Question: what is the answer for part (b) ? (a) An analyst argues that exchange rate movements depend on interest rate differentials (that is, the International

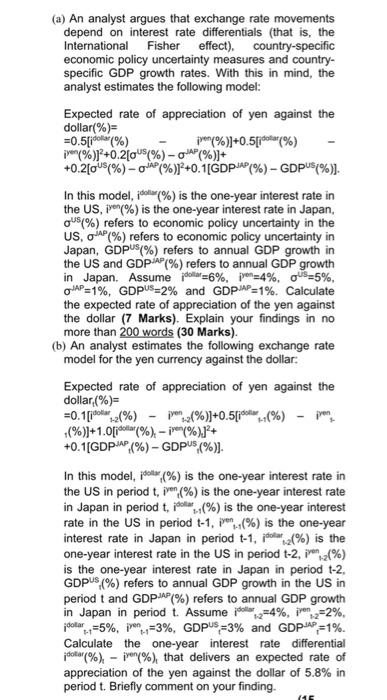

(a) An analyst argues that exchange rate movements depend on interest rate differentials (that is, the International Fisher effect), country-specific economic policy uncertainty measures and country- specific GDP growth rates. With this in mind, the analyst estimates the following model: Expected rate of appreciation of yen against the dollar(%)= =0.5[dollar (%) pren%)]+0.5[jota(%) jren %)2+0.2oUS(%) - AP(%)]+ +0.2[ous(%) -que %)] +0.1[GDPP (%) - GDPUS(%)). In this model, jelle() is the one-year interest rate in the US, ven(%) is the one-year interest rate in Japan, QU$(%) refers to economic policy uncertainty in the US, OP(%) refers to economic policy uncertainty in Japan, GDPUS(%) refers to annual GDP growth in the US and GDP. (%) refers to annual GDP growth in Japan. Assume polar=6%, yen=4%, OUS=5%, D'AP=1%, GDPUS=2% and GDPJAP=1%. Calculate the expected rate of appreciation of the yen against the dollar (7 Marks). Explain your findings in no more than 200 words (30 Marks). (b) An analyst estimates the following exchange rate model for the yen currency against the dollar: Expected rate of appreciation of yen against the dollar (%)= =0.1[100(%) iren.21%)]+0.5[. (%) pron (%))+1.opcoat (%), -jpeny%)]+ +0.1(GDP (%) - GDPUS (%)). In this model, pool(%) is the one-year interest rate in the US in period tiven (%) is the one-year interest rate in Japan in period t, joll(%) is the one-year interest rate in the US in period 1-1, iven..(%) is the one-year interest rate in Japan in period t-1, jolar (%) is the one-year interest rate in the US in period t-2, ive-21%) is the one-year interest rate in Japan in period t-2. GDPUS (%) refers to annual GDP growth in the US in period t and GDP/AP (%) refers to annual GDP growth in Japan in period t. Assume polariz=4%, penz=2%, "-7-5%, pe=3%, GDPUS=3% and GDP.AP=1%. Calculate the one-year interest rate differential Color(%), - ivon%), that delivers an expected rate of appreciation of the yen against the dollar of 5.8% in period t. Briefly comment on your finding. dotar (15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts