Question: what is the correct answer and how do I solve this? Quantitative Problem: Bellinger Industries is considening two projects for inclusion in its captal budget,

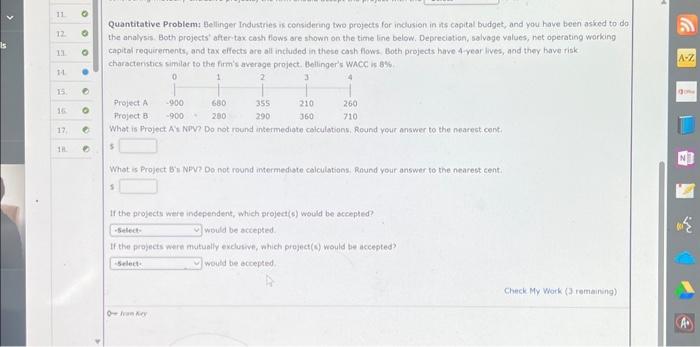

Quantitative Problem: Bellinger Industries is considening two projects for inclusion in its captal budget, and you have been asked to do the analysis. Both projects' aftertax cash flows are shown on the time line below. Depreciatian, salvoge values, net operating working capital requirements, and tax effects are all inchuded in these cash flows. Both projects have 4 year lives, nod they have riskcharactenstics similar to the firm's averoge project. Bellinger's whCC is 8%. What is Project As NPV? Do not round intermediate calculations, Round your answer to the nearest cont. s What is Project Bn NPV? Do not round imermediote calculations. Round your answer to the nearest cent. s If the projects were independent, which project(s) would be eccopted? would be accepted. If the projects wern mutually excluive, which project(0) would the accepted? would be accepted. Check My Work (3 remeining)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts