Question: What is the correct answer? Please help Kimmel, Accounting, 6e INTRODUCTORY ACCOUNTING I/II (ACT 22 Assignment Gradebook ORION Downloadable eTextbook nt 3:09 PMRemaining: 93 min.

What is the correct answer? Please help

What is the correct answer? Please help

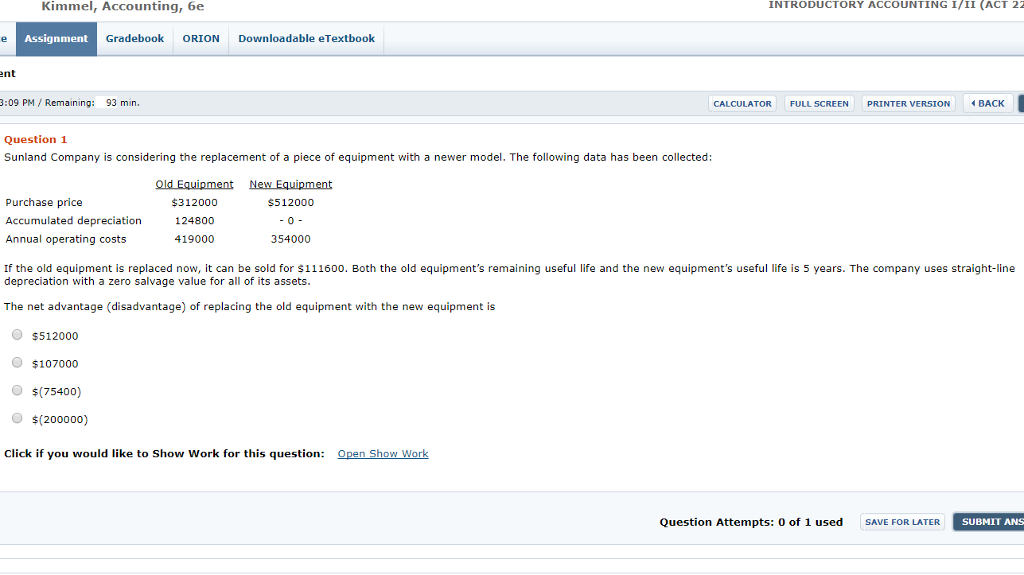

Kimmel, Accounting, 6e INTRODUCTORY ACCOUNTING I/II (ACT 22 Assignment Gradebook ORION Downloadable eTextbook nt 3:09 PMRemaining: 93 min. CALCULATOR FULL SCREEN PRINTER VERSION BACK Question 1 Sunland Company is considering the replacement of a piece of equipment with a newer model. The following data has been collected: Purchase price Accumulated depreciation Annual operating costs If the old equipment is replaced now, it can be sold for $111600. Both the old equipment's remaining useful life and the new equipment's useful life is 5 years. The company uses straight-line $312000 124800 419000 $512000 0 354000 depreciation with a zero salvage value for all of its assets The net advantage (disadvantage) of replacing the old equipment with the new equipment is $512000 $107000 O $(75400) O $(200000) Click if you would like to Show Work for this question Question Attempts: 0 of 1 used SAVE FOR LATER SUBMIT ANS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts