Question: What gain or loss is recognized by each partner, and what basis does each partner have in the assets distributed, if the partnership is liquidated

What gain or loss is recognized by each partner, and what basis does each partner have in the assets distributed, if the partnership is liquidated as follows:

(a) A receives the land and one-half of the accounts receivable and inventory and B receives the cash and the other half of the receivables and inventory?

(b) A receives the cash and one-half of the accounts receivable and inventory, B receiving the land and the other half of the receivables and inventory?

(c) A receives the land and all the accounts receivable and B receives all the inventory and the cash?

(d) A receives the cash and the accounts receivable and B receives the land and the inventory?

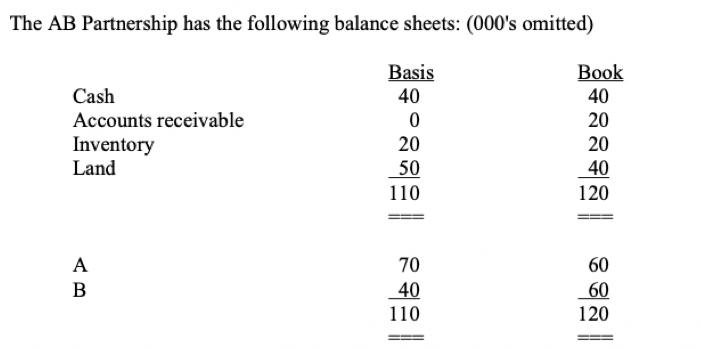

The AB Partnership has the following balance sheets: (000's omitted) Cash Accounts receivable Inventory Land A B Basis 40 0 20 50 110 70 40 110 Book 40 20 20 40 120 60 60 120

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Lets calculate the gain or loss recognized by each partner and determine the basis of assets distrib... View full answer

Get step-by-step solutions from verified subject matter experts