Question: What is a Transaction Processing System? Why do we use a Transaction Processing System? What are the uses? What are the advantages and disadvantages? How

What is a Transaction Processing System?

Why do we use a Transaction Processing System?

What are the uses?

What are the advantages and disadvantages?

How it is used in the business area? (Operational based)

Risk and Compliance?

And detailed review with a conclusion at the end

(please give the wright answers)

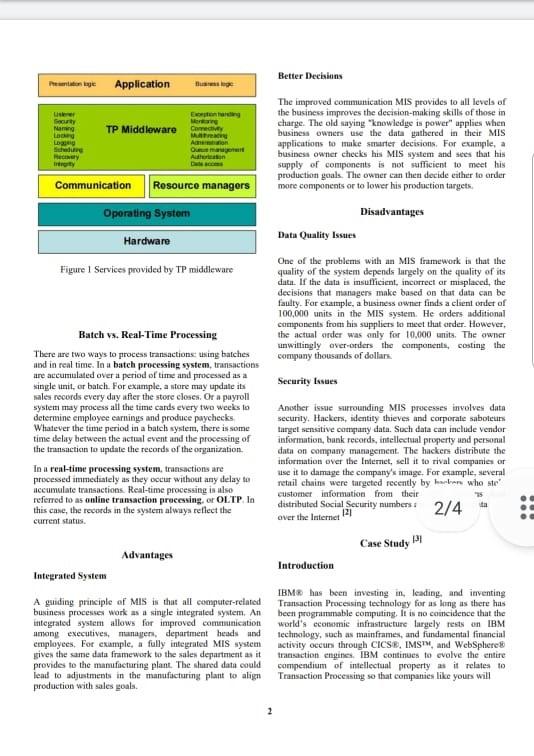

Transaction Processing System Instructor: Muhammad Zain Class: BBIS Course:MIS Transaction process system (TPS) In this paper, we reviewed the past, present A transaction process system (TPS) is an information and future of transaction processing and processing system for business transactions involving the transaction integrity. We decribed how we collection, modification and retrieval of all transaction data arrived at where we are and where the future Characteristics of a TPS include performance, reliability and of transaction processing might lead us. Most Abstract- consistency of the challenges and rewirements that led to the development and evolution of transaction processing TPS is also known as transaction processing or real-time systems are still applicable today, and recently, we have seen some intriguing developments, Predictions for future processing business and technology trends point at the increased importance of transaction processing system Why transaction processing is important to the business INTRODUCTION What is clear is that the integrity of the business relies The global economy is made up of an immense number heavily on the integrity of these transactions in the of business transactions, usually involving the exchange of Information system. If any one of these activities fails to do goods or services for money. These business transactions its job correctly, the business will be out of balance. If the inventory database is not updated correctly, the store will tend to be short and repetitive. Common characteristics think it has more books on hand than it does. What include concurrent access by many users, through multiple interfaces, to whared information. In this chapter, we review happened to the book? Did it get misplaced? Did someone more closely what we mean by a transaction, we look at the steal it? Was it islabeled Likewise, if the credit card is evolution of transaction processing, and we then consider not debited properly, the store could be out of money. If the how it differs from other types of information processing loyalty status is not updated correctly, the customer will miss out on the rewards they deserve. If the ledger in not updated, the cash register will be out of balance at closing What is a transaction? Any one of these situations is not necessarily detrimental on its own. Any of them can be reconciled later. A thorough What is a transaction when using the term transaction, inventory of the store and scan of receipts can reveal the clarifying whether you are talking about a business legitimate sale of the book. transaction or an information technology (IT) transaction is important? The difference is a matter of perspective. When Transaction processing middleware you walk into your neighborhood store and buy a book that It is possible to write stand-alone applications to perform is a business transaction. Likewise, these transactions are all business transactions when you submit an insurance transactions in shared multiple-user environments claim, yet your oil changed, see a doctor, pick up your however, doing so is complex Application developers would need to address issues, such as the communications prescription from the pharmacy, pass through a tollbooth. lly on an airplane, or even pay your electricity bill with the user interface ensuring that only authorized users access the system, preventing concurrent changes, handling However, in today's world, where almost everything we do failures and backing out partial updates, managing the in backed up with computer automation, nearly all of these database connectivity, and numerous other complicated business transaction drive one or more corresponding tasks each of which would have to be rewritten for each activities in the information system. When you buy a book the cashier enters the amount in the register, rings up a new application. This is why we have transaction processing (TP) middleware total, and collects your money. Each of these activities can be thought of as an IT transaction. Ot, all of them together can be thought of as a transaction. Or, some of these activities might be divided into smaller transactions. It all depends on how the application is written 1 Better Decisions Application Security Maming Sherg TP Middleware met An Om The improved communication MIS provides to all levels of the business improves the decision-making skills of those in charge. The old saying "knowledge is power" upplies when business owners use the data gathered in their MIS applications to muke smerter decisions. For example, a business owner checks his MIS system and sees that his supply of components is not sufficient to meet his production goals. The owner can then decide either to order more components or to lower his production targets Communication Resource managers Operating System Hardware Figure 1 Services provided by TP middleware Disadvantages Data Quality Issues One of the problems with an MIS framework is that the quality of the system depends largely on the quality of its data. If the data is insufficient, incorrect ar misplaced, the decisions that managers make based on that data can be faulty. For example, a business owner finds a client onder of 100,000 units in the MIS system. He orders additional components from his supplies to meet that order. However, the actual sider was only for 10,000 units. The owner unwillingly overorders the components, costing the company thousands of dollars Security Issues Batch vs. Real-Time Processing There are two ways to process transactions using batches and in real time. In a batch processing system, transactions are accumulated over a period of time and processed as a single unit, or batch For example, a store may update its sales records every day after the store closes. Or a payroll system may process all the time cards every two weeks to determine employee earnings and produce paychecks Whatever the time period in a batch system, there is some time delay between the actual event and the processing of the transaction to update the records of the organization In u real-time processing system, transactions are processed immediately as they occur without any delay to accumulate transactions Real-time processing is also referred to as online transaction processing, or OLTP In this case, the records in the system always reflect the current status. Another issue surrounding MIS processes involves data security. Hackers, identity thieves and corporale saboteurs target sensitive company data. Such data can include vendor information, bank records, intellectual property and personal data on company management. The hackers distribute the information over the Internet, sell it to rival companies or use it to damage the company's image. For example, several retail chains were targeted recently by haber who ste customer information from their distributed Social Security numbers ta 2/4 over the Internet I Case Study PI Advantages Introduction Integrated System A guiding principle of MIS is that all computer-related business processer work as a single integrated system. An integrated system allows for improved communication among executives, magen, department heads and employees. For example, a fully integrated MIS system gives the same data framework to the sales department as it provides to the manufacturing plant. The shared data could lead to adjustments in the manufacturing plant to align production with sales goals. IBM has been investing in, leading and inventing Transaction Processing technology for as long as there has been programmable computing. It is no concidence that the world's economie infrastructure largely rests on IBM technology, such as mainframes, and fundamental financial activity occurs through CICS, IMSPM, and WebSphere transaction engines. IBM continues to evolve the entire compendium of intellectual property as it relates to Transaction Processing so that companies like yours will 2 have the sophisticated technology required to not only support hul thrive in the new world of federated environments to offer product bundles based on a customer's specific requirements and buying hehavior Before TPS "We try to provide a friendly and pleasant online experience to our customers and that also rewards them for their loyalty" (Misha Kravchenko, Marriott International Risk and compliance In 1992, IBM executed most of his transactions in person, through the mail, or on the phone. ATMs were becoming more popular and were starting to provide a wider range of services, and debit cards were just being introduced. The introduction of Internet banking or online sales sites, such as Amazon or eBay, would not be introduced until the middle of the 1990s. A cellphone was the size of a "brick and cost thousands of dollars. Brick and mortar banks, retail stores, travel agents, and car and insurance agencies were still heavily used for conducting day-to-day business transactions. A typical business transaction would involve IBM interacting directly with a teller, sales person, or business representative. That person would employ a ser device (such as a cash register, teller machine, or terminal) conected to a hack-end system, where the transaction would be processed. A single business transaction would Manlly result in one or two back-end transactions. The integrity of that transaction was controlled at the back and and the dedicated connection to the terminal where the transaction was entered. These transactions were also limited to normal business hours. Consistent risk information throughout business units prevents unexpected losses and evil or criminal penalties The aim is to eliminate redundancies and reduce risk by improving the timeliness and quality of information that is available. Our interviewed clients stated that they have implemented an audit trail of who does what, and they stressed the need to extemalize user privilege rights in a rules engine that has similar service-level agreement (SLA) requirements as the TP system. Any program to reduce risk by increased data collection invariably has an impact on existing TP systems because much of the risk-related data in processed by these systems. To remain compliant in the face of regularly changing rules that are imposed by governments and other statutory bodies, financial institutions must enable their TP systems with the sensors necessary to detect and intercept certain events l'artner integration After TPS Business agility and optimization Being competitive was always a business goal, however, with the liberalization of markets and the added competition from emerging markets, the challenge is greater than ever. To succeed in today's competitive market, businesses need to simplify the architecture of their TP system to improve business agility, take out cost, and eliminate inefficiencies The aim is to use real-time information to make better business decisions that optimize return on investment (ROI). This ROI is witnessed in the travel industry, it particular where room occupancy is a clear measure of competitive efficiency. In the case of Marriott International business intelligence software looks at member status, inventory status, and dynamic pricing models. Factors considered include whether the customer is staying over on Wednesday night or through a weekend, and whether the Customer is a Platinum member. On the room inventory side, systems also consider whether rooms in the area for which the customer is requesting lodging are in att undersold or oversold staat. All of this system intelligence comes together in a best price best yield scenario for both the hotel chain and the customer in less than one second. A similar approach is witnessed in the banking and insurance industries Financial institutions are trying to develop more agile operating models and product engines that allow them Most of our surveyed clients have commented on the trend toward expanded partner integration to maximize the distribution channel for their products, or to subcontract parts of their supply chain. Companies that traditionally managed their own distribution channels are changing their business model and offering their services to external distribution channels. I FATCA (Foreign Account Tax Compliance Act) requires Foreign Financial Institutions to identify their US accounts and report them to the US tax authority (the Internal Revenue Service, or IRS). 16 Transaction Processing Past, Present and Future Straight through processing (STP) trading processes that remove the need for manual intervention, or interruptible business processes, today often span different companies. For interoperability, these processes need to be based on standard protocols Reducing costs The IT industry as a whole is challenged with improving business flexibility and minimizing tisk, but at the same time, CIOs are expected to hold to constant or decreasing hudgets. Across the industry, there is a deep desire to eliminate expense where possible. Specialized systems, such as optimizers and appliances, can play a role in reducing transaction costs in the following ways off-loading the processor intensive part of a workload, freeing up the general processors for other work simplifying the integration tasks that are required when building multi- platform solution, enabling new applications to be implemented more quickly and with fewer IT staff REFERENCES 1 https://www.techapedia.com definition 707 transactie procesystem.pi ht. www.chow.com/about_5494879 advantage disadvantages information management system. 131 http://www.redbooks.ibm.comredpapers/pdfsredp 4854.pdfStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts