Question: What is the company's value using the following methods? a) Residual Income b) Free Cash Flow (FCFF and FCFE) Assume no change in cash liquidity

What is the company's value using the following methods?

-

a) Residual Income

-

b) Free Cash Flow (FCFF and FCFE) Assume no change in cash liquidity

-

c) Valuation Ratios (Market Multiples), use at least three ratios.

-

d) Analyze and explain which one of the above valuation methods provides a better

and more realistic valuation based on the solutions and data in this case.

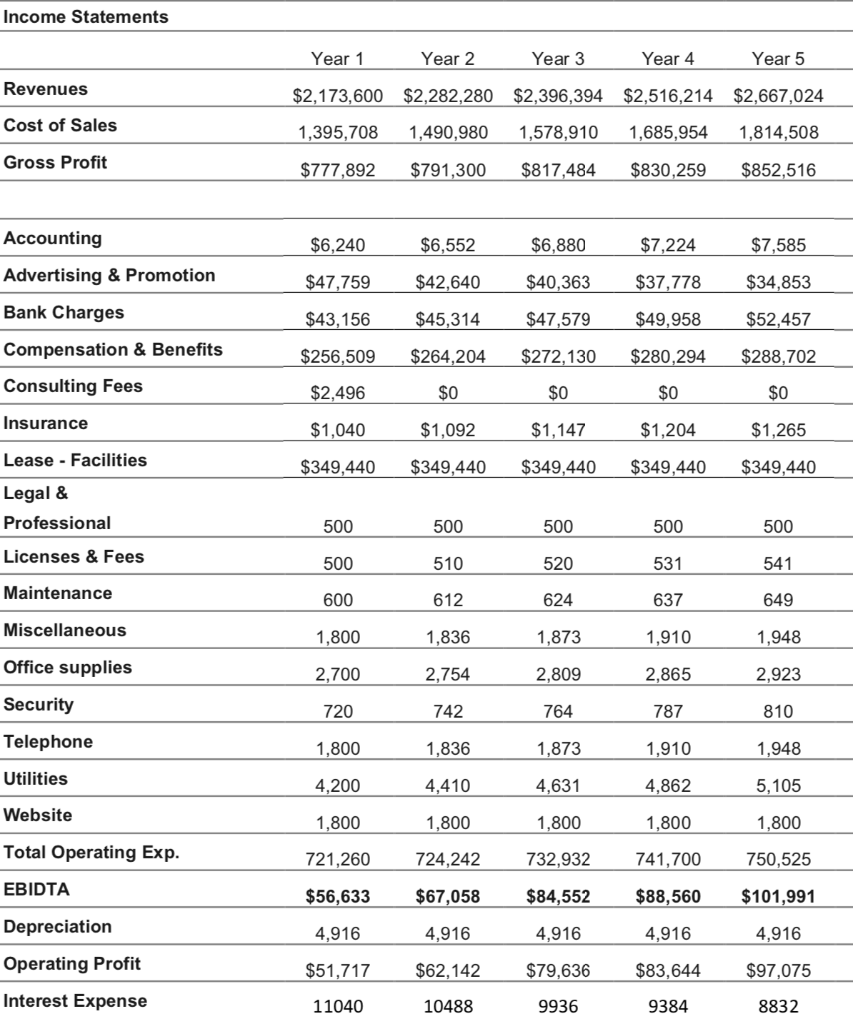

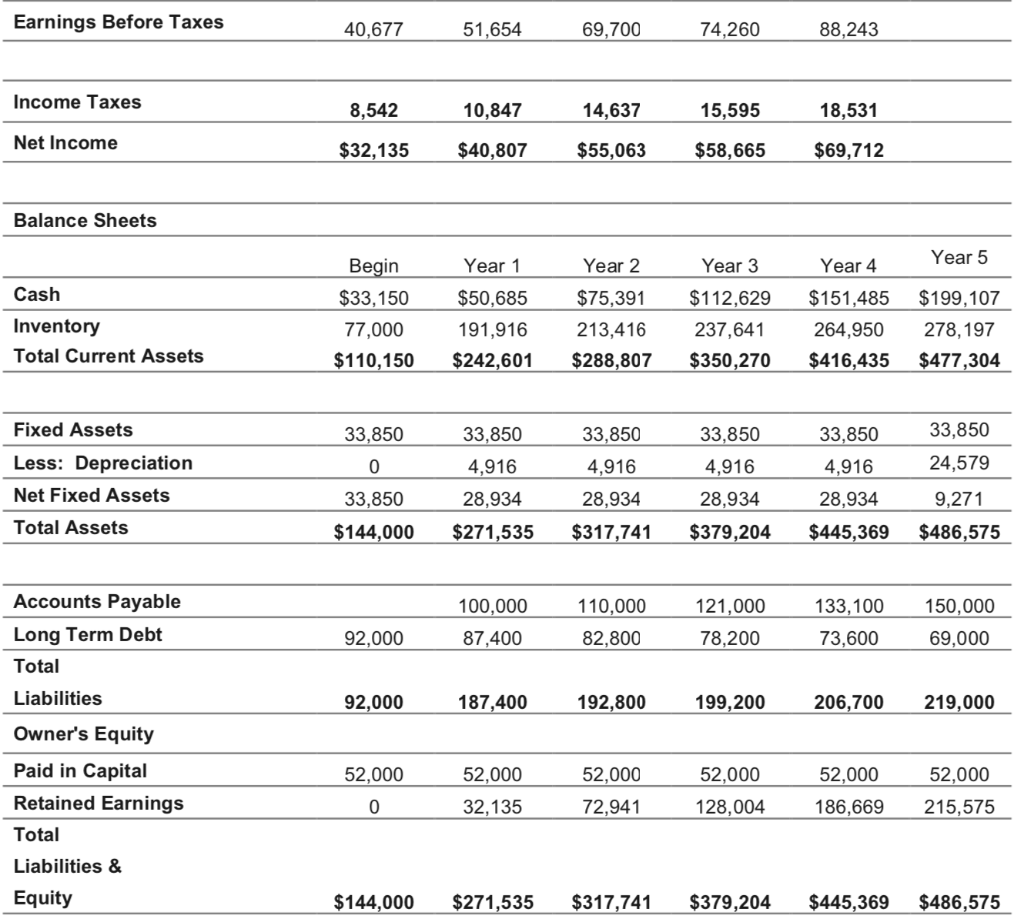

Earnings Before Taxes 40,677 51,654 69,700 74.260 88.243 Income Taxes 8,542 10,847 14,637 15,595 18,531 Net Income $32,135 $40,807 $55,063 $58,665 $69,712 Balance Sheets Cash Inventory Total Current Assets Begin $33,150 77,000 $110,150 Year 1 $50,685 191,916 $242,601 Year 2 $75,391 213,416 $288,807 Year 3 $112,629 237,641 $350,270 Year 4 $151,485 264,950 $416,435 Year 5 $199,107 278,197 $477,304 33,850 Fixed Assets Less: Depreciation Net Fixed Assets Total Assets 33,850 4,916 28,934 $271,535 33,850 4,916 28,934 $317,741 3 3,850 4,916 28,934 $379,204 33,850 4,916 28.934 $445,369 33,850 24,579 9.271 $486,575 O 024 33,850 $144,000 Accounts Payable Long Term Debt Total Liabilities 100,000 87,400 110,000 82,800 121,000 78,200 133,100 73,600 150,000 69,000 92,000 92,000 187,400 192,800 199,200 206,700 219,000 Owner's Equity Paid in Capital Retained Earnings Total Liabilities & Equity 52,000 0 52,000 32,135 52,000 7 2,941 52,000 128,004 52,000 186,669 52,000 215,575 $144,000 $271,535 $317,741 $379,204 $445,369 $486,575 Earnings Before Taxes 40,677 51,654 69,700 74.260 88.243 Income Taxes 8,542 10,847 14,637 15,595 18,531 Net Income $32,135 $40,807 $55,063 $58,665 $69,712 Balance Sheets Cash Inventory Total Current Assets Begin $33,150 77,000 $110,150 Year 1 $50,685 191,916 $242,601 Year 2 $75,391 213,416 $288,807 Year 3 $112,629 237,641 $350,270 Year 4 $151,485 264,950 $416,435 Year 5 $199,107 278,197 $477,304 33,850 Fixed Assets Less: Depreciation Net Fixed Assets Total Assets 33,850 4,916 28,934 $271,535 33,850 4,916 28,934 $317,741 3 3,850 4,916 28,934 $379,204 33,850 4,916 28.934 $445,369 33,850 24,579 9.271 $486,575 O 024 33,850 $144,000 Accounts Payable Long Term Debt Total Liabilities 100,000 87,400 110,000 82,800 121,000 78,200 133,100 73,600 150,000 69,000 92,000 92,000 187,400 192,800 199,200 206,700 219,000 Owner's Equity Paid in Capital Retained Earnings Total Liabilities & Equity 52,000 0 52,000 32,135 52,000 7 2,941 52,000 128,004 52,000 186,669 52,000 215,575 $144,000 $271,535 $317,741 $379,204 $445,369 $486,575

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts