Question: What is the basic earning per share and dividend per share for each year? What are the debt ratio and the growth rate in growth

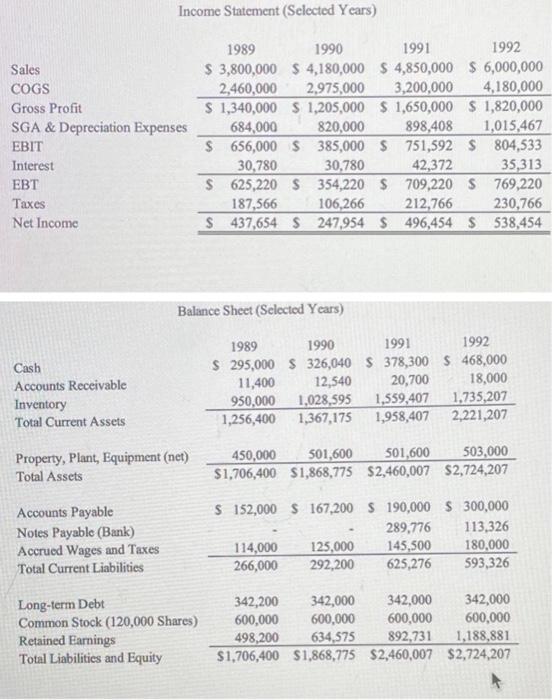

Income Statement (Sclected Years) Sales COGS Gross Profit SGA & Depreciation Expenses EBIT Interest EBT Taxes Net Income 1989 1990 1991 1992 $ 3,800,000 S 4,180,000 S 4,850,000 $ 6,000,000 2,460,000 2.975,000 3,200,000 4,180,000 S 1,340,000 $ 1,205,000 $ 1,650,000 $ 1,820,000 684,000 820,000 898,408 1,015,467 $ 656,000 S 385,000 $ 751,592 S 804,533 30,780 30,780 42,372 35,313 $ 625,220 S 354,220 $ 709,220 S 769,220 187,566 106,266 212,766 230,766 $ 437,654 S 247,954 S 496,454 $ 538,454 Balance Sheet (Selected Years) Cash Accounts Receivable Inventory Total Current Assets 1989 1990 1991 1992 $ 295,000 S 326,040 S 378,300 $ 468,000 11,400 12,540 20,700 18,000 950,000 1,028,595 1,559,407 1.735,207 1,256,400 1,367,175 1,958,407 2,221,207 Property, Plant, Equipment (net) Total Assets 450,000 501,600 501,600 503,000 $1,706,400 S1,868,775 $2,460,007 $2,724,207 Accounts Payable Notes Payable (Bank) Accrued Wages and Taxes Total Current Liabilities $ 152,000 S 167,200 $ 190,000 $300,000 289,776 113,326 114,000 125,000 145,500 180,000 266,000 292,200 625,276 593,326 Long-term Debt Common Stock (120,000 Shares) Retained Earnings Total Liabilities and Equity 342,200 342,000 342,000 342,000 600,000 600,000 600,000 600,000 498,200 634,575 892,731 1,188,881 $1,706,400 $1,868,775 $2,460,007 $2,724,207

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts