Question: What is a Present Value, and How Is It Calculated? Under the concepts of the time value of money, you can determine today's, or the

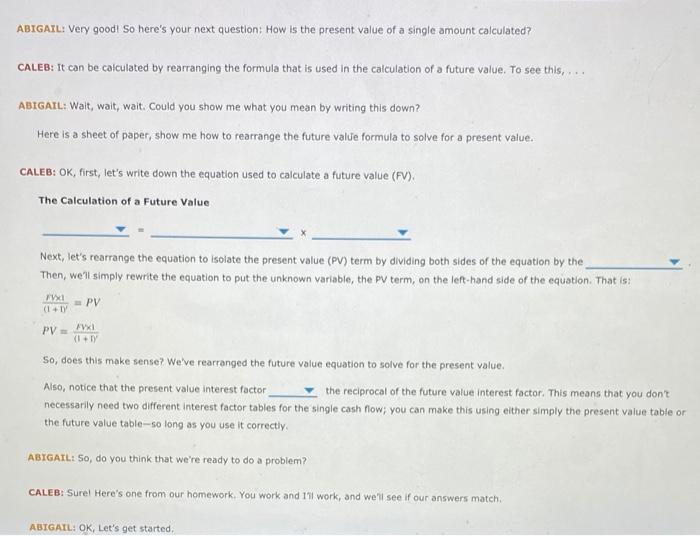

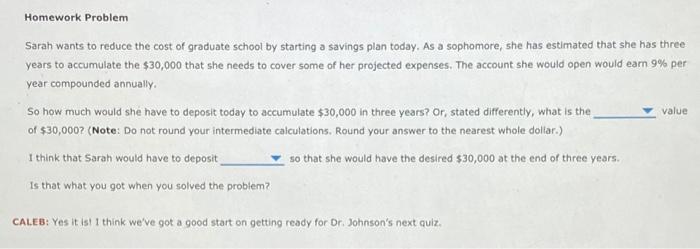

What is a Present Value, and How Is It Calculated? Under the concepts of the time value of money, you can determine today's, or the present, value of a cash receipt or payment that will occur at some specified time in the future, given a specified rate of Interest. This technique can be used to calculate (1) the present value of a single receipt or payment made or (2) a series of receipts or payments. Abigail and Caleb are walking, after class, between the library and the best pizzeria near campus. They're discussing Dr. Johnson's latest personal finance lecture, which addressed the concept of present value and the process of calculating it in anticipation of tomorrow's quiz, they've decided to review their lecture notes and the textbook materials and then practice one or two problems. CALEB: So, what is a present value, and why is it important to be able to calculate it? ABIGAIL: According to Dr. Johnson, an asset's present, or receive in the future. value is the current value of the cash flows that it will pay or CALEB: Wait Can you give me an example of when it would be appropriate to calculate a present value? ABIGAIL: Sure, but it might make more sense for you to identify a situation in which calculating a present value is appropriate. So, in which of the following two scenarios would you use a present value calculation, and then explain why that is so Scenario 1: You would like to know how much you should place on deposit to have accumulated a certain amount of money by a specific future date Scenario 2: You would like to know how much a given amount deposited today will grow into by a specific future date. CALEB: Ummm. I think is the situation that requires the calculation of a present value. The reason is that the amount to be placed on deposit is both and occurs ABIGAIL: Very good! So here's your next question: How is the present value of a single amount calculated? CALEB: It can be calculated by rearranging the formula that is used in the calculation of a future value. To see this, ABIGAIL: Wait, wait,wait Could you show me what you mean by writing this down? Here is a sheet of paper, show me how to rearrange the future value formula to solve for a present value. CALEB: OK, first, let's write down the equation used to calculate a future value (FV). The Calculation of a Future Value Next, let's rearrange the equation to Isolate the present value (PV) term by dividing both sides of the equation by the Then, we'll simply rewrite the equation to put the unknown variable, the PV term, on the left-hand side of the equation. That is: VI (1+1 PV PV = XVI (11) So, does this make sense? We've rearranged the future Value equation to solve for the present value Also, notice that the present value interest factor the reciprocal of the future value interest factor. This means that you don't necessarily need two different interest factor tables for the single cash flow; you can make this using either simply the present value table or the future value table-so long as you use it correctly ABIGAIL: So, do you think that we're ready to do a problem? CALEB: Surel Here's one from our homework. You work and 15 work, and we'll see if our answers match ABIGAIL: OK, Let's get started. Homework Problem Sarah wants to reduce the cost of graduate school by starting a savings plan today. As a sophomore, she has estimated that she has three years to accumulate the $30,000 that she needs to cover some of her projected expenses. The account she would open would eam 9% per year compounded annually So how much would she have to deposit today to accumulate $30,000 in three years? Or, stated differently, what is the of $30,000? (Note: Do not round your intermediate calculations. Round your answer to the nearest whole doltar.) I think that Sarah would have to deposit so that she would have the desired $30,000 at the end of three years. is that what you got when you solved the problem? value CALES: Yes it is I think we've got a good start on getting ready for Dr. Johnson's next quiz

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts