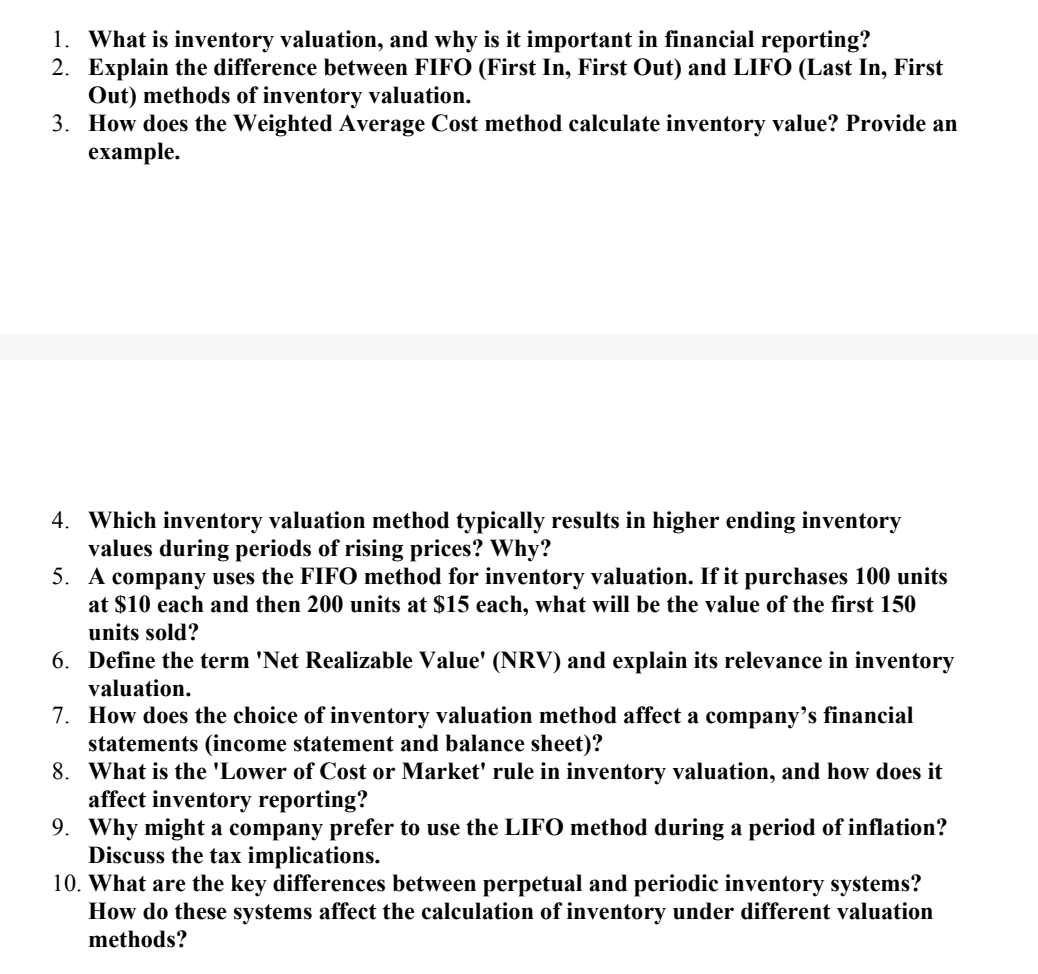

Question: What is inventory valuation, and why is it important in financial reporting? Explain the difference between FIFO ( First In , First Out ) and

What is inventory valuation, and why is it important in financial reporting?

Explain the difference between FIFO First In First Out and LIFO Last In First

Out methods of inventory valuation.

How does the Weighted Average Cost method calculate inventory value? Provide an

example.

Which inventory valuation method typically results in higher ending inventory

values during periods of rising prices? Why?

A company uses the FIFO method for inventory valuation. If it purchases units

at $ each and then units at $ each, what will be the value of the first

units sold?

Define the term 'Net Realizable Value' NRV and explain its relevance in inventory

valuation.

How does the choice of inventory valuation method affect a company's financial

statements income statement and balance sheet

What is the 'Lower of Cost or Market' rule in inventory valuation, and how does it

affect inventory reporting?

Why might a company prefer to use the LIFO method during a period of inflation?

Discuss the tax implications.

What are the key differences between perpetual and periodic inventory systems?

How do these systems affect the calculation of inventory under different valuation

methods?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock