Question: what is the answer to this? 2. Deb - single, 46 years old - is the sole shareholder of Timeless Corporation, a calendar year C

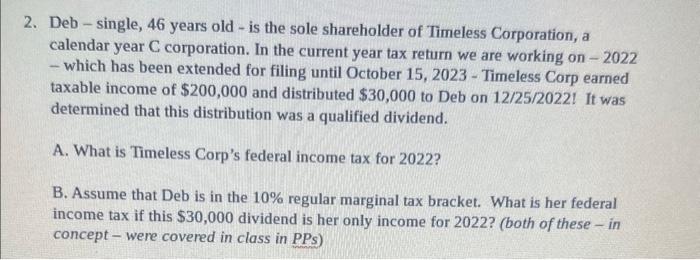

2. Deb - single, 46 years old - is the sole shareholder of Timeless Corporation, a calendar year C corporation. In the current year tax return we are working on -2022 - which has been extended for filing until October 15, 2023 - Timeless Corp earned taxable income of $200,000 and distributed $30,000 to Deb on 12/25/2022 l It was determined that this distribution was a qualified dividend. A. What is Timeless Corp's federal income tax for 2022? B. Assume that Deb is in the 10% regular marginal tax bracket. What is her federal income tax if this $30,000 dividend is her only income for 2022? (both of these - in concept - were covered in class in PPs)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts