Question: What is the answer to question c? Problem 15-18 Suppose that the prices of zero-coupon bonds with various maturities are given in the following table.

What is the answer to question c?

What is the answer to question c?

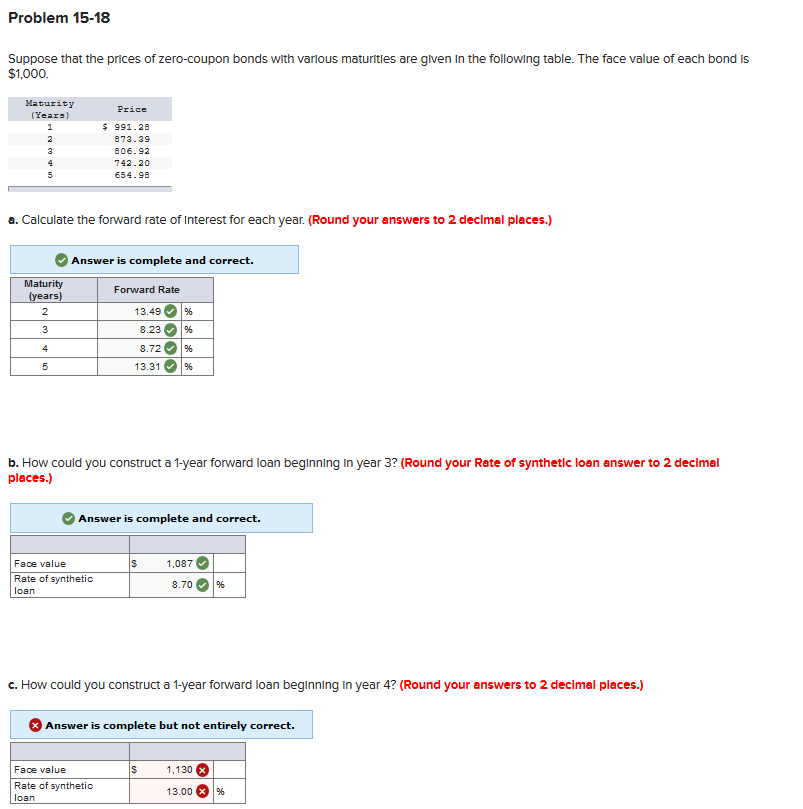

Problem 15-18 Suppose that the prices of zero-coupon bonds with various maturities are given in the following table. The face value of each bond is $1,000. Maturity (Years) 1 Price $ 991.28 873.39 806.92 742.20 654.90 5 a. Calculate the forward rate of Interest for each year. (Round your answers to 2 decimal places.) Answer is complete and correct. Maturity (years) 2 Forward Rate 13.49 % 3 8.23 % 4 % 8.72 13.31 5 % b. How could you construct a 1-year forward loan beginning in year 3? (Round your Rate of synthetic loan answer to 2 decimal places.) Answer is complete and correct. S 1,087 Face value Rate of synthetic loan 8.70 % c. How could you construct a 1-year forward loan beginning in year 4? (Round your answers to 2 decimal places.) Answer is complete but not entirely correct. S 1.130 X Face value Rate of synthetic loan 13.00 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts