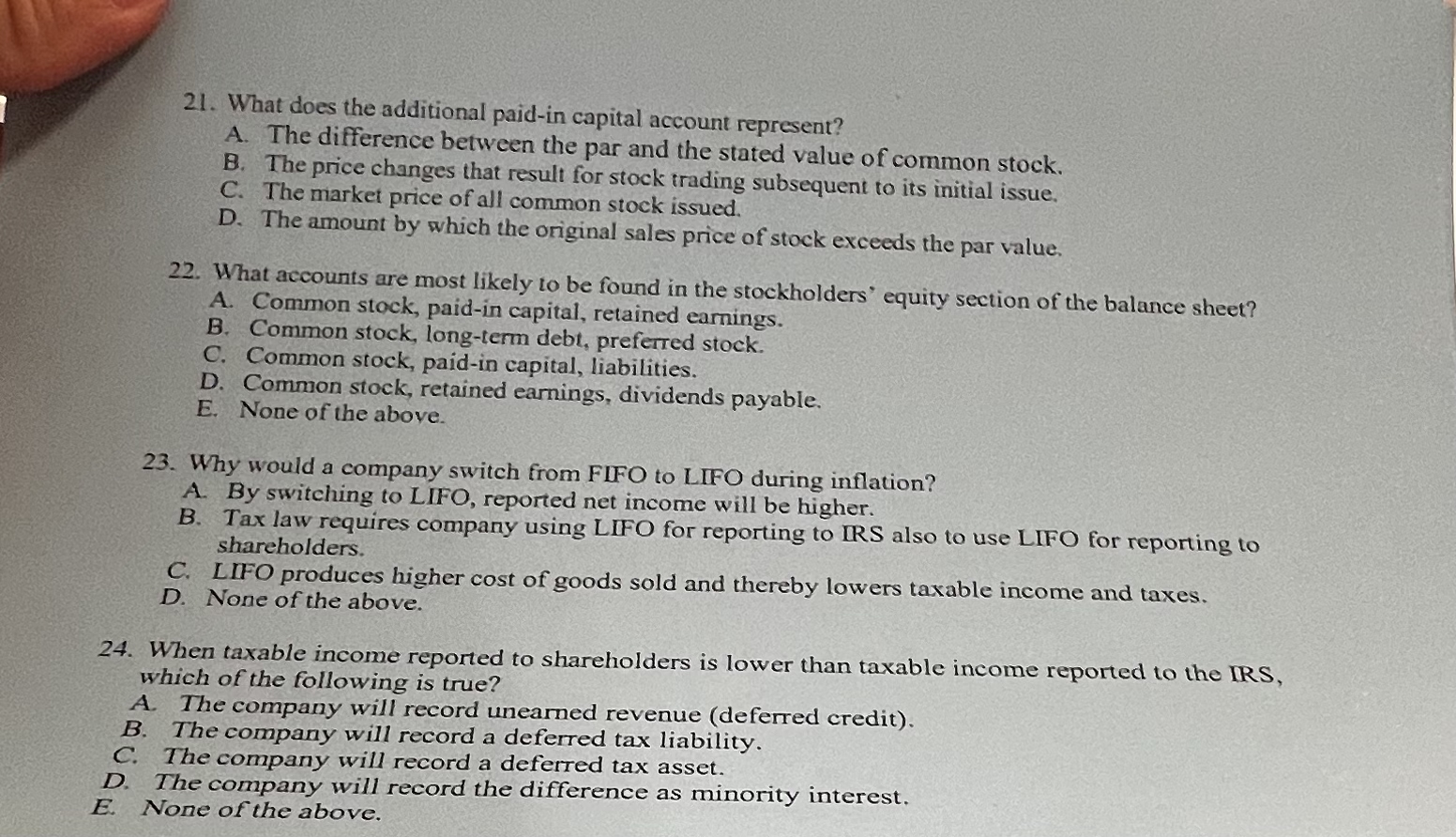

Question: What does the additional paid - in capital account represent? A . The difference between the par and the stated value of common stock. B

What does the additional paidin capital account represent?

A The difference between the par and the stated value of common stock.

B The price changes that result for stock trading subsequent to its initial issue.

C The market price of all common stock issued.

D The amount by which the original sales price of stock exceeds the par value.

What accounts are most likely to be found in the stockholders' equity section of the balance sheet?

A Common stock, paidin capital, retained earnings.

B Common stock, longterm debt, preferred stock.

C Common stock, paidin capital, liabilities.

D Common stock, retained earnings, dividends payable.

E None of the above.

Why would a company switch from FIFO to LIFO during inflation?

A By switching to LIFO, reported net income will be higher.

B Tax law requires company using LIFO for reporting to IRS also to use LIFO for reporting to shareholders.

C LIFO produces higher cost of goods sold and thereby lowers taxable income and taxes.

D None of the above.

When taxable income reported to shareholders is lower than taxable income reported to the IRS, which of the following is true?

A The company will record unearned revenue deferred credit

B The company will record a deferred tax liability.

C The company will record a deferred tax asset.

D The company will record the difference as minority interest.

E None of the above.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock