Question: What is spread effect in the Repricing Gap Model? The value of an FI to its owners. The premium paid to compensate for the future

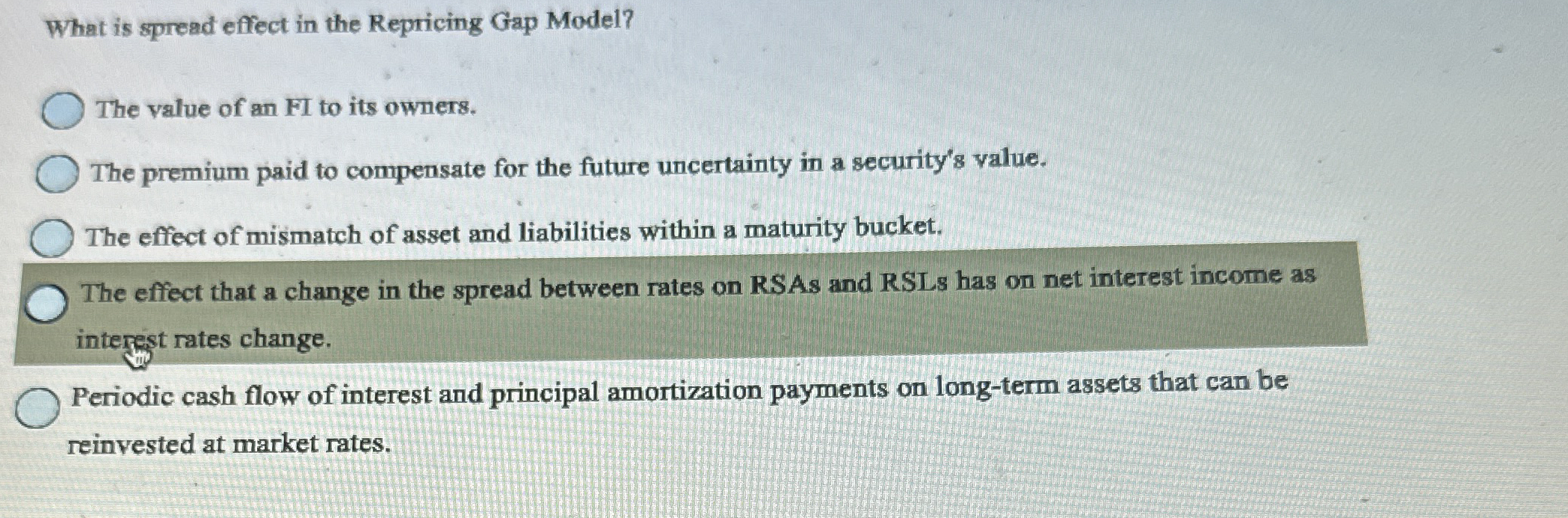

What is spread effect in the Repricing Gap Model?

The value of an FI to its owners.

The premium paid to compensate for the future uncertainty in a securitys value.

The effect of mismatch of asset and liabilities within a maturity bucket.

The effect that a change in the spread between rates on RSAs and RSLs has on net interest income as

interest rates change.

Periodic cash flow of interest and principal amortization payments on longterm assets that can be

reinvested at market rates.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock