Question: what else do you need thats the entire question and data table The Crestone Company provides landscaping services to corporations and businesses. All its landscaping

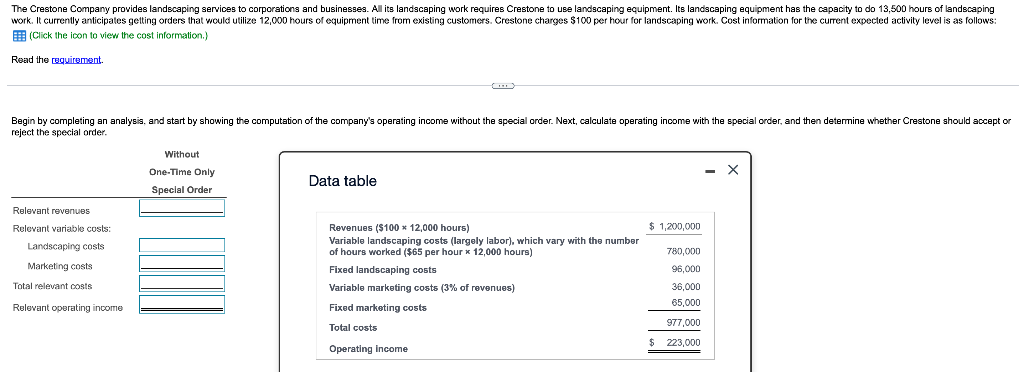

The Crestone Company provides landscaping services to corporations and businesses. All its landscaping work requires Crestone to use landscaping equipment. Its landscaping equipment has the capacity to do 13,500 hours of landscaping work. It currently anticipates getting orders that would utilize 12,000 hours of equipment time from existing customers. Crestone charges $100 per hour for landscaping work. Cost information for the current expected activity level is as follows: (Click the icon to view the cost information.) Read the requirement Begin by completing an analysis, and start by showing the computation of the company's operating income without the special order. Next, calculate operating income with the special order, and then determine whether Crestone should accept or reject the special order. Without One-Time Only Special Order Data table $ 1,200,000 Relevant revenues Relevant variable costs: Landscaping costs Marketing costs Revenues ($100 * 12,000 hours) Variable landscaping costs (largely labor), which vary with the number of hours worked ($65 per hour * 12,000 hours) Fixed landscaping costs Variable marketing costs (3% of revenues) Fixed marketing costs Total costs Operating income 780,000 96,000 36,000 65,000 Total relevant costs Relevant operating income 977,000 223,000 The Crestone Company provides landscaping services to corporations and businesses. All its landscaping work requires Crestone to use landscaping equipment. Its landscaping equipment has the capacity to do 13,500 hours of landscaping work. It currently anticipates getting orders that would utilize 12,000 hours of equipment time from existing customers. Crestone charges $100 per hour for landscaping work. Cost information for the current expected activity level is as follows: (Click the icon to view the cost information.) Read the requirement Begin by completing an analysis, and start by showing the computation of the company's operating income without the special order. Next, calculate operating income with the special order, and then determine whether Crestone should accept or reject the special order. Without One-Time Only Special Order Data table $ 1,200,000 Relevant revenues Relevant variable costs: Landscaping costs Marketing costs Revenues ($100 * 12,000 hours) Variable landscaping costs (largely labor), which vary with the number of hours worked ($65 per hour * 12,000 hours) Fixed landscaping costs Variable marketing costs (3% of revenues) Fixed marketing costs Total costs Operating income 780,000 96,000 36,000 65,000 Total relevant costs Relevant operating income 977,000 223,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts