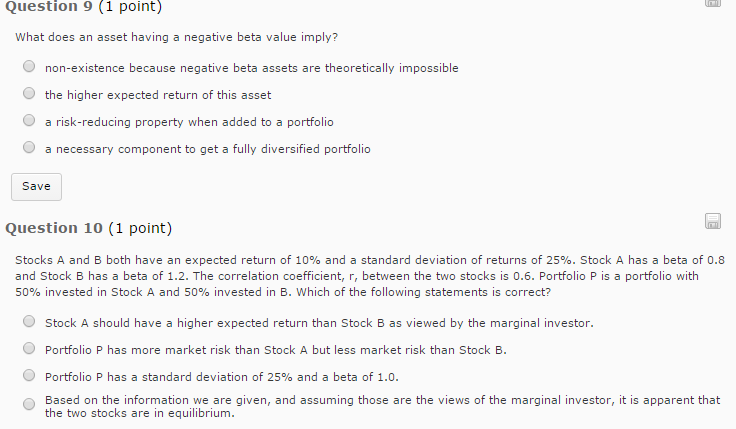

Question: What does an asset having a negative beta value imply? non-existence because negative beta assets are theoretically impossible the higher expected return of this asset

What does an asset having a negative beta value imply? non-existence because negative beta assets are theoretically impossible the higher expected return of this asset a risk-reducing property when added to a portfolio a necessary component to get a fully diversified portfolio Stocks A and B both have an expected return of 10% and a standard deviation of returns of 25%. Stock A has a beta of 0.8 and Stock B has a beta of 1.2. The correlation coefficient, r, between the two stocks is 0.6. Portfolio P is a portfolio with 50% invested in Stock A and 50% invested in B. Which of the following statements is correct? Stock A should have a higher expected return than Stock B as viewed by the marginal investor. Portfolio P has more market risk than Stock A but less market risk than Stock B. Portfolio P has a standard deviation of 25% and a beta of 1.0. Based on the information we are given, and assuming those are the views of the marginal investor, it is apparent that the two stocks are in equilibrium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts