Question: what is the answer for question 2 and 4 please Question 2 (8 marks) Ahmad and Hamzeh are partners in a firm. Their capital accounts

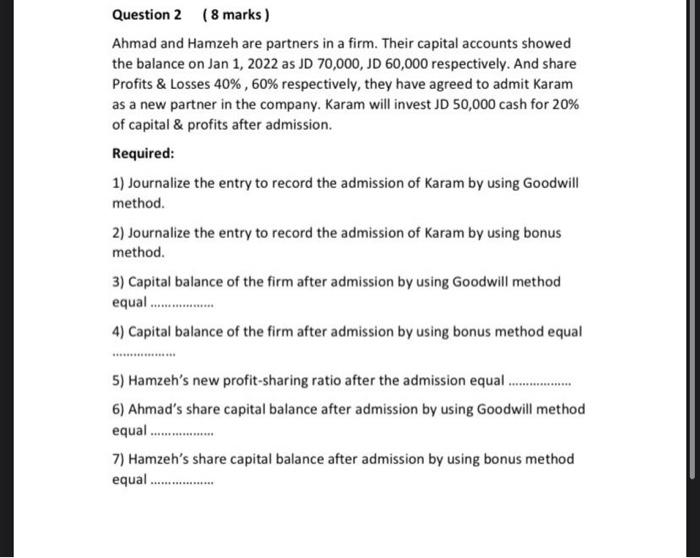

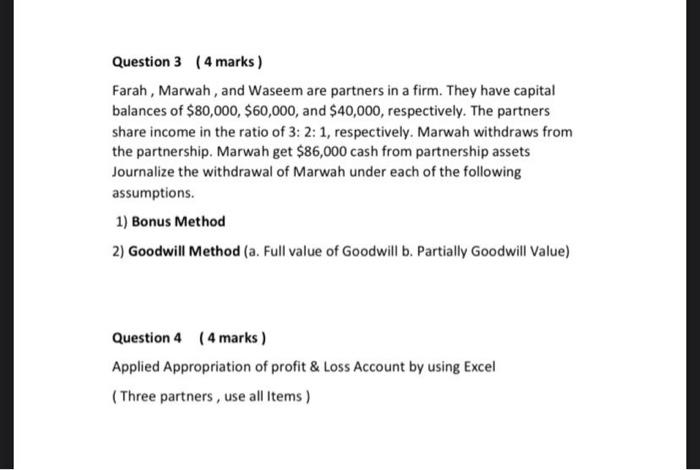

Question 2 (8 marks) Ahmad and Hamzeh are partners in a firm. Their capital accounts showed the balance on Jan 1, 2022 as JD 70,000, JD 60,000 respectively. And share Profits & Losses 40%, 60% respectively, they have agreed to admit Karam as a new partner in the company. Karam will invest JD 50,000 cash for 20% of capital & profits after admission. Required: 1) Journalize the entry to record the admission of Karam by using Goodwill method. 2) Journalize the entry to record the admission of Karam by using bonus method. 3) Capital balance of the firm after admission by using Goodwill method equal.............. 4) Capital balance of the firm after admission by using bonus method equal 5) Hamzeh's new profit-sharing ratio after the admission equal. 6) Ahmad's share capital balance after admission by using Goodwill method equal 7) Hamzeh's share capital balance after admission by using bonus method equal....... Question 3 (4 marks) Farah , Marwah, and Waseem are partners in a firm. They have capital balances of $80,000, $60,000, and $40,000, respectively. The partners share income in the ratio of 3: 2:1, respectively. Marwah withdraws from the partnership. Marwah get $86,000 cash from partnership assets Journalize the withdrawal of Marwah under each of the following assumptions. 1) Bonus Method 2) Goodwill Method (a. Full value of Goodwill b. Partially Goodwill Value) Question 4 (4 marks) Applied Appropriation of profit & Loss Account by using Excel (Three partners, use all Items)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts