Question: What is the calculation formula for future selling prices ($1,018, $982, and $1,037)? And what is the excel function? LOS: Define, calculate, and interpret Macaulay,

What is the calculation formula for future selling prices ($1,018, $982, and $1,037)? And what is the excel function?

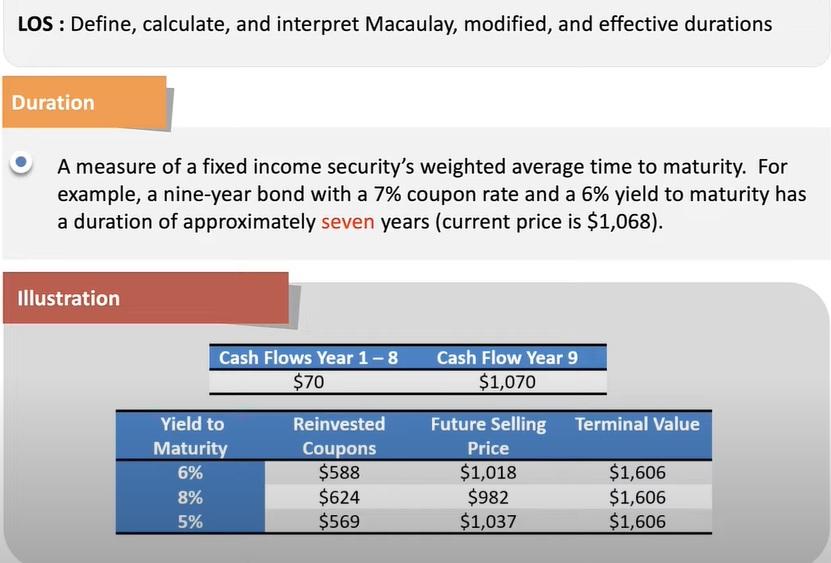

LOS: Define, calculate, and interpret Macaulay, modified, and effective durations Duration A measure of a fixed income security's weighted average time to maturity. For example, a nine-year bond with a 7% coupon rate and a 6% yield to maturity has a duration of approximately seven years (current price is $1,068). Illustration Cash Flows Year 1-8 $70 Cash Flow Year 9 $1,070 Reinvested Future Selling Terminal Value Coupons Price $588 $1,018 $1,606 $624 $982 $1,606 $569 $1,037 $1,606 Yield to Maturity 6% 8% 5% LOS: Define, calculate, and interpret Macaulay, modified, and effective durations Duration A measure of a fixed income security's weighted average time to maturity. For example, a nine-year bond with a 7% coupon rate and a 6% yield to maturity has a duration of approximately seven years (current price is $1,068). Illustration Cash Flows Year 1-8 $70 Cash Flow Year 9 $1,070 Reinvested Future Selling Terminal Value Coupons Price $588 $1,018 $1,606 $624 $982 $1,606 $569 $1,037 $1,606 Yield to Maturity 6% 8% 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts