Question: What impact (increase, decrease or no change) would each of the following activities have on a firm's debt ratio (assuming the debt ratio of the

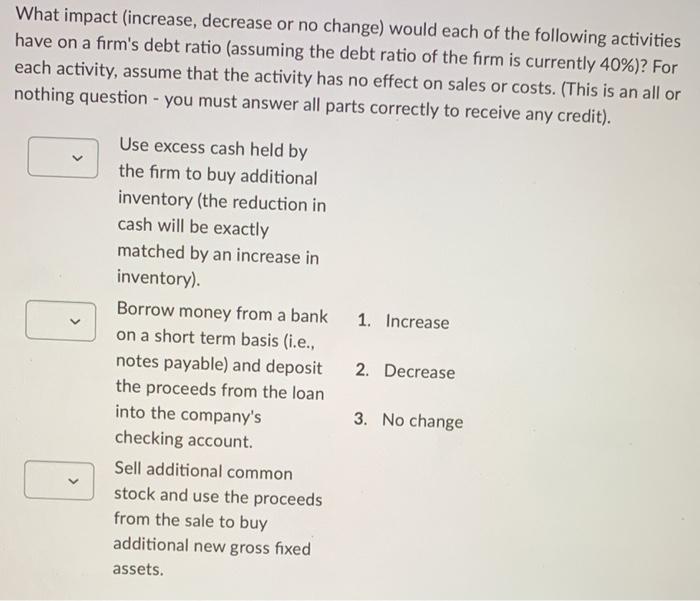

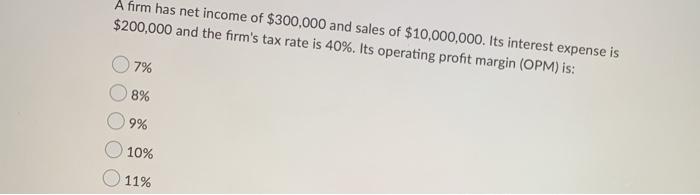

What impact (increase, decrease or no change) would each of the following activities have on a firm's debt ratio (assuming the debt ratio of the firm is currently 40%)? For each activity, assume that the activity has no effect on sales or costs. (This is an all or nothing question - you must answer all parts correctly to receive any credit). 1. Increase Use excess cash held by the firm to buy additional inventory (the reduction in cash will be exactly matched by an increase in inventory). Borrow money from a bank on a short term basis (i.e., notes payable) and deposit the proceeds from the loan into the company's checking account. Sell additional common stock and use the proceeds from the sale to buy additional new gross fixed assets. 2. Decrease 3. No change A firm has net income of $300,000 and sales of $10,000,000. Its interest expense is $200,000 and the firm's tax rate is 40%. Its operating profit margin (OPM) is: 7% 8% 9% 10% 11%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts