Question: what is A-G? ACCT 300 Practice Set #4 60 Points Shannon Distributors, which sells on terms of 2/10,n/30, had the following transactions during October, the

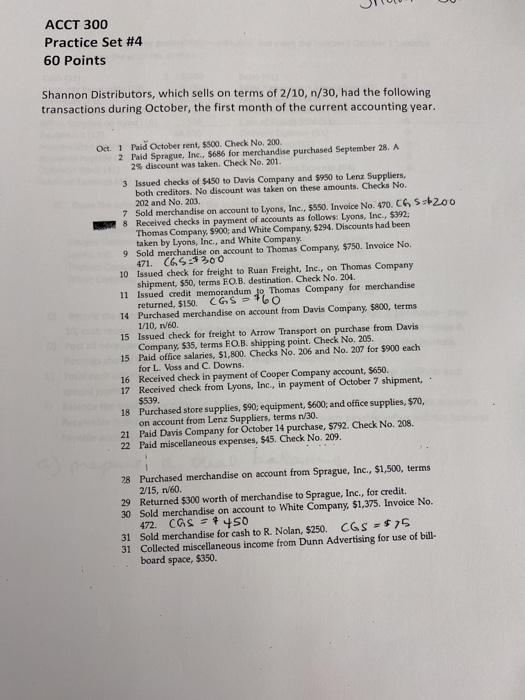

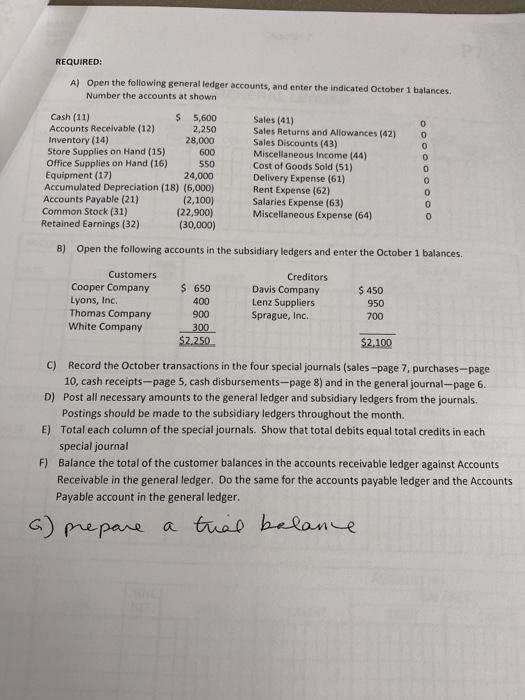

ACCT 300 Practice Set #4 60 Points Shannon Distributors, which sells on terms of 2/10,n/30, had the following transactions during October, the first month of the current accounting year. Oct. 1 Paid October rent, $500. Check No. 200. 2 Paid Sprague, Inc., $686 for merchandise purchased September 28. A 2% discount was taken. Check No, 201. 3 Issued checks of $450 to Davis Company and 9950 to Lena Suppliers, both creditors. No discount was taken on these amounts. Checks No. 202 and No. 203. 7 Sold merchandise on account to Lyons, Inc., 5550. Invoice No. 470, CG S:200 8 Received checks in payment of accounts as follows: Lyons, Inc., 5392, Thomas Company $900, and White Company, $294. Discounts had been taken by Lyons, Inc., and White Company 9 Sold merchandise on account to Thomas Company, $750. Invoice No. 471. C65:5300 10 Issued check for freight to Ruan Freight, Inc., on Thomas Company shipment, $50, terms FO.B. destination. Check No. 204 11 Issued credit memorandum to Thomas Company for merchandise returned, $150. CGS-160 14 Purchased merchandise on account from Davis Company, 5800, terms 1/10, V60 15 Issued check for freight to Arrow Transport on purchase from Davis Company, 535, terms EO.B. shipping point. Check No. 205. 15 Paid office salaries, $1,800. Checks No. 206 and No. 207 for $900 each for L Voss and C. Downs 16 Received check in payment of Cooper Company account, $650. 17 Received check from Lyons, Inc., in payment of October 7 shipment, $539. 18 Purchased store supplies, 590, equipment, 5600, and office supplies, $70, on account from Lenz Suppliers, terms 1/30. 21 Paid Davis Company for October 14 purchase, $792. Check No. 208. 22 Paid miscellaneous expenses, $45. Check No. 209. 28 Purchased merchandise on account from Sprague, Inc., $1,500, terms 2/15, n/60 29 Returned $300 worth of merchandise to Sprague, Inc., for credit. 30 Sold merchandise on account to White Company, $1,375. Invoice No. 472. CAS = 450 31 Sold merchandise for cash to R. Nolan, $250 CGS = $75 31 Collected miscellaneous income from Dunn Advertising for use of bill- board space, $350. REQUIRED: A) Open the following general ledger accounts, and enter the indicated October 1 balances. Number the accounts at shown Cash (11) $ 5,600 Sales (41) Accounts Receivable (12) 2,250 Sales Returns and Allowances (42) Inventory (14) 28,000 Sales Discounts (43) Store Supplies on Hand (15) 600 Miscellaneous Income (44) Office Supplies on Hand (16) 550 Cost of Goods Sold (51) Equipment (17) 24,000 Delivery Expense (61) Accumulated Depreciation (18) (6,000) Rent Expense (62) Accounts Payable (21) (2,100) Salaries Expense (63) Common Stock (31) (22,900) Miscellaneous Expense (64) Retained Earnings (32) (30,000) OOOOOOOOO B) Open the following accounts in the subsidiary ledgers and enter the October 1 balances. Customers Cooper Company Lyons, Inc. Thomas Company White Company $ 650 400 900 300 $2,250 Creditors Davis Company Lenz Suppliers Sprague, Inc. $ 450 950 700 $2,100 C) Record the October transactions in the four special journals (sales -page 7, purchases--page 10, cash receipts-page 5, cash disbursements-page 8) and in the general journal--page 6. D) Post all necessary amounts to the general ledger and subsidiary ledgers from the journals. Postings should be made to the subsidiary ledgers throughout the month. E) Total each column of the special journals. Show that total debits equal total credits in each special journal F) Balance the total of the customer balances in the accounts receivable ledger against Accounts Receivable in the general ledger. Do the same for the accounts payable ledger and the Accounts Payable account in the general ledger. 6) prepare a trial balance ACCT 300 Practice Set #4 60 Points Shannon Distributors, which sells on terms of 2/10,n/30, had the following transactions during October, the first month of the current accounting year. Oct. 1 Paid October rent, $500. Check No. 200. 2 Paid Sprague, Inc., $686 for merchandise purchased September 28. A 2% discount was taken. Check No, 201. 3 Issued checks of $450 to Davis Company and 9950 to Lena Suppliers, both creditors. No discount was taken on these amounts. Checks No. 202 and No. 203. 7 Sold merchandise on account to Lyons, Inc., 5550. Invoice No. 470, CG S:200 8 Received checks in payment of accounts as follows: Lyons, Inc., 5392, Thomas Company $900, and White Company, $294. Discounts had been taken by Lyons, Inc., and White Company 9 Sold merchandise on account to Thomas Company, $750. Invoice No. 471. C65:5300 10 Issued check for freight to Ruan Freight, Inc., on Thomas Company shipment, $50, terms FO.B. destination. Check No. 204 11 Issued credit memorandum to Thomas Company for merchandise returned, $150. CGS-160 14 Purchased merchandise on account from Davis Company, 5800, terms 1/10, V60 15 Issued check for freight to Arrow Transport on purchase from Davis Company, 535, terms EO.B. shipping point. Check No. 205. 15 Paid office salaries, $1,800. Checks No. 206 and No. 207 for $900 each for L Voss and C. Downs 16 Received check in payment of Cooper Company account, $650. 17 Received check from Lyons, Inc., in payment of October 7 shipment, $539. 18 Purchased store supplies, 590, equipment, 5600, and office supplies, $70, on account from Lenz Suppliers, terms 1/30. 21 Paid Davis Company for October 14 purchase, $792. Check No. 208. 22 Paid miscellaneous expenses, $45. Check No. 209. 28 Purchased merchandise on account from Sprague, Inc., $1,500, terms 2/15, n/60 29 Returned $300 worth of merchandise to Sprague, Inc., for credit. 30 Sold merchandise on account to White Company, $1,375. Invoice No. 472. CAS = 450 31 Sold merchandise for cash to R. Nolan, $250 CGS = $75 31 Collected miscellaneous income from Dunn Advertising for use of bill- board space, $350. REQUIRED: A) Open the following general ledger accounts, and enter the indicated October 1 balances. Number the accounts at shown Cash (11) $ 5,600 Sales (41) Accounts Receivable (12) 2,250 Sales Returns and Allowances (42) Inventory (14) 28,000 Sales Discounts (43) Store Supplies on Hand (15) 600 Miscellaneous Income (44) Office Supplies on Hand (16) 550 Cost of Goods Sold (51) Equipment (17) 24,000 Delivery Expense (61) Accumulated Depreciation (18) (6,000) Rent Expense (62) Accounts Payable (21) (2,100) Salaries Expense (63) Common Stock (31) (22,900) Miscellaneous Expense (64) Retained Earnings (32) (30,000) OOOOOOOOO B) Open the following accounts in the subsidiary ledgers and enter the October 1 balances. Customers Cooper Company Lyons, Inc. Thomas Company White Company $ 650 400 900 300 $2,250 Creditors Davis Company Lenz Suppliers Sprague, Inc. $ 450 950 700 $2,100 C) Record the October transactions in the four special journals (sales -page 7, purchases--page 10, cash receipts-page 5, cash disbursements-page 8) and in the general journal--page 6. D) Post all necessary amounts to the general ledger and subsidiary ledgers from the journals. Postings should be made to the subsidiary ledgers throughout the month. E) Total each column of the special journals. Show that total debits equal total credits in each special journal F) Balance the total of the customer balances in the accounts receivable ledger against Accounts Receivable in the general ledger. Do the same for the accounts payable ledger and the Accounts Payable account in the general ledger. 6) prepare a trial balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts