Question: What is Amazon's WACC? Note: Amazon does not have r preferred stock. Apply the CAPM to estimate the cost of equity using the expected market

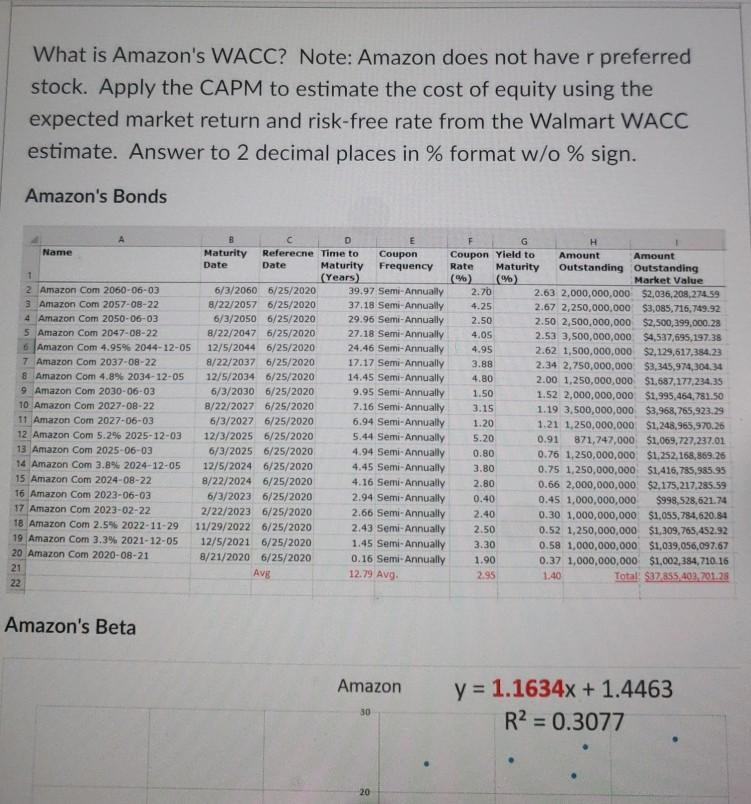

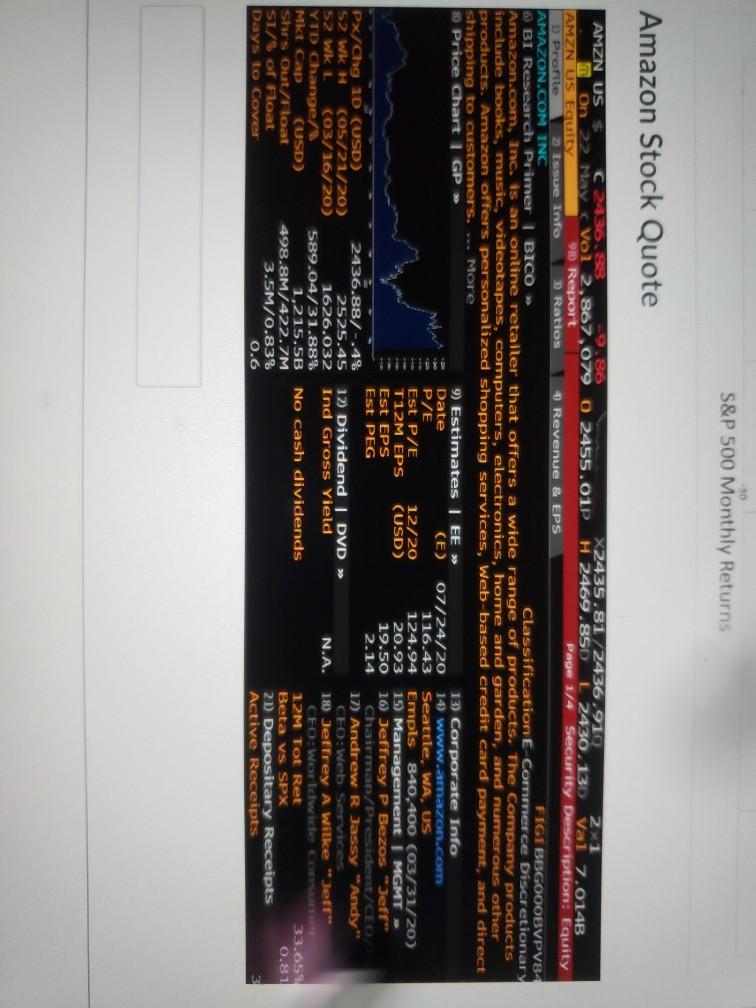

What is Amazon's WACC? Note: Amazon does not have r preferred stock. Apply the CAPM to estimate the cost of equity using the expected market return and risk-free rate from the Walmart WACC estimate. Answer to 2 decimal places in % format w/o % sign. Amazon's Bonds D E G H Name Maturity Referecne Time to Coupon Coupon Yield to Amount Amount Date Date Maturity Frequency Rate Maturity Outstanding Outstanding 1 (Years) (%) (%) Market Value 2 Amazon Com 2060-06-03 6/3/2060 6/25/2020 39.97 Semi-Annually 2.75 2.63 2,000,000,000 $2,036,208,27459 3 Amazon Com 2057-08-22 8/22/2057 6/25/2020 37.18 Semi-Annually 4.25 2.67 2,250,000,000 $3,085,716,749.92 4 Amazon Com 2050-06-03 6/3/2050 6/25/2020 29.96 Semi-Annually 2.50 2.50 2,500,000,000 $2,500,399,000.28 5 Amazon Com 2047-08-22 8/22/2047 6/25/2020 27.18 Semi-Annually 4.05 2.53 3,500,000,000 $4,537,695,197.38 6 | Amazon Com 4.95% 2044-12-05 12/5/2044 6/25/2020 24.46 Semi-Annually 4.95 2.62 1,500,000,000 $2,129,617,384.23 7 Amazon Com 2037-08-22 a/22/2037 6/25/2020 17.17 Semi-Annually 3.88 2.34 2,750,000,000 $3,345,974,304.34 8 Amazon Com 4.8% 2034-12-05 12/5/2034 6/25/2020 14.45 Semi-Annually 4.80 2.00 1,250,000,000 $1,687,177,234.35 9 Amazon Com 2030-06-03 6/3/2030 6/25/2020 9.95 Semi-Annually 1.50 1.52 2,000,000,000 $1,995,464,781.50 10 Amazon Com 2027-08-22 B/22/2027 6/25/2020 7.16 Semi-Annually 3.15 1.19 3,500,000,000 $3,968, 765,923.29 11 Amazon Com 2027-06-03 6/3/2027 6/25/2020 6.94 Semi-Annually 1.20 1.21 1,250,000,000 $1,248,965,970.26 12 Amazon Com 5.2% 2025-12-03 12/3/2025 6/25/2020 5.44 Semi-Annually 5.20 0.91 871,747,000 $1,069,727,237.01 13 Amazon Com 2025-06-03 6/3/2025 6/25/2020 4.94 Semi-Annually 0.80 0.76 1.250,000,000 $1,252,168,869.26 14 Amazon Com 3.8% 2024-12-05 12/5/2024 6/25/2020 4.45 Semi-Annually 3.80 0.75 1,250,000,000 $1,416,785,985.95 15 Amazon Com 2024-08-22 8/22/2024 6/25/2020 4.16 Semi-Annually 2.80 0.66 2,000,000,000 $2,175,217.285.59 16 Amazon Com 2023-06-03 6/3/2023 6/25/2020 2.94 Semi-Annually 0.40 0.45 1,000,000,000 $998,528,621.74 17 Amazon Com 2023-02-22 2/22/2023 6/25/2020 2.66 Semi-Annually 2.40 0.30 1,000,000,000 $1,055,784,620.84 18 Amazon Com 2.5% 2022-11-29 11/29/2022 6/25/2020 2.43 Semi-Annually 2.50 0.52 1,250,000,000 $1,309,765, 452.92 19 Amazon Com 3.3% 2021-12-05 12/5/2021 6/25/2020 1.45 Semi-Annually 3.30 0.58 1,000,000,000 $1,039,056,097.67 20 Amazon Com 2020-08-21 8/21/2020 6/25/2020 0.16 Semi-Annually 1.90 0.37 1,000,000,000 $1,002,384,710 16 21 Avg 12.79 Avg 2.95 1.40 Total: $37,855,402.01.25 22 Amazon's Beta Amazon y = 1.1634x + 1.4463 R2 = 0.3077 30 20 S&P 500 Monthly Returns Amazon Stock Quote 21 AMZN US S C2436.88 X2435.8172436.910 On 22 May > 9) Estimates | EE 13) Corporate Info Date (E) 07/24/20 14) www.amazon.com P/E 116.43 Seattle, WA, US Est P/E 12/20 124.94 Empts 840,400 (03/31/20) T12M EPS (USD) 20.93 15) Management | MGMT Est EPS 19.50 16) Jeffrey P Bezos "Jeff" Est PEG 2.14 Chairman/President/CEO Px/Chg 1D (USD) 2436.88/-.4% 17) Andrew R Jassy "Andy** 52 WK H (05/21/20) 2525.45 12) Dividend | DVD >> CEO: Web Services 52 WkL (03/16/20) 1626.032 Ind Gross Yield N.A. 18) Jeffrey A Wilke "Jeff" YTD Change/ 589.04/31.88% CEO: Worldwide cons Mkt Cap (USD) 1,215.5B No cash dividends 12M Tot Ret 33.65% Shrs Out/Float 498.8M/422.ZM Beta vs SPX 0.81 SI/3 of Float 3.5M/0.83% 21 Depositary Receipts Days to Cover 0.6 Active Receipts What is Amazon's WACC? Note: Amazon does not have r preferred stock. Apply the CAPM to estimate the cost of equity using the expected market return and risk-free rate from the Walmart WACC estimate. Answer to 2 decimal places in % format w/o % sign. Amazon's Bonds D E G H Name Maturity Referecne Time to Coupon Coupon Yield to Amount Amount Date Date Maturity Frequency Rate Maturity Outstanding Outstanding 1 (Years) (%) (%) Market Value 2 Amazon Com 2060-06-03 6/3/2060 6/25/2020 39.97 Semi-Annually 2.75 2.63 2,000,000,000 $2,036,208,27459 3 Amazon Com 2057-08-22 8/22/2057 6/25/2020 37.18 Semi-Annually 4.25 2.67 2,250,000,000 $3,085,716,749.92 4 Amazon Com 2050-06-03 6/3/2050 6/25/2020 29.96 Semi-Annually 2.50 2.50 2,500,000,000 $2,500,399,000.28 5 Amazon Com 2047-08-22 8/22/2047 6/25/2020 27.18 Semi-Annually 4.05 2.53 3,500,000,000 $4,537,695,197.38 6 | Amazon Com 4.95% 2044-12-05 12/5/2044 6/25/2020 24.46 Semi-Annually 4.95 2.62 1,500,000,000 $2,129,617,384.23 7 Amazon Com 2037-08-22 a/22/2037 6/25/2020 17.17 Semi-Annually 3.88 2.34 2,750,000,000 $3,345,974,304.34 8 Amazon Com 4.8% 2034-12-05 12/5/2034 6/25/2020 14.45 Semi-Annually 4.80 2.00 1,250,000,000 $1,687,177,234.35 9 Amazon Com 2030-06-03 6/3/2030 6/25/2020 9.95 Semi-Annually 1.50 1.52 2,000,000,000 $1,995,464,781.50 10 Amazon Com 2027-08-22 B/22/2027 6/25/2020 7.16 Semi-Annually 3.15 1.19 3,500,000,000 $3,968, 765,923.29 11 Amazon Com 2027-06-03 6/3/2027 6/25/2020 6.94 Semi-Annually 1.20 1.21 1,250,000,000 $1,248,965,970.26 12 Amazon Com 5.2% 2025-12-03 12/3/2025 6/25/2020 5.44 Semi-Annually 5.20 0.91 871,747,000 $1,069,727,237.01 13 Amazon Com 2025-06-03 6/3/2025 6/25/2020 4.94 Semi-Annually 0.80 0.76 1.250,000,000 $1,252,168,869.26 14 Amazon Com 3.8% 2024-12-05 12/5/2024 6/25/2020 4.45 Semi-Annually 3.80 0.75 1,250,000,000 $1,416,785,985.95 15 Amazon Com 2024-08-22 8/22/2024 6/25/2020 4.16 Semi-Annually 2.80 0.66 2,000,000,000 $2,175,217.285.59 16 Amazon Com 2023-06-03 6/3/2023 6/25/2020 2.94 Semi-Annually 0.40 0.45 1,000,000,000 $998,528,621.74 17 Amazon Com 2023-02-22 2/22/2023 6/25/2020 2.66 Semi-Annually 2.40 0.30 1,000,000,000 $1,055,784,620.84 18 Amazon Com 2.5% 2022-11-29 11/29/2022 6/25/2020 2.43 Semi-Annually 2.50 0.52 1,250,000,000 $1,309,765, 452.92 19 Amazon Com 3.3% 2021-12-05 12/5/2021 6/25/2020 1.45 Semi-Annually 3.30 0.58 1,000,000,000 $1,039,056,097.67 20 Amazon Com 2020-08-21 8/21/2020 6/25/2020 0.16 Semi-Annually 1.90 0.37 1,000,000,000 $1,002,384,710 16 21 Avg 12.79 Avg 2.95 1.40 Total: $37,855,402.01.25 22 Amazon's Beta Amazon y = 1.1634x + 1.4463 R2 = 0.3077 30 20 S&P 500 Monthly Returns Amazon Stock Quote 21 AMZN US S C2436.88 X2435.8172436.910 On 22 May > 9) Estimates | EE 13) Corporate Info Date (E) 07/24/20 14) www.amazon.com P/E 116.43 Seattle, WA, US Est P/E 12/20 124.94 Empts 840,400 (03/31/20) T12M EPS (USD) 20.93 15) Management | MGMT Est EPS 19.50 16) Jeffrey P Bezos "Jeff" Est PEG 2.14 Chairman/President/CEO Px/Chg 1D (USD) 2436.88/-.4% 17) Andrew R Jassy "Andy** 52 WK H (05/21/20) 2525.45 12) Dividend | DVD >> CEO: Web Services 52 WkL (03/16/20) 1626.032 Ind Gross Yield N.A. 18) Jeffrey A Wilke "Jeff" YTD Change/ 589.04/31.88% CEO: Worldwide cons Mkt Cap (USD) 1,215.5B No cash dividends 12M Tot Ret 33.65% Shrs Out/Float 498.8M/422.ZM Beta vs SPX 0.81 SI/3 of Float 3.5M/0.83% 21 Depositary Receipts Days to Cover 0.6 Active Receipts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts