Question: what is the correct answer? 30) Why would a business decide to use an external company to prepare their payroll cheques and related reports? 31)

what is the correct answer?

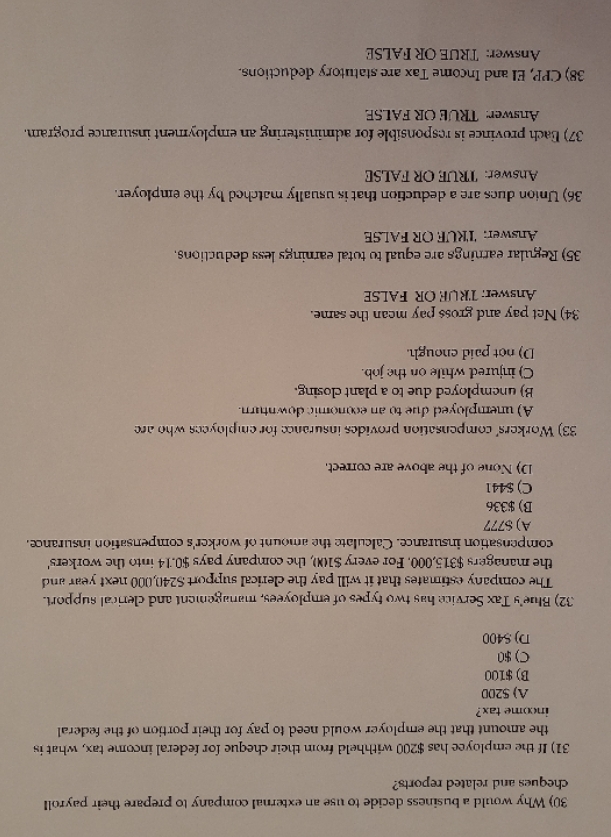

30) Why would a business decide to use an external company to prepare their payroll cheques and related reports? 31) If the employee has $200 withheld from their cheque for federal income tax, what is the amount that the employer would need to pay for their portion of the federal income tax? A) 5200 B) $100 ( $0 D) $400 32) Blue's Tax Service has two types of employees, management and clerical support. The company estimates that it will pay the clerical support $240,000 next year and the managers $315,000, For every $1(M), the company pays $0.14 into the workers compensation insurance. Calculate the amount of worker's compensation insurance A) $777 B) $336 C) $441 1) None of the above are correct. 33) Workers' compensation provides insurance for employees who are A) unemployed due to an economic downturn. B) unemployed due to a plant closing. C) injured while on the job. D) not paid enough 34) Net pay and gross pay mean the same. Answer: TRUE OR FALSE 35) Regular earnings are equal to total earnings less deductions Answer. TRUE OR FALSE 36) Union dues are a deduction that is usually matched by the employer. Answer: TRUE OR FALSE 37) Each province is responsible for administering an employment insurance program. Answer: TRUE OR FALSE 38) CPP, El and Income Tax are statutory deductions. Answer: TRUE OR FALSE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts