Question: what is the continuing value ( terminal value) ? assume that after the forecast period, MCI will move to a long-term D/V ratio of 0.5

what is the continuing value ( terminal value) ? assume that after the forecast period, MCI will move to a long-term D/V ratio of 0.5 . based on your analysis, is MCI fairly valued at $47 ? WACC= 14% Inflation= 4% growth rate

thanks

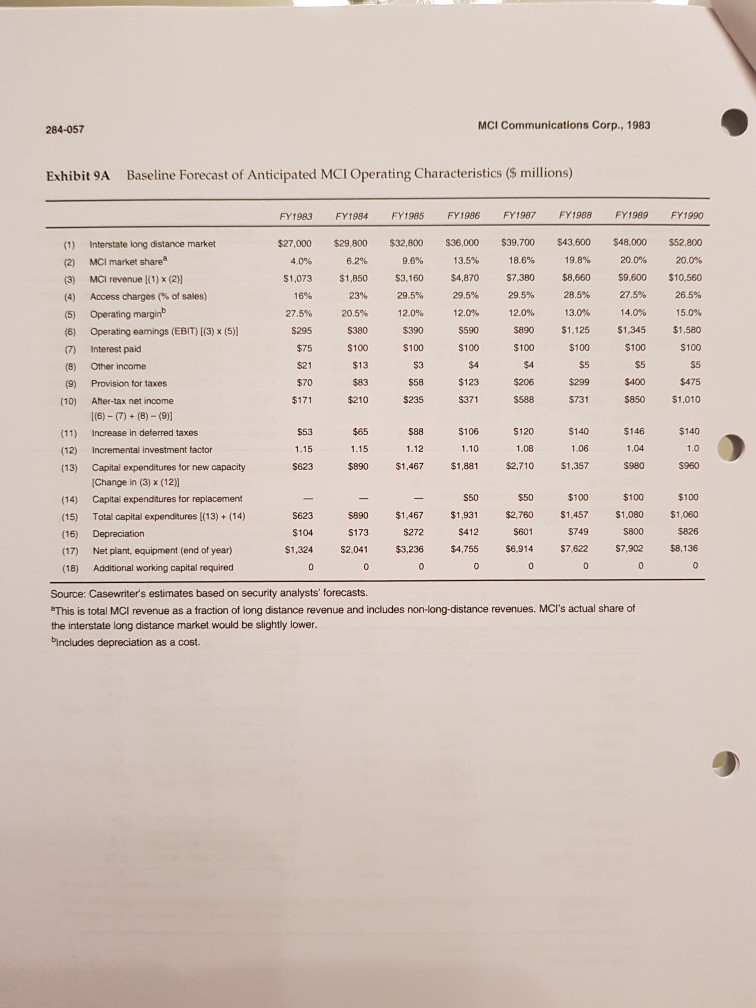

284-057 MCI Communications Corp., 1983 Exhibit 9A Baseline Forecast of Anticipated MCI Operating Characteristics (S millions) FY1983 FY1984 FY1985 FY1986FY1987 FY1988FY1989 FY1990 (1) Interstate long distance market (2) MCI market share (3) MCI revenue [(1) x (2) (4) Access charges (% of sales) (5) Operating margin (6) Operating eamings (EBIT) I(3) x (5) (7) Interest paid (8) Other income (9) Provision for taxes (10) Aher-tax net income $27,000 $29,800 $32,800 $36,000 $39,700 $43,600 $48,000 $52,800 4.0% 6.2% 9.6% 13.5% 18.6% 19.8% 20.0% 20.0% $1,073 $1,850 $3,160 $4,870 7.380 $8,60 9,600 $10,560 16% 23% 29.5% 29.5% 29.5% 28.5% 27.5% 26.5% 27.5% 20.5% 12.0% 12.0% 12.0% 13.0% 14.0% 15.0% $295$380 $390 S590 $890 $1,125 $1,345 $1,580 $75 $100 $100 $100 $100 $100 $100 S100 $21 $13 $58 $123 $206 $299 $400 $475 $171 $210 $235 S371 588 $731 850$1.010 $88 S106 $120 140 $146 $140 $623 $890 $1,467 $1,881 $2,710 1,357 $960 2 (11) (12) (13) Increase in deferred taxes Incremental investment factor Capital expenditures for new capacity Change in (3) x (12)] 1.15 1.08 1,04 $50 $100 $100 $100 S623 $890 $1,467 $1,931 $2,760 $1.457 1,080 $1,060 $104 S173 $272 $412 S601 S749 800 $826 $1,324 2,041 $3,236 $4,755 $6,914 $7,622 7,902 $8,136 (14) Capital expenditures for replacement (15) Total capital expenditures (13)(14) (17) Net plant equipment (end of year) Additional working capital required (18) Source: Casewriters estimates based on security analysts' forecasts. This is total MCI revenue as a fraction of long distance revenue and includes non-long-distance revenues. MCI's actual share of the interstate long distance market would be slightly lower Includes depreciation as a cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts