Question: What do I put for the incorrect answer? Here are my choices: Buzzard Bicycle speclalizes in custom painting and design of bicycles. December 31 is

What do I put for the incorrect answer? Here are my choices:

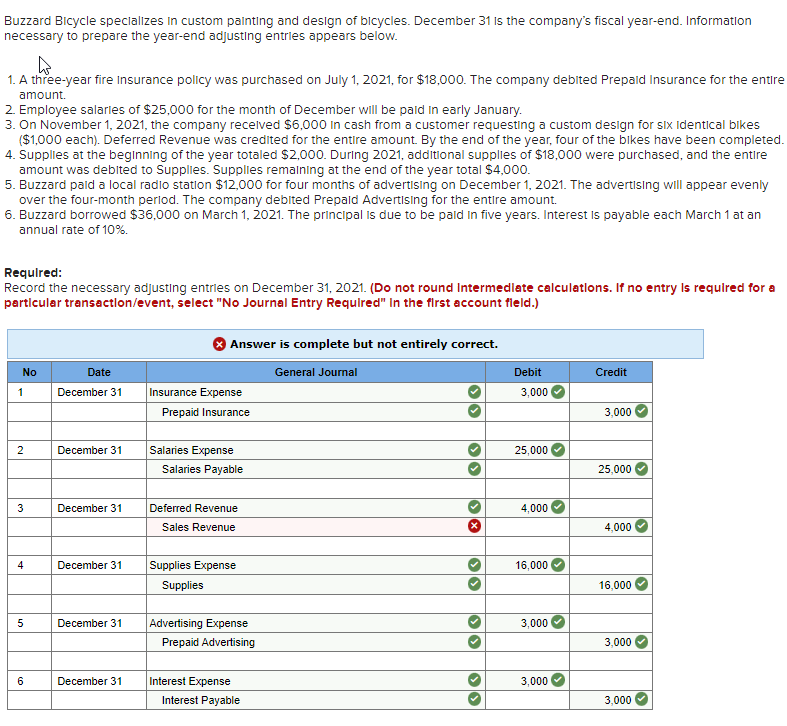

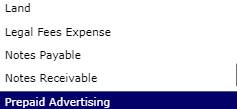

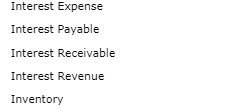

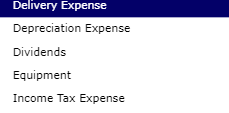

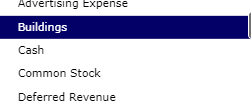

Buzzard Bicycle speclalizes in custom painting and design of bicycles. December 31 is the company's fiscal year-end. Information necessary to prepare the year-end adjusting entrles appears below. 1. A three-year fire insurance policy was purchased on July 1,2021 , for $18,000. The company debited Prepaid Insurance for the entire amount. 2. Employee salarles of $25,000 for the month of December will be paid in early January. 3. On November 1,2021 , the company recelved $6,000 In cash from a customer requesting a custom design for six Identical bikes ($1,000 each). Deferred Revenue was credited for the entire amount. By the end of the year, four of the bikes have been completed 4. Supplies at the beginning of the year totaled $2,000. During 2021 , additional supplies of $18,000 were purchased, and the entire amount was debited to Supplies. Supplies remaining at the end of the year total $4,000. 5. Buzzard paid a local radio station $12,000 for four months of advertising on December 1,2021 . The advertising will appear evenly over the four-month period. The company debited Prepald Advertising for the entire amount. 6. Buzzard borrowed $36,000 on March 1, 2021. The principal is due to be pald in five years. Interest is payable each March 1 at an annual rate of 10%. Required: Record the necessary adjusting entrles on December 31, 2021. (Do not round Intermedlate calculations. If no entry is requlred for a particular transaction/event, select "No Journal Entry Required" In the first account fleld.) Service Revenue Supplies Supplies Expense Utilities Expense Utilities Payable Retained Earnings Salaries Expense Salaries Payable Sales Revenue Service Fee Expense Prepaid Advertising Prepaid Insurance Prepaid Rent Rent Expense Repairs and Maintenance Expense Land Legal Fees Expense Notes Payable Notes Receivable Prepaid Advertising Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Delivery Expense Depreciation Expense Dividends Equipment Income Tax Expense Advertising Expense Buildings Cash Common Stock Deferred Revenue No Journal Entry Required Accounts Payable Accounts Receivable Accumulated Depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts