Question: What do you mean by that? REQUIRED Show the effect of the following transactions of Havenside Stores on the Accounting equation. Use + to denote

What do you mean by that?

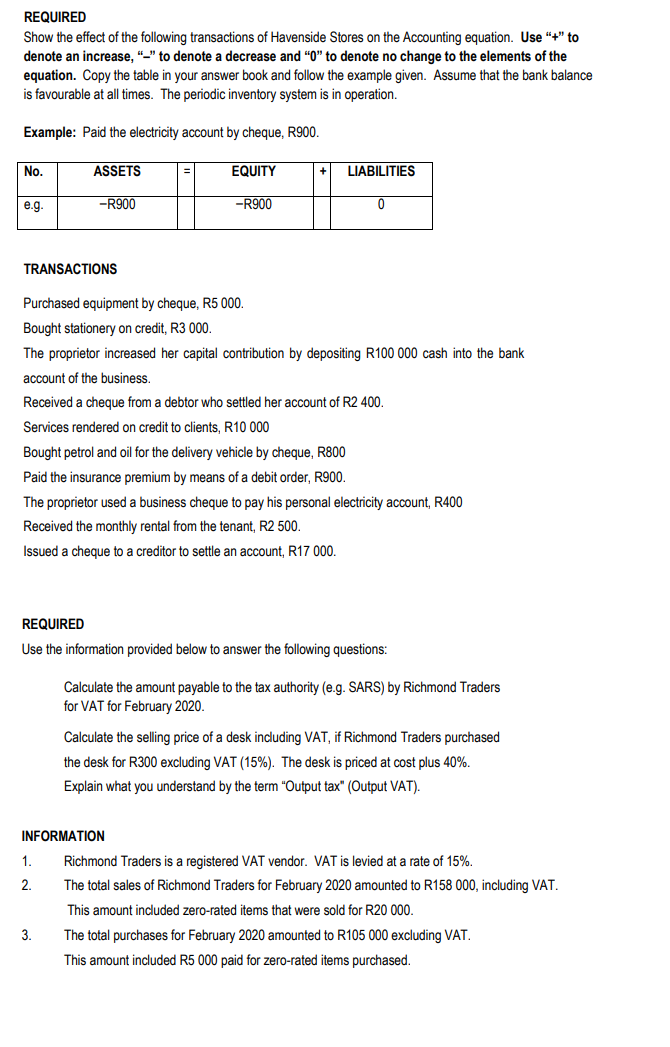

REQUIRED Show the effect of the following transactions of Havenside Stores on the Accounting equation. Use "+" to denote an increase, "-" to denote a decrease and "O" to denote no change to the elements of the equation. Copy the table in your answer book and follow the example given. Assume that the bank balance is favourable at all times. The periodic inventory system is in operation. Example: Paid the electricity account by cheque, R900. No. ASSETS EQUITY + LIABILITIES e.g. -R900 -R900 0 TRANSACTIONS Purchased equipment by cheque, R5 000. Bought stationery on credit, R3 000 The proprietor increased her capital contribution by depositing R100 000 cash into the bank account of the business. Received a cheque from a debtor who settled her account of R2 400 Services rendered on credit to clients, R10 000 Bought petrol and oil for the delivery vehicle by cheque, R800 Paid the insurance premium by means of a debit order, R900. The proprietor used a business cheque to pay his personal electricity account, R400 Received the monthly rental from the tenant, R2 500. Issued a cheque to a creditor to settle an account, R17 000 REQUIRED Use the information provided below to answer the following questions: Calculate the amount payable to the tax authority (e.g. SARS) by Richmond Traders for VAT for February 2020. Calculate the selling price of a desk including VAT, if Richmond Traders purchased the desk for R300 excluding VAT (15%). The desk is priced at cost plus 40%. Explain what you understand by the term "Output tax" (Output VAT). 1. INFORMATION Richmond Traders is a registered VAT vendor. VAT is levied at a rate of 15%. 2. The total sales of Richmond Traders for February 2020 amounted to R158 000, including VAT. This amount included zero-rated items that were sold for R20 000. 3. The total purchases for February 2020 amounted to R105 000 excluding VAT. This amount included R5 000 paid for zero-rated items purchased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts