Question: what goes in May 3? Please help with May 3rd entry Required information The following information applies to the questions displayed below) Allied Merchandisers was

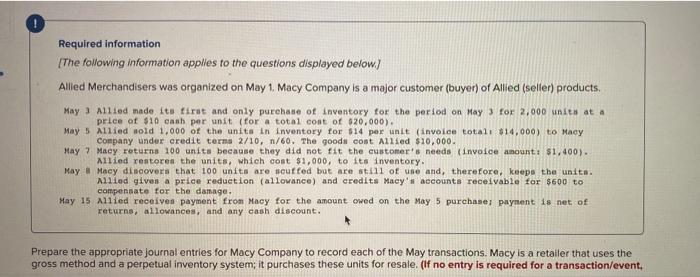

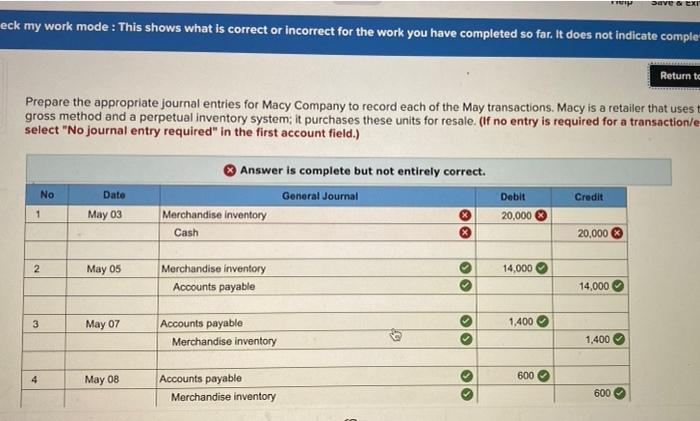

Required information The following information applies to the questions displayed below) Allied Merchandisers was organized on May 1. Macy Company is a major customer (buyer) of Allied (seller) products, May ) Allied made ito tirat and only purchase of inventory for the period on May 3 for 2,000 units at a price of $10 cash per unit (for a total cost of $20,000). May 5 Allied sold 1,000 of the units in inventory for $14 per unit (invoice total $14,000) to Macy Company under credit terns 2/10, 1/60. The goods cost. Allied $10,000. May 7 Macy returns 100 units because they did not fit the customer's needs (invoice amount: $1,400). Allied restore the units, which cont $1,000, to its inventory. May Macy discovers that 100 units are scuffed but are still of use and, therefore, keeps the unito. Allied gives a price reduction (allowance) and credits Macy's accounts receivable for $600 to compensate for the damage. May 15 Allied receives payment from Macy for the amount owed on the May 5 purchase: paynent is net of returns, allowances, and any cash discount. Prepare the appropriate journal entries for Macy Company to record each of the May transactions. Macy is a retailer that uses the gross method and a perpetual inventory system; it purchases these units for resale. (If no entry is required for a transaction/event, Save & ex eck my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate comple Return to Prepare the appropriate journal entries for Macy Company to record each of the May transactions. Macy is a retailer that uses gross method and a perpetual inventory system; it purchases these units for resale. (if no entry is required for a transaction/e select "No journal entry required" in the first account field.) No Answer is complete but not entirely correct. General Journal Merchandise inventory Cash Credit Date May 03 Debit 20,000 1 20.000 2 2 May 05 14,000 Merchandise inventory Accounts payable 9 14,000 3 May 07 1,400 Accounts payable Merchandise inventory 3 1,400 4 600 May 08 Accounts payable Merchandise inventory 600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts