Question: what headings would you suggest using in this case assignment on loreal in the section overview? Synergie had recently been introduced successfully in France, the

what headings would you suggest using in this case assignment on loreal in the section overview?

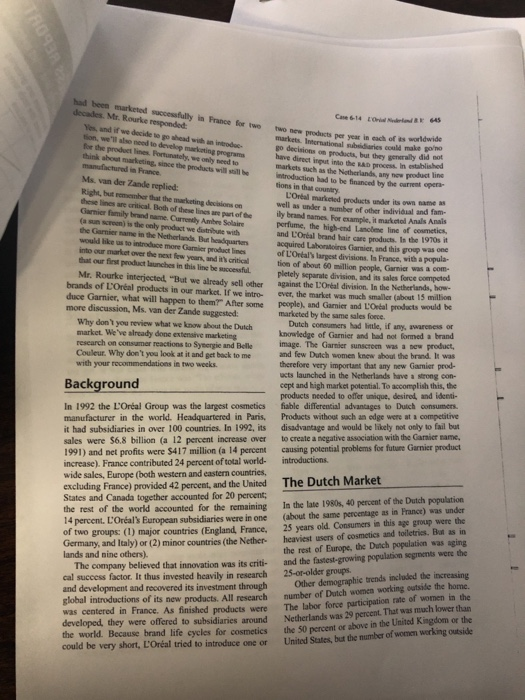

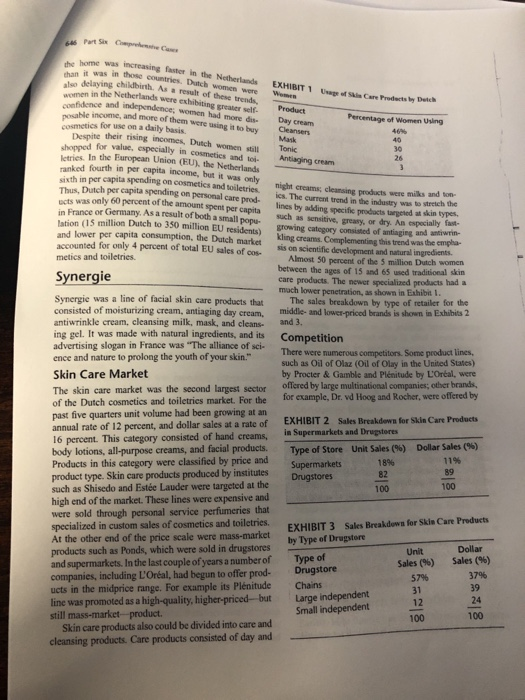

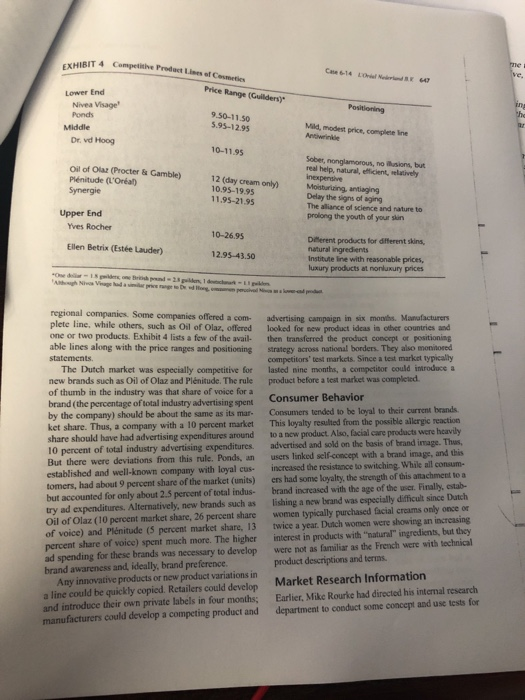

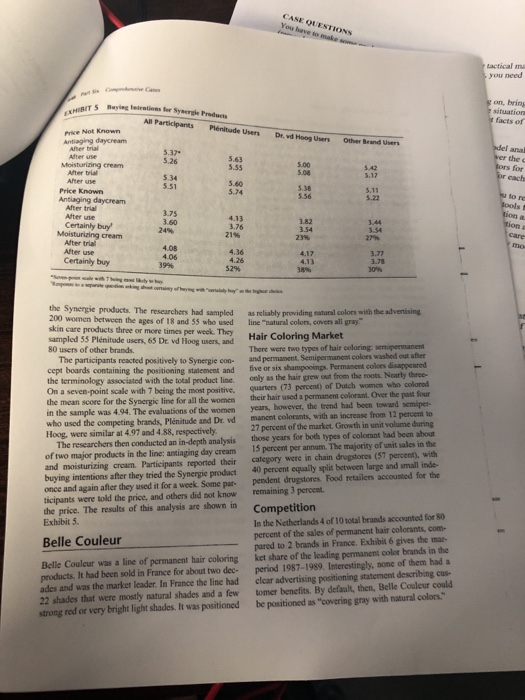

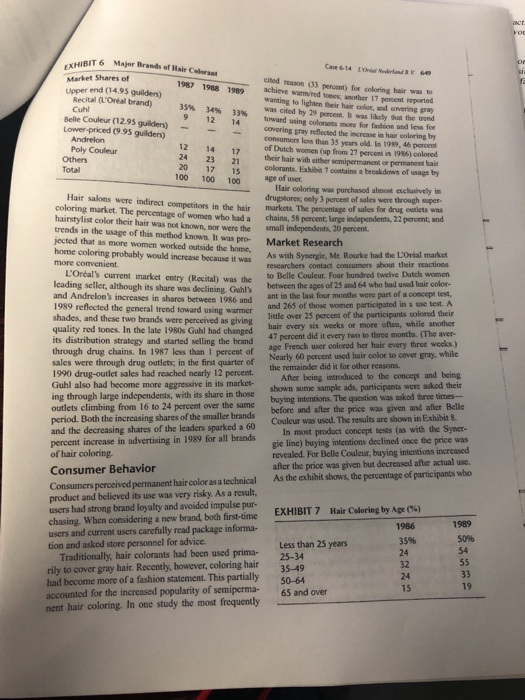

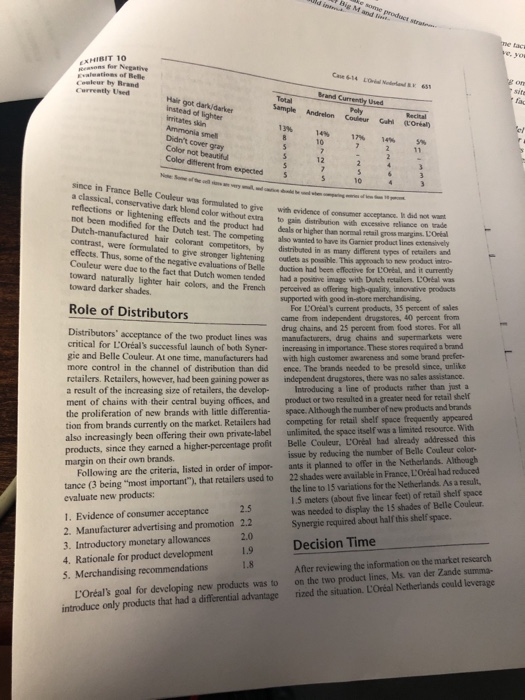

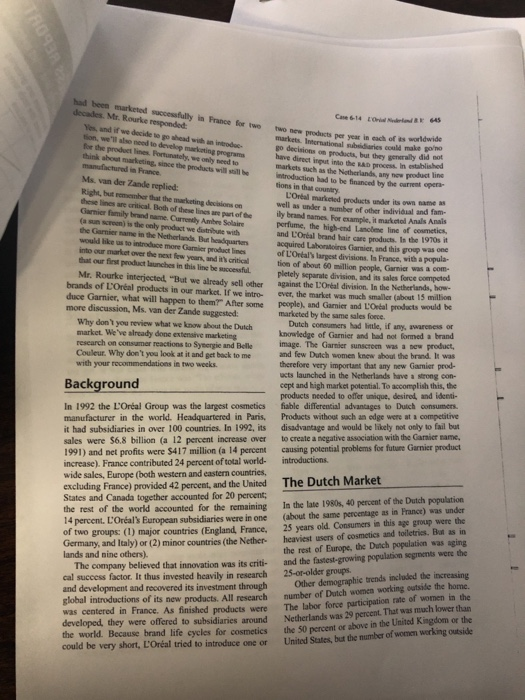

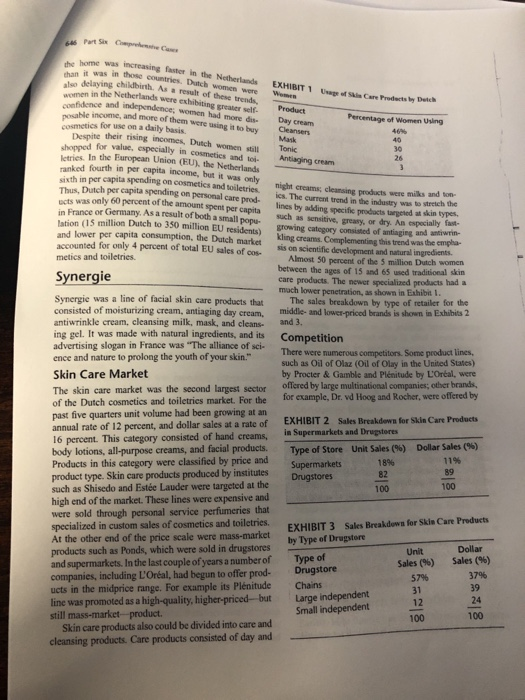

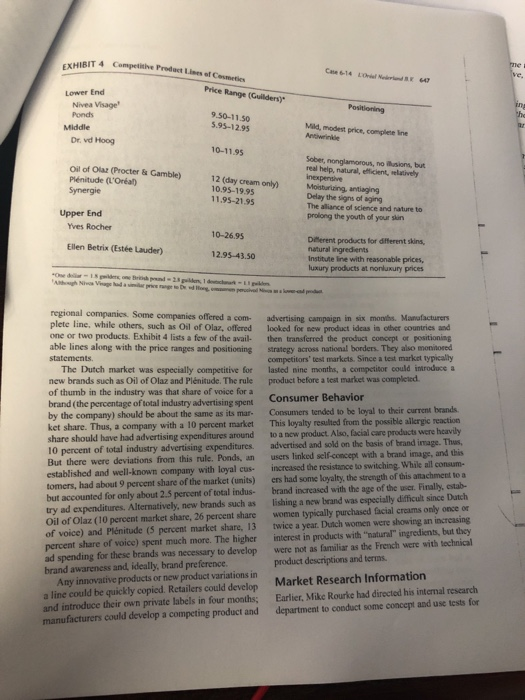

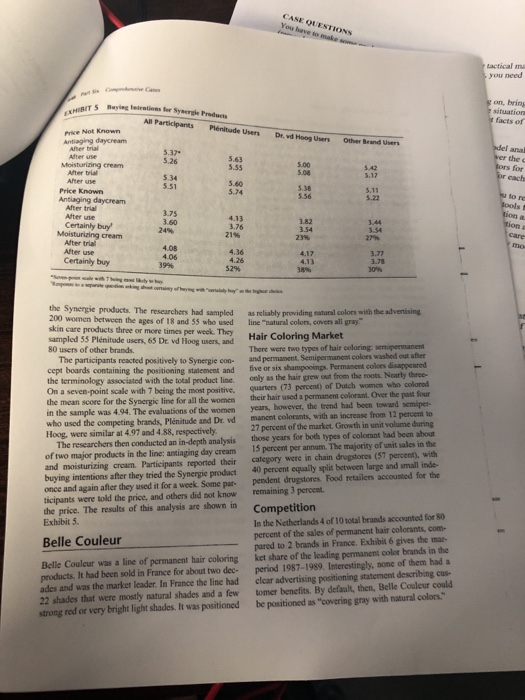

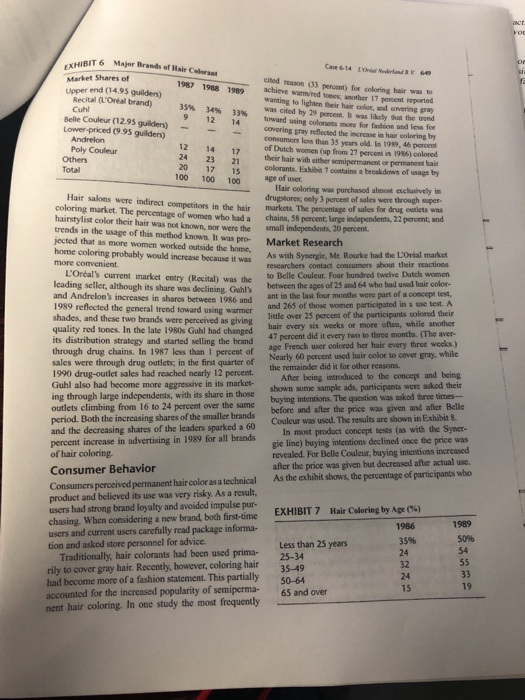

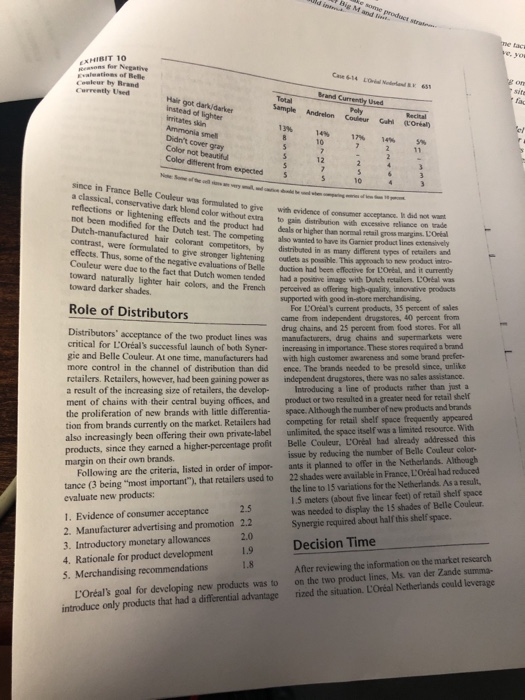

Synergie had recently been introduced successfully in France, the home country for L'Oral. Belle Couleur Case 6-14 L'Oral Nederland B.V. Yolanda van der Zande, director of the Netherlands L'Oral subsidiary, faced two tough decisions and was discussing them with Mike Rourke, her market man- ager for cosmetics and toiletries. "We have to decide whether to introduce the Synergie skin care line and Belle Couleur permanent hair colorants," she told him. This case was prepared by Frederick W. Langrehr, Val- paraiso University, Lee Dahringer, Butler University, and Anne Stcker. This case was written with the cooperation of management solely for the purpose of stimulating student discussion. All events and individuals are real, but names have been disguised. We appreciate the help of J. B. Wilkinson and V. B. Langrehr on earlier drafts of this case. Copyright 1994 by the Case Research Journal and the authors. had been markedsfully in France for the Come 64 dB SAS decades. Mr. Rourke responded: two new products per year in each of worldwide Yes, and if we decide to go whead with an introduc met interstil diaries could make porno tion, we also need to developing program yo decisions products, but they generally did for the product lines. Fortunately need to have direct input into the process. In bished think about marketing, since the products will still be martes such as the Netherlands, any how product line manufactured in France Introductie had to be faced by the current per Ms. van der Zande replied: tions in the L'Orbal marketed products under same Right, but her that the marketing decisions on well as under a umber of other individual and the these we cal. Both of these lines are part of the Garnier mitybame Currently Ambre Solaire ily brand names. For example, it makestol Anals Anals perfume, the high-end Lace line of cosmetics () is the only product we distribute with and L'Oral band hair care products. In the 1970s the Garniere in the Netherlands. But headquare acquired Laboratoires Garnier, and this group was one would like to introduce more Gare product lines Intet over the next few years, and the critical of L'Oreal largest divisions, la France, with a popula- tion of about 60 million people, Garnier was a com that our first product launches in line befol. pletely separate division, and its sales force competed Mr. Rourke interjected "But we already sell other against the L'Oreal division. In the Netherlands, how- brands of L'Oreal products in our market. if we intro ever, the market was much smaller (about 15 million duce Garnier, what will happen to them? After some people), and Garnier and L'Ortal products would be more discussion, Ms. van der Zande suggested marketed by the same sales force Dutch consumers had little, if any, wareness or Why don't you review what we know about the Dutch knowledge of Garnier and had not formed a brand market. We've already done extensive marketing image. The Garnier sunscreen was a new product, research on consumer reactions to Synergie and Belle and few Dutch women knew about the brand. It was Couleur. Why don't you look at it and get back to me therefore very important that any new Garnier prod- with your recommendations in two weeks. ucts launched in the Netherlands have a strong con- cept and high market potential. To accomplish this, the products needed to offer unique, desired, and identi- fiable differential advantages to Dutch consumers. Products without such an edge were at a competitive disadvantage and would be likely not only to fail but to create a negative association with the Garnier name, causing potential problems for future Garnier product introductions Background In 1992 the L'Oral Group was the largest cosmetics manufacturer in the world. Headquartered in Paris, it had subsidiaries in over 100 countries. In 1992, its sales were $6.8 billion (a 12 percent increase over 1991) and net profits were $417 million (a 14 percent increase). France contributed 24 percent of total world- wide sales, Europe (both western and eastern countries, excluding France) provided 42 percent, and the United States and Canada together accounted for 20 percent; the rest of the world accounted for the remaining 14 percent. L'Oral's European subsidiaries were in one of two groups: (1) major countries (England, France, Germany, and Italy) or (2) minor countries (the Nether- lands and nine others) The company believed that innovation was its criti- cal success factor. It thus invested heavily in research and development and recovered its investment through global introductions of its new products. All research was centered in France. As finished products were developed, they were offered to subsidiaries around the world. Because brand life cycles for cosmetics could be very short, L'Oral tried to introduce one The Dutch Market In the late 1980s, 40 percent of the Dutch population (about the same percentage as in France) was under 25 years old. Consumers in this age group were the heaviest users of cosmetics and toiletries. But as in the rest of Europe, the Dutch population was aging and the fastest-growing population segments were the 25-or-older groups Other demographic trends included the increasing number of Dutch women working outside the home. The labor force participation rate of women in the Netherlands was 29 percent. That was much lower than the 50 percent or above in the United Kingdom or the United States, but the number of women werking outside the home was increasing faster in the Netherlands that was in those unes. Dit women were al delaying childbirth. As a result of these trends women in the Netherlands were exhibiting greater self confidence and independence; women had more di posae income, and more of them were using it to buy EXHIBIT 1 Use of Skin Care Products by Dutch W Product Day Cream Cleansers Mask Tonic Antiaging cream Percentage of Women Using 401 40 30 26 3 cosmetics for use on a daily basis Despite their tising incomes. Dutch women still shopped for value, especially in cosmetics und wi- letries. In the European Union (EU), the Netherlands ranked fourth in per capita income, but it was only sixth in per capita spending on cosmetics and toiletries. Thus, Dutch per capita spending on personal care prod- ucts was only 60 percent of the amount spent per capita in France or Germany. As a result of both a small popu fation (15 million Dutch to 350 million EU residents) and lower per capita consumption, the Dutch market accounted for only 4 percent of total EU sales of co- night cream, cleansing products were mills and to ies. The current trend in the industry was to stich the lines by adding specific products targeted at skin types. such as sensitive, greasy or dry. An especially fast- growing category consisted of antiaging and antiwrin kling creams Complementing this trend was the emplo. sis on scientific development and natural ingredients metics and toiletries Almost 50 percent of the 5 million Dutch women Synergie between the ages of 15 and 65 used traditional skin care products. The newer specialized products had a Synergie was a line of facial skin care products that much lower penetration, as shown in Exhibit I. consisted of moisturizing cream, antiaging day cream, The sales breakdown by type of retailer for the middle and lower-priced brands is shown in Exhibits 2 antiwrinkle cream, cleansing milk, mask, and cleans and 3. ing gel. It was made with natural ingredients, and its advertising slogan in France was "The alliance of sci- Competition ence and nature to prolong the youth of your skin." There were numerous competitors. Some product lines, such as Oil of Olaz (Oil of Olay in the United States) Skin Care Market by Procter & Gamble and Plenitude by L'Oral, were The skin care market was the second largest sector offered by large multinational companies, other brands. of the Dutch cosmetics and toiletries market. For the for example, Dr. vd Hoog and Rocher, were offered by past five quarters unit volume had been growing at an annual rate of 12 percent, and dollar sales at a rate of EXHIBIT 2 Sales Breakdown for Skin Care Products 16 percent. This category consisted of hand creams, in Supermarkets and Drugstores body lotions, all-purpose creams, and facial products. Type of Store Unit Sales (9) Dollar Sales (%) Products in this category were classified by price and Supermarkets 18% 11% product type. Skin care products produced by institutes Drugstores 82 89 such as Shisedo and Este Lauder were targeted at the 100 100 high end of the market. These lines were expensive and were sold through personal service perfumeries that specialized in custom sales of cosmetics and toiletries. EXHIBIT 3 Sales Breakdown for Skin Care Products At the other end of the price scale were mass-market by Type of Drugstore products such as Ponds, which were sold in drugstores Unit Dollar and supermarkets. In the last couple of years a number of Sales (96) Sales (%) companies, including L'Oral, had begun to offer prod Drugstore 57% 3796 ucts in the midprice range. For example its Plenitude 31 39 line was promoted as a high-quality, higher-priced but 12 24 still mass-market product. Small independent 100 100 Skin care products also could be divided into care and cleansing products. Care products consisted of day and Type of Chains Large independent EXHIBIT 4 Competitive Product Lines of Coches me C14 LOK 647 Price Range (Guilders Positioning in Lower End Nivea Visage Ponds Middle Dr. vd Hoog 9.50-11.50 5.95-12.95 Mild, modest price, completene Antowe 10-11.95 Oil of Olar (Procter & Gamble) Plenitude (L'Orat) Synergie 12 (day cream only 10.95-19.95 11.95-21.95 Sober,nonglamorous, nousions, but real help, natural, elicient, elatively inexpensive Moisturizing, antiaging Delay the signs of aging The alliance of science and nature to prolong the youth of your skin Upper End Yves Rocher 10-26.95 Ellen Betrix (Este Lauder) 12.95 43.50 Diferent products for different skins, natural ingredients Institute line with reasonable prices, luxury products at noluxury prices regional companies. Some companies offered a com- plete line, while others, such as Oil of Olaz, offered one or two products. Exhibit 4 lists a few of the avail- able lines along with the price ranges and positioning statements The Dutch market was especially competitive for new brands such as Oil of Olaz and Plenitude. The rule of thumb in the industry was that share of voice for a brand (the percentage of total industry advertising spent by the company) should be about the same as its mar- ket share. Thus, a company with a 10 percent market share should have had advertising expenditures around 10 percent of total industry advertising expenditures. But there were deviations from this rule. Ponds, an established and well-known company with loyal cus- tomers, had about 9 percent share of the market (units) but accounted for only about 2.5 percent of total indus- try ad expenditures. Alternatively, new brands such as Oil of Olaz (10 percent market share, 26 percent share of voice) and Plenitude (5 percent market share, 13 percent share of voice) spent much more. The higher ad spending for these brands was necessary to develop brand awareness and, ideally, brand preference. Any innovative products or new product Variations in a line could be quickly copied. Retailers could develop and introduce their own private labels in four months; manufacturers could develop a competing product and advertising campaign in six months. Manufacturers looked for new product ideas in other countries and then transferred the product concept or positioning strategy across national borders. They also monitored competitors' test markets. Since a test market typically lasted nine months, a competitor could introduce a product before a test market was completed Consumer Behavior Consumers tended to be loyal to their current brands. This loyalty resulted from the possible allergic reaction to a new product. Also, facial care products were heavily advertised and sold on the basis of brand image. Thus, users linked self-concept with a brand image, and this increased the resistance to switching. While all consum ers had some loyalty, the strength of this attachment to a brand increased with the age of the war. Finally, estab lishing a new brand was especially difficult since Dutch women typically purchased facial creams only once or twice a year. Dutch women were showing an increasing interest in products with natural ingredients, but they were not as familiar as the French were with technical product descriptions and terms. Market Research Information Earlier, Mike Rourke had directed his internal research department to conduct some concept and use tests for CASE QUESTIONS You have to make Lactical you need Cewe EXHIBITS Beyingarins for Synerle Products All Participants Menitude Users gon, bring situation facts of De Hoogers Other Brand Users Price Not Known Antiaging daycream Alert Alter Use Moisturizing cream Alter trial 5.37 5.26 5.63 5.55 delana er the tors for or cache 5.00 5.42 5.17 5.34 5.51 5.60 5.74 5.38 5.56 5.11 5.22 Alte se Price Known Antiaging daycream After trial Alter use Certainly buy Moisturizing cream After trial Alter use Certainly buy 3.75 3.60 24% tone Jools tion thon 4.13 3.76 3.82 3.54 23% 3.54 21 mo 4.08 406 39 4.36 4.26 52% 4.17 4.13 38% 3.72 3.78 30% 1 the Synergie products. The researchers had sampled 200 women between the ages of 18 and 55 who used skin care products three or more times per week. They sampled 55 Plenitude users, 65 De vd Hoog users, and 80 users of other brands. The participants reacted positively to Synergie con cept boards containing the positioning statement and the terminology associated with the total product line. On a seven-point scale with 7 being the most positive. the mean score for the Synergie line for all the women in the sample was 4.94. The evaluations of the women who used the competing brands, Plenitude and Dr. vd Hoog, were similar at 4.97 and 4.88, respectively The researchers then conducted an in-depth analysis of two major products in the line: antiaging day cream and moisturizing cream. Participants reported their buying intentions after they tried the Synergie product once and again after they used it for a week. Some par ticipants were told the price, and others did not know the price. The results of this analysis are shown in Exhibit 5. as reliably providing natural colors with the advertising line natural colors, covers all gray." Hair Coloring Market There were two types of hair coloring: semipermanent and permanent Semipermanent colors washed out after five or six shampooings. Permanent colors disappeared only as the hair grow out from the roots. Nearly three quarters (73 percent) of Dutch women who colored their hair used a permanent colorant. Over the past four years, however, the trend had been toward semiper manent colorants, with an increase from 12 percent to 27 percent of the market. Growth in unit volume during those years for both types of colorant had been about 15 percent per annum. The majority of unit sales in the category were in chain drugstores (57 percent), with 40 percent equally split between large and small inde- pendent drugstores. Food retailers accounted for the remaining 3 percent Competition In the Netherlands 4 of 10 total brands accounted for 80 percent of the sales of permanent hair colorants, com pared to 2 brands in France. Exhibit 6 gives the mar ket share of the leading permanent color brands in the period 1987-1989. Interestingly, none of them had a clear advertising positioning statement describing cus- tomer benefits. By default, then, Belle Couleur could be positioned as "covering gray with natural colors." Belle Couleur Belle Couleur was a line of permanent hair coloring products. It had been sold in France for about two dec- ades and was the market leader. In France the line had 22 shades that were mostly natural shades and a few strong red or very bright light shades. It was positioned VOL or 614 1987 1988 1989 9 12 14 EXHIBIT 6 Majer Brands of Hair Care Market shares of cited (33 percent) for coloring hair was to Upper end (14.95 guilders) achieve warm red one another 17 percent reported Recital (L'Oral brand) wanting to be heldering Cuhl was cited by 29 percent. It was that the end Belle Couleur (12.95 guilders) toward using colorants more for file for Lower priced (9.95 guilders) covering gray reflected the increase sharing by Andrelon consumers less than 35 years old. In 1999, 46 percent 12 Poly Couleur 17 of Dutch women (up from 27 percent in 1956) colored Others 24 23 21 their hair with either semipermanent or permanente 20 Total 17 15 colorants. Exhibit 7 contains a breakdows of age by 100 100 100 age of user Hair coloring was purchased almost exclusively in Hair salons were indirect competitors in the hair drugstores, only 3 percent of sales were through super coloring market. The percentage of women who had a markets. The percentage of sales for drug outlets was hairstylist color their hair was not known, nor were the chains, 58 percent, large independents, 22 percent, and trends in the usage of this method known. It was pro- small independents, 20 percent. jected that as more women worked outside the home, Market Research home coloring probably would increase because it was As with Synergie, Mr. Rourke had the L'Oral market more convenient researchers contact consumers about their reactions L'Oral's current market entry (Recital) was the to Belle Couleur Pour hundred twelve Dutch women leading seller, although its share was declining. Guhl's between the ages of 25 and 64 who had used hair color- and Andrelon's increases in shares between 1986 and ant in the last four months were part of a concept test, 1989 reflected the general trend toward using warmer and 265 of those women participated in a use test. A shades, and these two brands were perceived as giving little over 25 percent of the participants colored their hair every six weeks or more often, while another quality red tones. In the late 1980s Guhl had changed 47 percent did it every two to three months. The aver its distribution strategy and started selling the brand age French user colored her hair every three weeks.) through drug chains. In 1987 less than 1 percent of Nearly 60 percent used hair color to cover gray, while sales were through drug outlets; in the first quarter of the remainder did it for other reasons. 1990 drug-outlet sales had reached nearly 12 percent. After being introduced to the concept and being Guhl also had become more aggressive in its market- shown some sample ads, participants were asked their ing through large independents, with its share in those buying intentions. The question was asked tree times- outlets climbing from 16 to 24 percent over the same before and after the price was given and after Belle period. Both the increasing shares of the smaller brands Couleur was used. The results are shown in Exhibit 8. and the decreasing shares of the leaders sparked a 60 In most product concept tests (as with the Syner percent increase in advertising in 1989 for all brands gie line) buying intentions declined once the price was of hair coloring revealed. For Belle Couleur, buying intentions increased Consumer Behavior after the price was given but decreased after actual use. As the exhibit shows the percentage of participants who Consumers perceived permanent hair color as a technical product and believed its use was very risky. As a result, users had strong brand loyalty and avoided impulse pur- EXHIBIT 7 Hair Coloring by Age (96) chasing. When considering a new brand, both first-time 1986 1989 users and current users carefully read package informa- 50% 35% tion and asked store personnel for advice. Less than 25 years 54 24 Traditionally, hair colorants had been used prima 25-34 32 rily to cover gray hair. Recently, however, coloring hair 35-49 24 33 had become more of a fashion statement. This partially 50-64 15 19 accounted for the increased popularity of semiperma- 65 and over nent hair coloring. In one study the most frequently 55 ke some products Big Mand in EXHIBIT 10 Ros for Negative sations of Belle Couleur by Brand Currently Used 6-14 x 651 hom Brand Currently used Total Poly Sample Andrelon Condeur Gul Oral Hair got dark darker Instead of lighter mitates Armonia smel Didn't cover gay Color not be Color different from expected 13 le 11 2 5 11 5 5 5 5 101 10 7 12 7 5 2 5 10 2 2 4 6 3 3 3 since in France Belle Couleur was formulated to give a classical, conservative dark blond color without extra reflections or lightening effects and the product had not been modified for the Dutch test. The competing Dutch-manufactured hair color competitors, by contrast, were formulated to give stronger lightening effects. Thus, some of the negative evaluations of Belle Couleur were dae to the fact that Dutch women tended toward naturally lighter hair colors, and the French toward darker shades. with evidence of consumer acceptance dado to gain distribution with excessive me on trade deals or higher than normal retail gross margins. Ortal also wanted to have its Garnier product lines extensively distributed in as many different types of retailers and outlets as possible. This approach to new product intro duction had been effective for L'Oral, and it currently had a positive image with Dutch retailers, L'Oral was perceived as offering high-quality, innovative products Role of Distributors supported with good in-store merchandising For L'Oral current products, 35 percent sales came from independent drugstores, 40 percent from Distributors' acceptance of the two product lines was drug chains, and 25 percent from food stores. For all critical for L'Oral's successful launch of both Syner- manufacturers, drug chains and supermarkets were gie and Belle Couleur. At one time, manufacturers had increasing in importance. These stores required a brand with high customer awareness and some brand prefer more control in the channel of distribution than did ence. The brands needed to be presold since, unlike retailers. Retailers, however, had been gaining power as independent drugstores, there was no sales assistance a result of the increasing size of retailers, the develop Introducing a line of products rather than just a ment of chains with their central buying offices, and product or two resulted in a greater need for retail shelf the proliferation of new brands with little differentia space. Although the number of new products and brands tion from brands currently on the market. Retailers had competing for retail shelf space frequently appeared also increasingly been offering their own private-label unlimited the space itself was a limited resource. With products, since they carned a higher-percentage profit Belle Couleur, L'Oral had already addressed this margin on their own brands issue by reducing the number of Belle Couleur color- Following are the criteria, listed in order of impor ants it planned to offer in the Netherlands. Although tance (3 being "most important"), that retailers used to 22 shades were available in France, L'Oral had reduced evaluate new products: the line to 15 variations for the Netherlands. As a result, 1.5 meters (about five linear feet) of retail shelf space 1. Evidence of consumer acceptance 2.5 was needed to display the 15 shades of Belle Couleur 2. Manufacturer advertising and promotion 2.2 Synergie required about half this shelf space. 2.0 3. Introductory monetary allowances 1.9 Decision Time 4. Rationale for product development 1.8 5. Merchandising recommendations After reviewing the information on the market research on the two product lines, Ms van der Zande summa- L'Oreal's goal for developing new products was to rized the situation. L'Oral Netherlands could leverage introduce only products that had a differential advantage ke some product strategy and most likely some tact rising of the Garnier name by promoting two at once Consumers would hear and see the Garnier me twice, not just once. As a result, Dutch consum- es might see Garnier as a major supplier of cosmetics and toiletries. But she was concerned about the selling effort that would be needed to sell the L'Oral brands Big M and little m?). From the ald introduce Synergie anul ctive, you Compre Cane ping on the situ ant fact Ms. van der Zande reflected that she was facing three decision areas. First, she had to decide if she should introduce one of both product lines, and she had to make this decision knowing that Ortal would not reformulate the products just for the Dutch market Second, if she decided to introduce either one or both of the product lines, she needed to develop a marketing program. This meant she had to make decisions on the promotion of the product line(s) to both retailers and consumers as well as the pricing and distribution of the line(s). Third, given that the Garnier product introduc- tions might negatively affect the sales of her current product lines, she needed tactical marketing plans for those products. that were already in the Dutch market and at the same time introduce not just one but two new brand name product lines. The Dutch Oral sales force would have to handle both family brands, since the much lower market potential of the Netherlands market could not support a separate Garnier sales force, as in France. She was also concerned about retailer reaction to a sales pitch for two product lines. odel ver ti ors to ols 3

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock