Question: What do you mean the base question is missing? I posted 6 questions followed by the data applicable to the questions QUESTION 42: (1.50) Which

What do you mean the base question is missing? I posted 6 questions followed by the data applicable to the questions

QUESTION 42: (1.50)

Which of the following alternatives represents the correct amount to be recorded as Sales in the Statement of Profit/Loss for the financial year ending 28 February 20.22?

A: R 812 700

B: R 662 608, 70

C: R 695 739,13

D: R 800 100

E: R 876 300

QUESTION 43: (1.50)

Which of the following alternatives represents the correct amount to be recorded as Cost of Sales in the Statement of Profit/Loss for the financial year ending 28 February 20.22?

A: R 323 400

B: R 438 105, 36

C: R 569 355, 36

D: R 471 194, 64

E: R 700 605, 36

QUESTION 44: (1.50)

Which of the following alternatives represents the correct amount to be recorded as an adjustment to Credit Losses in the Statement of Profit/Loss for the financial year ending 28 February 20.22?

A: - (R 15 000)

B: R 15 000

C: - (R 5 775)

D: R 5 775

E: R 9 225

QUESTION 45: (1.50)

Which of the following alternatives represents the correct amount to be recorded as an Stationary consumed in the Statement of Profit/Loss for the financial year ending 28 February 20.22?

A: R 9 150

B: R 12 150

C: R 13 230

D: R 9 000

E: R 5 250

QUESTION 46: (1.50)

Which of the following alternatives represents the correct amount to be recorded as depreciation relating to the Catering Equipment in the Statement of Profit/Loss for the financial year ending 28 February 20.22?

A: R 21 000

B: R 30 000

C: R 35 000

D: R 30 500

E: R 22 166, 66

QUESTION 47: (1.50)

Which of the following alternatives represents the correct amount to be recorded as depreciation relating to the Vehicles in the Statement of Profit/Loss for the financial year ending 28 February 20.22?

A: R 56 500

B: R 63 000

C: R 48 307, 50

D: R 50 825

E: R 43 476, 75

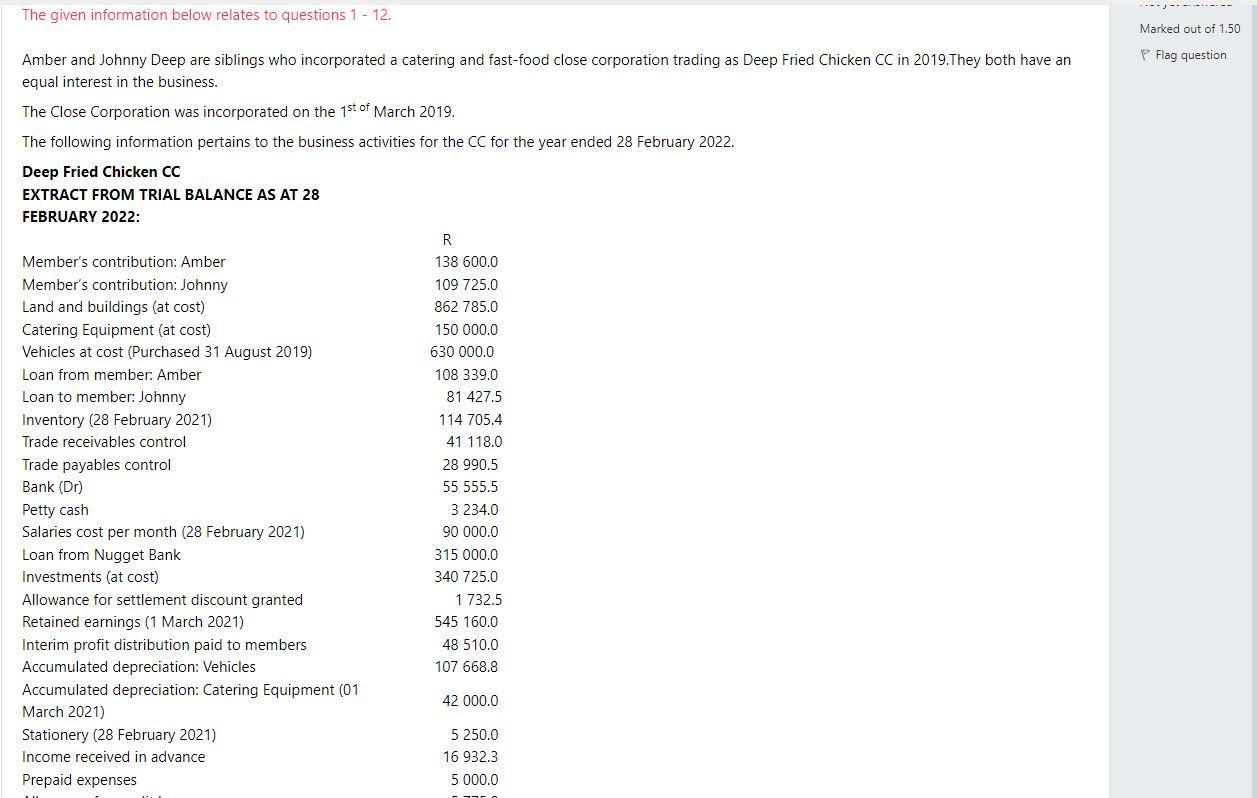

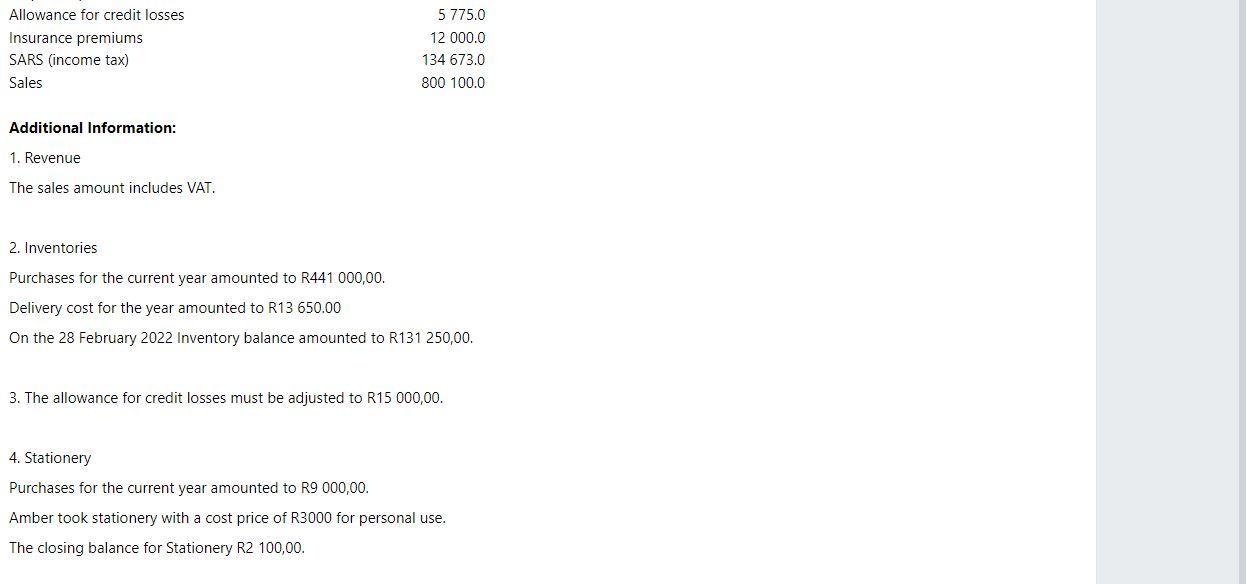

The given information below relates to questions 1 - 12. Amber and Johnny Deep are siblings who incorporated a catering and fast-food close corporation trading as Deep Fried Chicken CC in 2019.They both have an equal interest in the business. The Close Corporation was incorporated on the 1st of March 2019. The following information pertains to the business activities for the CC for the year ended 28 February 2022. Deep Fried Chicken CC EXTRACT FROM TRIAL BALANCE AS AT 28 FEBRUARY 2022: R 138 600.0 Member's contribution: Amber Member's contribution: Johnny 109 725.0 Land and buildings (at cost) 862 785.0 Catering Equipment (at cost) 150 000.0 630 000.0 108 339.0 Vehicles at cost (Purchased 31 August 2019) Loan from member: Amber Loan to member: Johnny Inventory (28 February 2021) 81 427.5 114 705.4 Trade receivables control 41 118.0 Trade payables control 28 990.5 Bank (Dr) 55 555.5 Petty cash 3 234.0 Salaries cost per month (28 February 2021) 90 000.0 Loan from Nugget Bank 315 000.0 Investments (at cost) 340 725.0 Allowance for settlement discount granted 1 732.5 Retained earnings (1 March 2021) 545 160.0 Interim profit distribution paid to members 48 510.0 Accumulated depreciation: Vehicles 107 668.8 Accumulated depreciation: Catering Equipment (01 March 2021) 42 000.0 Stationery (28 February 2021) 5 250.0 Income received in advance 16 932.3 Prepaid expenses 5 000.0 Marked out of 1.50 Flag question Allowance for credit losses Insurance premiums SARS (income tax) Sales Additional Information: 1. Revenue The sales amount includes VAT. 2. Inventories Purchases for the current year amounted to R441 000,00. Delivery cost for the year amounted to R13 650.00 On the 28 February 2022 Inventory balance amounted to R131 250,00. 3. The allowance for credit losses must be adjusted to R15 000,00. 4. Stationery Purchases for the current year amounted to R9 000,00. Amber took stationery with a cost price of R3000 for personal use. The closing balance for Stationery R2 100,00. 5 775.0 12 000.0 134 673.0 800 100.0 4. Depreciation Vehicles: 10% per annum on diminishing method. Residual value of R65 000,00 for the two vehicles, namely: Toyota Hiluz - Purchased and brought into use 01 September 2018. Nissan KP2008 - Purchased and brought into use 31 June 2018. On the 01st of March 2021 the Nissan was sold for R290 000,00 cash. Cost of the vehicle was R350 000,00. Catering Equipment: 20% per annum on the straight-line method., Residual value Rnill. A new stove was purchased cash for R45 000, 00 on the 31st of December 2021. The stove is depreciated at 20% on the straight-line method with an estimated residual value of R10 000. There were no other purchases/disposals relating to assets in the current year. 5. The CC employees are entitled to an annual salary increase of 1% above inflation rate at the beginning of December every year, the current year's adjustment has not been recorded. 6. Deep Fried took out insurance on the 01st of January 2022. The monthly premiums are R1 000,00. The annual payment for the insurance was made on the 5th of January. 7. Loan from Nugget Bank The loan was granted on the 1st of June 2020 at an interest rate of 15% per annum payable on 28 February every year. The loan is unsecured and is repayable in bi-annually in 8 equal instalments from 1 December 2022. 8. The income tax for the year R76 088.25 must still be provided for. 9. Assume inflation rate of 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts