Question: what is the answer to this? a) Distinguish between the following concepts with respect to capital management i) Regulatory Capital and Economic Capital ii) Capital

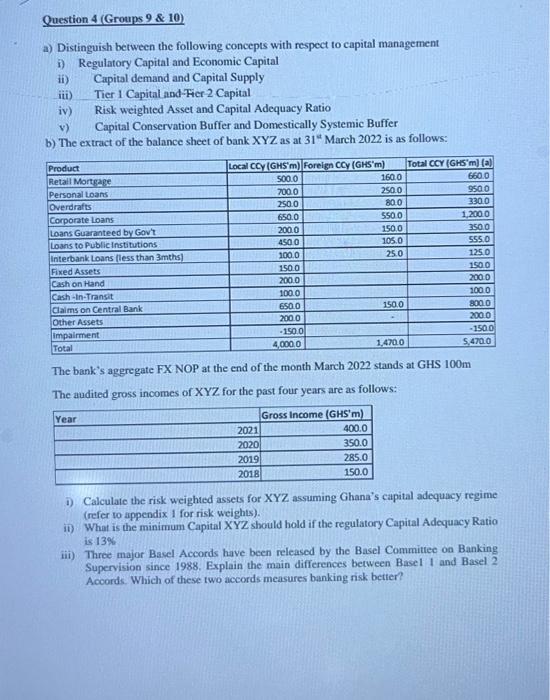

a) Distinguish between the following concepts with respect to capital management i) Regulatory Capital and Economic Capital ii) Capital demand and Capital Supply iii) Tier 1 Capital and-Fer 2 Capital iv) Risk weighted Asset and Capital Adequacy Ratio v) Capital Conservation Buffer and Domestically Systemic Buffer b) The extract of the balance sheet of bank XYZ as at 31d March 2022 is as follows: The bank's aggregate FX NOP at the end of the month March 2022 stands at GHS 100m The audited gross incomes of XYZ for the past four years are as follows: i) Calculate the risk weighted assets for XYZ assuming Ghana's capital adequacy regime (refer to appendix 1 for risk weights). ii) What is the minimum Capital XYZ should hold if the regulatory Capital Adequacy Ratio is 13% iii) Three major Basel Accords have been released by the Basel Committee on Banking Supervision since 1988. Explain the main differences between Basel 1 and Basel 2 Acoords. Which of these two accords measures banking risk better? a) Distinguish between the following concepts with respect to capital management i) Regulatory Capital and Economic Capital ii) Capital demand and Capital Supply iii) Tier 1 Capital and-Fer 2 Capital iv) Risk weighted Asset and Capital Adequacy Ratio v) Capital Conservation Buffer and Domestically Systemic Buffer b) The extract of the balance sheet of bank XYZ as at 31d March 2022 is as follows: The bank's aggregate FX NOP at the end of the month March 2022 stands at GHS 100m The audited gross incomes of XYZ for the past four years are as follows: i) Calculate the risk weighted assets for XYZ assuming Ghana's capital adequacy regime (refer to appendix 1 for risk weights). ii) What is the minimum Capital XYZ should hold if the regulatory Capital Adequacy Ratio is 13% iii) Three major Basel Accords have been released by the Basel Committee on Banking Supervision since 1988. Explain the main differences between Basel 1 and Basel 2 Acoords. Which of these two accords measures banking risk better

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts