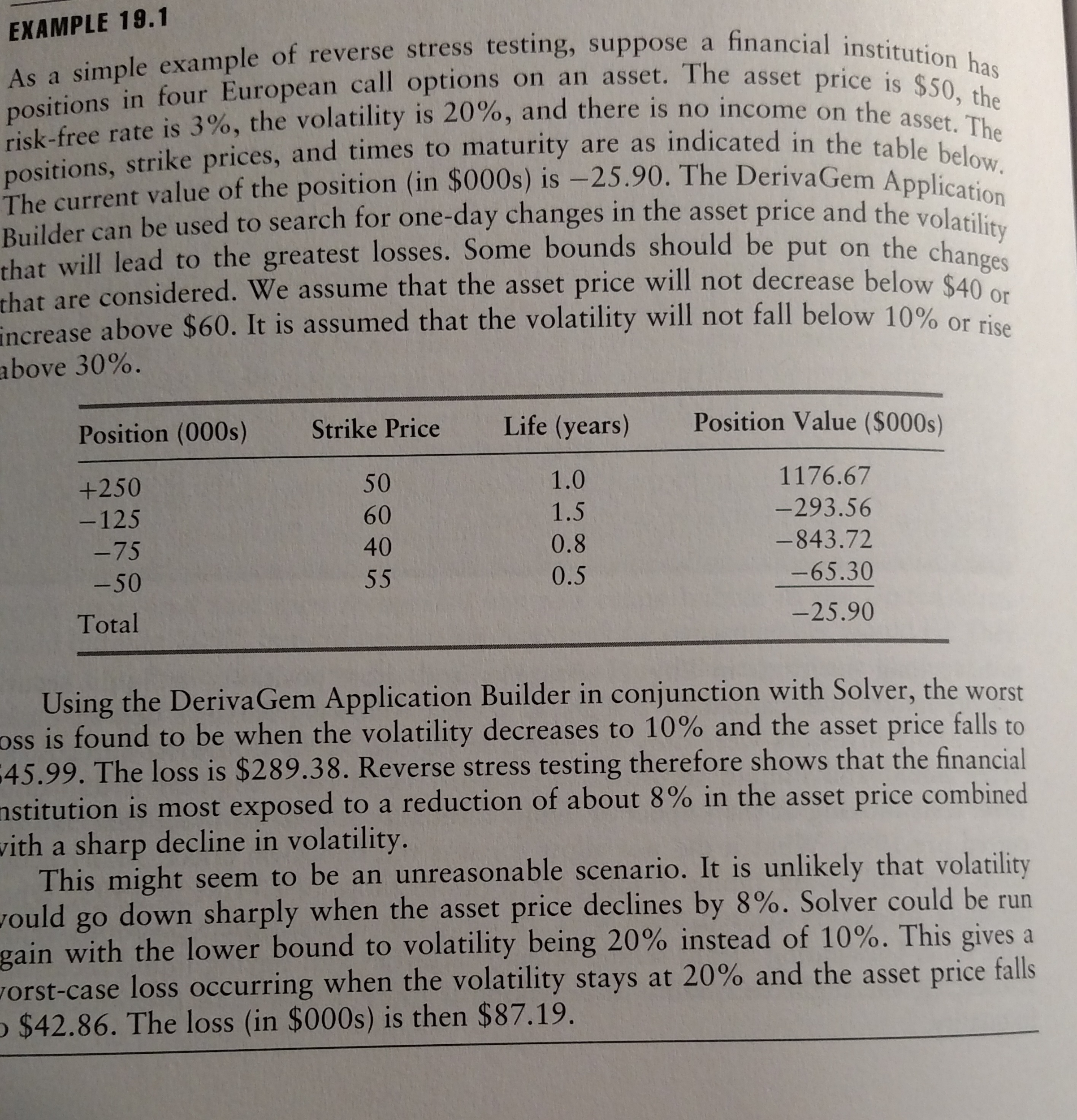

What difference does it make to the worst-case scenario in Example 19.1 if (a) the options are American rather than European and (b) the options are barrier options that are knocked out if the asset price reaches $65? Use the DerivaGem Application Builder in conjunction with Solver to search over asset prices between $40 and $60 and volatilities between 18% and 30%. Risk Management and Financial Institutions by John Hull

Please show work.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts