Question: What is the answer if you take a short position for the last question: Today's settlement price on a Chicago Mercantile Exchange (CME) futures contract

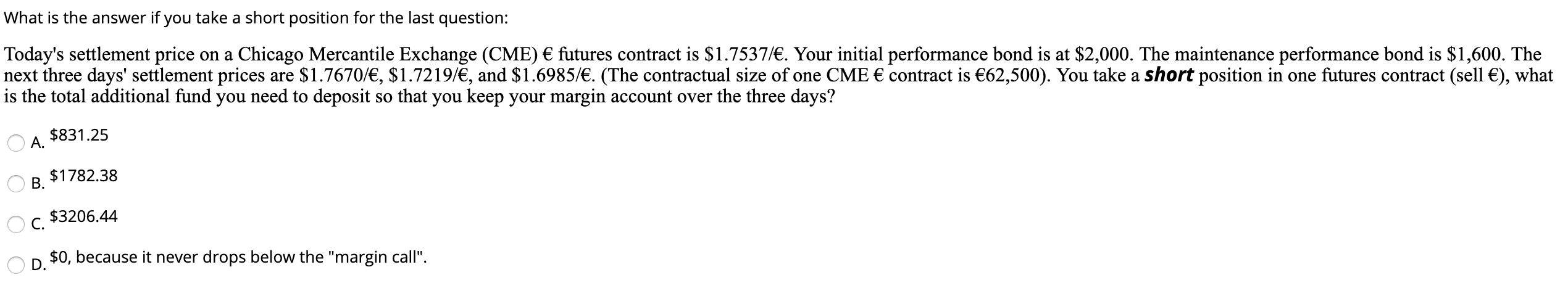

What is the answer if you take a short position for the last question: Today's settlement price on a Chicago Mercantile Exchange (CME) futures contract is $1.7537/. Your initial performance bond is at $2,000. The maintenance performance bond is $1,600. The next three days' settlement prices are $1.7670/, $1.7219/, and $1.6985/. (The contractual size of one CME contract is 62,500). You take a short position in one futures contract (sell ), what is the total additional fund you need to deposit so that you keep your margin account over the three days? O A. $831.25 O B. $1782.38 O c. $3206.44 D. $0, because it never drops below the "margin call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts