Question: What does this mean Problem 4 - 1 6 Calculating Rates of Return [ LO 3 ] Refer back to the Serles EE savings bonds

What does this mean

Problem Calculating Rates of Return LO

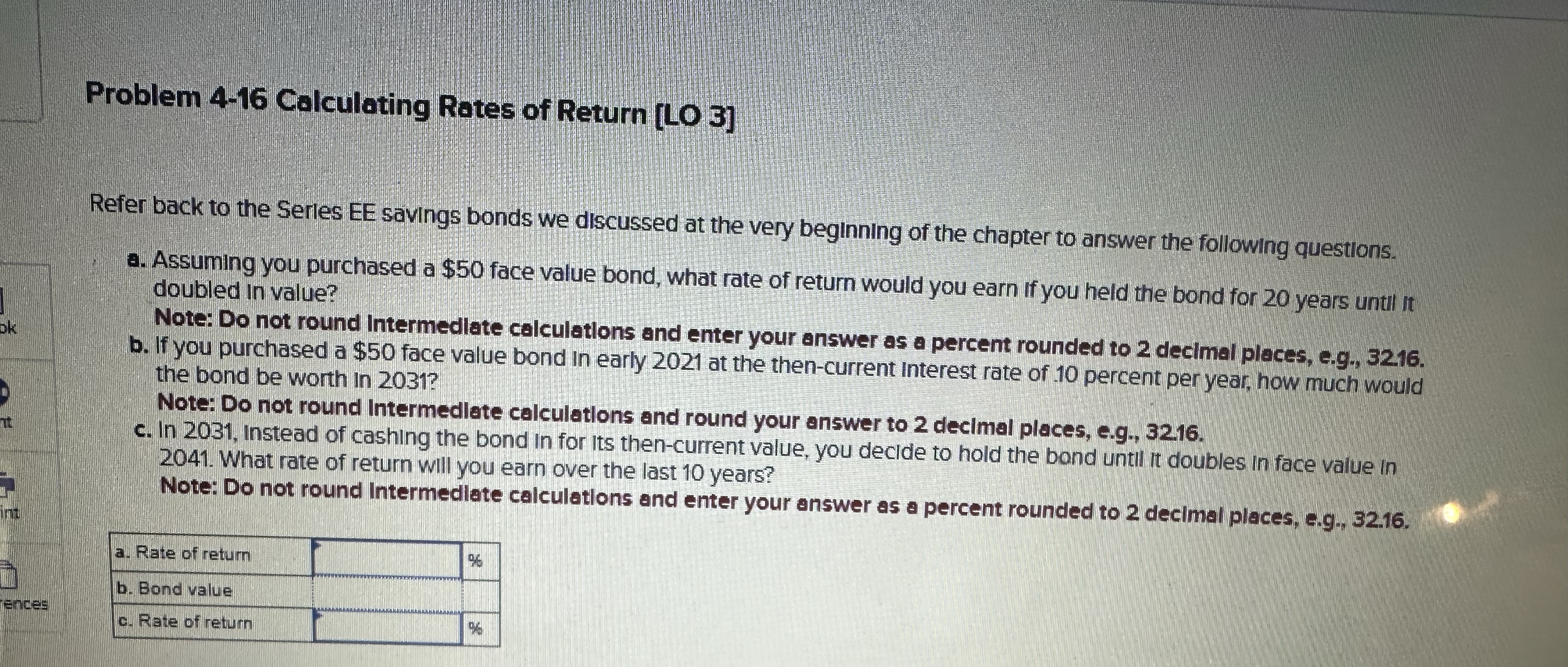

Refer back to the Serles EE savings bonds we discussed at the very beginning of the chapter to answer the following questions.

a Assuming you purchased a $ face value bond, what rate of return would you earn if you held the bond for years untll it doubled in value?

Note: Do not round intermedlate calculations and enter your answer as a percent rounded to decimal places, eg

b If you purchased a $ face value bond in early at the thencurrent interest rate of percent per year, how much would the bond be worth in

Note: Do not round intermediate calculations and round your answer to decimal places, eg

c In instead of cashing the bond in for its thencurrent value, you decide to hold the bond untll it doubles in face value in What rate of return will you earn over the last years?

Note: Do not round Intermediate calculations and enter your answer as a percent rounded to decimal places, eg

tablea Rate of return,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock