Question: What is the Cash Conversion Cycle? Use the attached financial data to calculate the ratios. Round to the nearest decim Abercrombie & Fitch Co

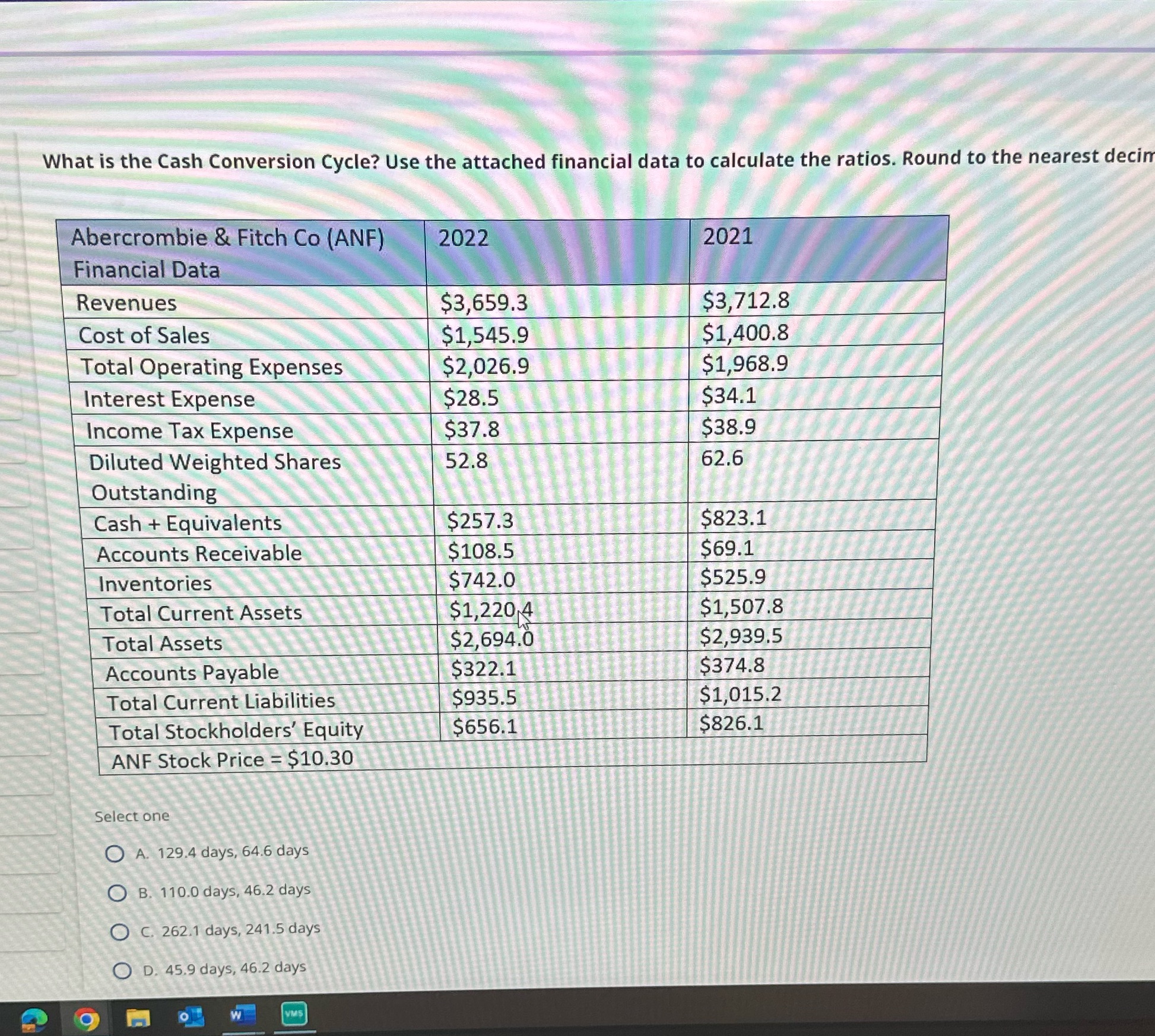

What is the Cash Conversion Cycle? Use the attached financial data to calculate the ratios. Round to the nearest decim Abercrombie & Fitch Co (ANF) Financial Data Revenues Cost of Sales Total Operating Expenses Interest Expense Income Tax Expense Diluted Weighted Shares Outstanding Cash+ Equivalents Accounts Receivable Inventories Total Current Assets Total Assets Accounts Payable Total Current Liabilities Total Stockholders' Equity ANF Stock Price = $10.30 Select one OA. 129.4 days, 64.6 days OB. 110.0 days, 46.2 days OC. 262.1 days, 241.5 days OD. 45.9 days, 46.2 days VMS 2022 $3,659.3 $1,545.9 $2,026.9 $28.5 $37.8 52.8 $257.3 $108.5 $742.0 $1,2204 $2,694.0 $322.1 $935.5 $656.1 2021 $3,712.8 $1,400.8 $1,968.9 $34.1 $38.9 62.6 $823.1 $69.1 $525.9 $1,507.8 $2,939.5 $374.8 $1,015.2 $826.1

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Sure The Cash Conversion Cycle CCC is a ... View full answer

Get step-by-step solutions from verified subject matter experts