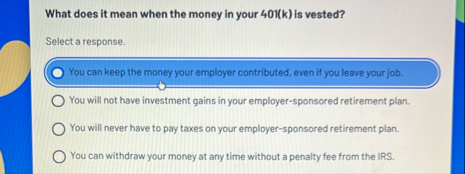

Question: What does it mean when the money in your 4 0 1 ( k ) is vested? Select a response. You can keep the money

What does it mean when the money in your is vested?

Select a response.

You can keep the money your employer contributed, even if you leave your job.

You will not have investment gains in your employersponsored retirement plan.

You will never have to pay taxes on your employersponsored retirement plan.

You can withdraw your money at any time without a penalty fee from the IRS.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock