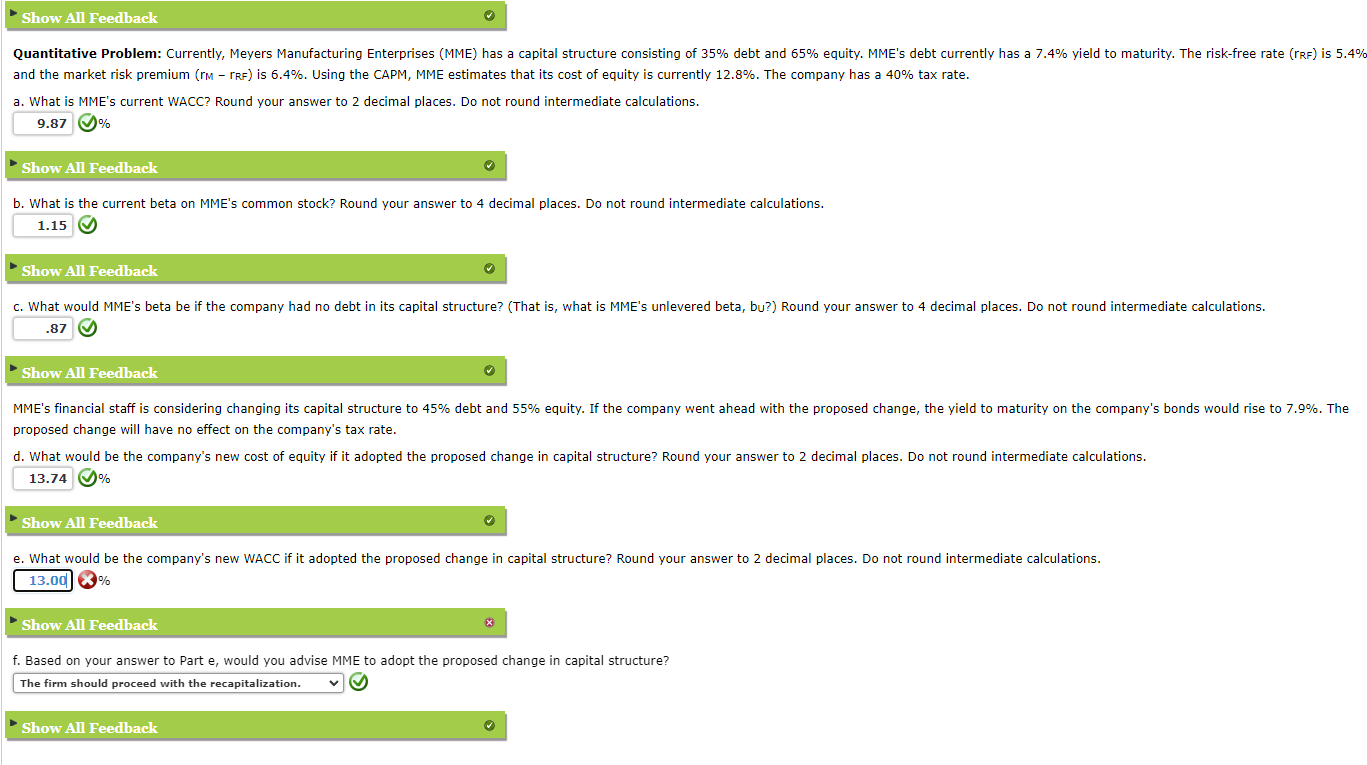

Question: What is the answer for E/ Please solve and explain Show All Feedback and the market risk premium ( rmMrrFRF) is 6.4%. Using the CAPM,

What is the answer for E/ Please solve and explain

Show All Feedback and the market risk premium ( rmMrrFRF) is 6.4%. Using the CAPM, MME estimates that its cost of equity is currently 12.8%. The company has a 40% tax rate. a. What is MME's current WACC? Round your answer to 2 decimal places. Do not round intermediate calculations. % b. What is the current beta on MME's common stock? Round your answer to 4 decimal places. Do not round intermediate calculations. proposed change will have no effect on the company's tax rate. d. What would be the company's new cost of equity if it adopted the proposed change in capital structure? Round your answer to 2 decimal places. Do not round intermediate calculations. e. What would be the company's new WACC if it adopted the proposed change in capital structure? Round your answer to 2 decimal places. Do not round intermediate calculations. f. Based on your answer to Part e, would you advise MME to adopt the proposed change in capital structure? \%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts