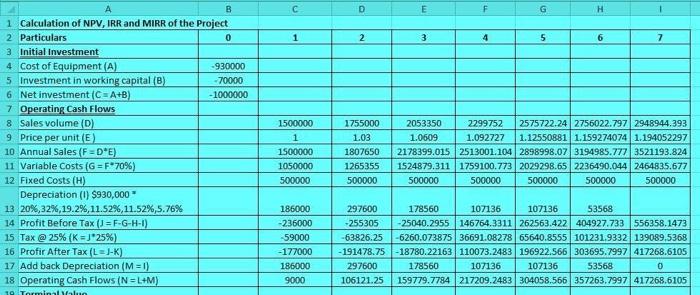

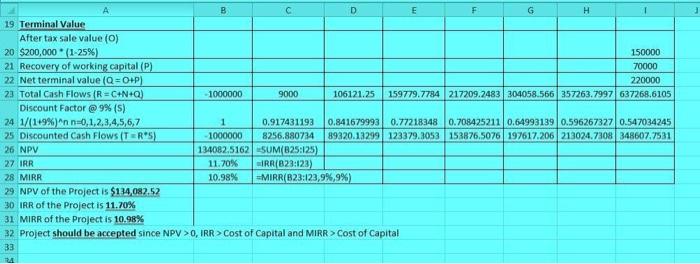

Question: What does the sensitivity analysis data in this excel mean? Can you help with the interpretation part? B 1 Calculation of NPV, IRR and MIRR

B 1 Calculation of NPV, IRR and MIRR of the Project 2 Particulars 0 3 Initial Investment 4 Cost of Equipment (A) 5 Investment in working capital (B) -930000 -70000 -1000000 6 Net investment (C=A+B) 7 Operating Cash Flows 8 Sales volume (D) 9 Price per unit (E) 10 Annual Sales (F=D*E) 11 Variable Costs (G=F*70%) 12 Fixed Costs (H) Depreciation (1) $930,000* 13 20%, 32 %, 19.2 %, 11.52 %, 11.52 % ,5.76% 14 Profit Before Tax (J=F-G-H-I) 15 Tax @ 25% (K=J*25%) 16 Profir After Tax (L=J-K) 17 Add back Depreciation (M=1) 18 Operating Cash Flows (N=L+M) 19 Terminal Malun C 1 1500000 1 1500000 1050000 500000 186000 -236000 -59000 -177000 186000 9000 D E F G 2 3 4 5 6 7 2053350 1755000 1.03 1807650 1265355 2299752 2575722.24 2756022.797 2948944.393 1.0609 1.092727 1.12550881 1.159274074 1.194052297 2178399.015 2513001.104 2898998.07 3194985.777 3521193.824 1524879.311 1759100.773 2029298.65 2236490.044 2464835.677 500000 500000 500000 500000 500000 500000 178560 107136 107136 53568 297600 -255305 -25040.2955 146764.3311 262563.422 404927.733 556358.1473 -63826.25 -6260.073875 36691.08278 65640.8555 101231.9332 139089.5368 -191478.75 -18780.22163 110073.2483 196922.566 303695.7997 417268.6105 297600 178560 107136 107136 53568 0 106121.25 159779.7784 217209.2483 304058.566 357263.7997 417268.6105 H B C D E F G H 1 19 Terminal Value After tax sale value (0) 20 $200,000 (1-25%) 21 Recovery of working capital (P) 150000 70000 220000 -1000000 9000 106121.25 159779.7784 217209.2483 304058.566 357263.7997 637268.6105 22 Net terminal value (Q=O+P) 23 Total Cash Flows (R=C+N+Q) Discount Factor @ 9% (S) 24 1/11499%)nnn=0,1,2.34567 25 Discounted Cash Flows (T=R*5) 26 NPV 1 -1000000 0.917431193 0.841679993 0.77218348 0.708425211 0.64993139 0.596267327 0.547034245 8256.880734 89320.13299 123379.3053 153876.5076 197617.206 213024.7308 348607.7531 SUM(825:125) 134082.5162 27 IRR 11.70% IRR(823:123) -MIRR(B23:123,9%,9%) 28 MIRR 10.98% 29 NPV of the Project is $134,082.52 30 IRR of the Project is 11.70% 31 MIRR of the Project is 10.98% 32 Project should be accepted since NPV >0, IRR>Cost of Capital and MIRR>Cost of Capital 33 RA B 1 Calculation of NPV, IRR and MIRR of the Project 2 Particulars 0 3 Initial Investment 4 Cost of Equipment (A) 5 Investment in working capital (B) -930000 -70000 -1000000 6 Net investment (C=A+B) 7 Operating Cash Flows 8 Sales volume (D) 9 Price per unit (E) 10 Annual Sales (F=D*E) 11 Variable Costs (G=F*70%) 12 Fixed Costs (H) Depreciation (1) $930,000* 13 20%, 32 %, 19.2 %, 11.52 %, 11.52 % ,5.76% 14 Profit Before Tax (J=F-G-H-I) 15 Tax @ 25% (K=J*25%) 16 Profir After Tax (L=J-K) 17 Add back Depreciation (M=1) 18 Operating Cash Flows (N=L+M) 19 Terminal Malun C 1 1500000 1 1500000 1050000 500000 186000 -236000 -59000 -177000 186000 9000 D E F G 2 3 4 5 6 7 2053350 1755000 1.03 1807650 1265355 2299752 2575722.24 2756022.797 2948944.393 1.0609 1.092727 1.12550881 1.159274074 1.194052297 2178399.015 2513001.104 2898998.07 3194985.777 3521193.824 1524879.311 1759100.773 2029298.65 2236490.044 2464835.677 500000 500000 500000 500000 500000 500000 178560 107136 107136 53568 297600 -255305 -25040.2955 146764.3311 262563.422 404927.733 556358.1473 -63826.25 -6260.073875 36691.08278 65640.8555 101231.9332 139089.5368 -191478.75 -18780.22163 110073.2483 196922.566 303695.7997 417268.6105 297600 178560 107136 107136 53568 0 106121.25 159779.7784 217209.2483 304058.566 357263.7997 417268.6105 H B C D E F G H 1 19 Terminal Value After tax sale value (0) 20 $200,000 (1-25%) 21 Recovery of working capital (P) 150000 70000 220000 -1000000 9000 106121.25 159779.7784 217209.2483 304058.566 357263.7997 637268.6105 22 Net terminal value (Q=O+P) 23 Total Cash Flows (R=C+N+Q) Discount Factor @ 9% (S) 24 1/11499%)nnn=0,1,2.34567 25 Discounted Cash Flows (T=R*5) 26 NPV 1 -1000000 0.917431193 0.841679993 0.77218348 0.708425211 0.64993139 0.596267327 0.547034245 8256.880734 89320.13299 123379.3053 153876.5076 197617.206 213024.7308 348607.7531 SUM(825:125) 134082.5162 27 IRR 11.70% IRR(823:123) -MIRR(B23:123,9%,9%) 28 MIRR 10.98% 29 NPV of the Project is $134,082.52 30 IRR of the Project is 11.70% 31 MIRR of the Project is 10.98% 32 Project should be accepted since NPV >0, IRR>Cost of Capital and MIRR>Cost of Capital 33 RA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts