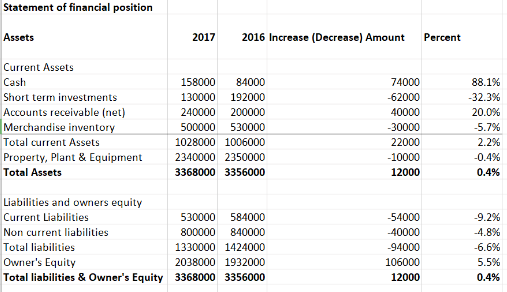

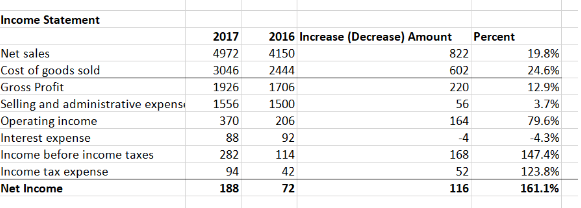

Question: What do I write in my interpretation analysis on the statement of financial position and statement of comprehensive income? Please separate the analysis of each

What do I write in my interpretation analysis on the statement of financial position and statement of comprehensive income? Please separate the analysis of each financial statement and state why it increased or decreased (each account please), thank you! Example of an interpretation analysis: https://www.youtube.com/watch?v=obS_1RwIe34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts