Question: What is taxable income? Do not use commas, $ or +/- Numeric answer Type your response Pre-tax accounting income is $650,000 and tax rate is

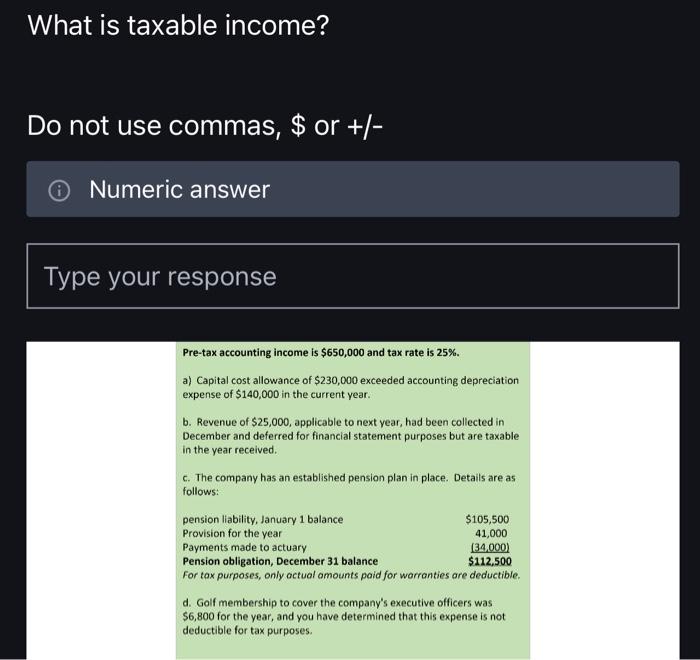

What is taxable income? Do not use commas, $ or +/- Numeric answer Type your response Pre-tax accounting income is $650,000 and tax rate is 25%. a) Capital cost allowance of $230,000 exceeded accounting depreciation expense of $140,000 in the current year. b. Revenue of $25,000, applicable to next year, had been collected in December and deferred for financial statement purposes but are taxable in the year received. c. The company has an established pension plan in place. Details are as follows: pension liability, January 1 balance $105,500 41,000 Provision for the year Payments made to actuary (34,000) Pension obligation, December 31 balance $112,500 For tax purposes, only actual amounts paid for warranties are deductible. d. Golf membership to cover the company's executive officers was $6,800 for the year, and you have determined that this expense is not deductible for tax purposes.

What is taxable income? Do not use commas, $ or +/ (i) Numeric answer Pre-tax accounting income is $650,000 and tax rate is 25%. a) Capital cost allowance of $230,000 exceeded accounting depreciation expense of $140,000 in the current year. b. Revenue of $25,000, applicable to next year, had been collected in December and deferred for financial statement purposes but are taxable in the year received. c. The company has an established pension plan in place. Details are as follows: d. Golf membership to cover the company's executive officers was $6,800 for the year, and you have determined that this expense is not deductible for tax purposes

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock